Welspun Corp Limited is one of the largest manufacturers of large diameter pipes globally. The company also manufactures BIS-certified Steel Billets, TMT (Thermo-Mechanically Treated) Rebars, Ductile Iron (DI) Pipes, Stainless Steel Pipes, and Tubes & Bars. The company acquired Sintex-BAPL, a market leader in water tanks and other plastic products, to expand its building materials portfolio. It has also made strategic acquisition of specified assets of ABG Shipyard. The company ranks among the top 3 line pipe manufacturers globally and is one of the largest producers of large-diameter SAW/ERW pipes worldwide. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

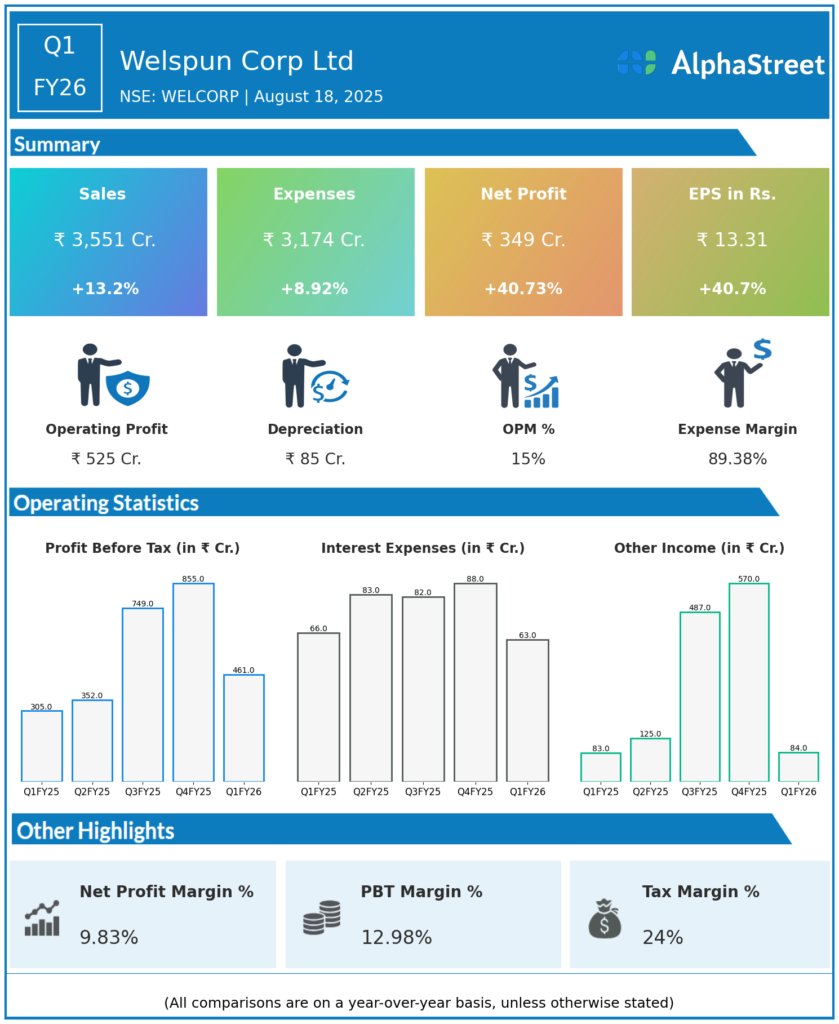

Total Income: ₹3,551 crore, up 13.2% year-over-year (YoY) but down 21.1% quarter-on-quarter (QoQ).

-

Total Expenses: ₹3,174.44 crore, up 8.9% YoY but down 26% QoQ.

-

Profit Before Tax (PBT): ₹461.08 crore, a significant increase of 55.4% YoY and 64% QoQ.

-

Profit After Tax (PAT): ₹349.16 crore, up 40.7% YoY and 21.5% QoQ.

-

Earnings Per Share (EPS): ₹13.31, up 40.7% YoY and 30.4% QoQ.

-

EBITDA: Reported surge of 40.4% YoY to ₹525 crore, with EBITDA margin at 14.8% (up from 11.9% YoY).

-

Welspun expanded its existing US spiral pipe order from 36” to 42”, increasing order value by approximately ₹735 crore, taking total order book to around ₹19,000 crore.

-

Orders are expected to be executed largely in fiscal 2026 and 2027.

Management Commentary and Strategic Highlights

-

The company benefits from a robust order book and has witnessed strong operational performance.

-

Growth drivers include infrastructure development demand for oil, gas, and water transmission.

-

Cost control measures delivered efficiency gains while maintaining revenue growth.

-

US-based order upsizing reflects customer confidence and project expansion.

Q4 FY25 Earnings Results

-

Total Income: ₹3,925 crore, a decline of 12 percent over the last year .

-

Profit After Tax: ₹699 crore, up by more than a 100 percent on the YoY basis.

-

The quarter was stronger sequentially with higher revenue and profitability, typical of seasonal trends.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.