Company Overview

Wanbury Ltd. is an Indian pharmaceutical company engaged in the manufacture and distribution of active pharmaceutical ingredients (APIs) and formulations. Established in 1990, Wanbury has built a reputation for its focus on anti-diabetic and gastroenterological drugs. The company operates in both domestic and international markets, exporting to over 50 countries, including the US and Europe. Wanbury is also known for its robust product pipeline, consisting of several generic and specialty drugs

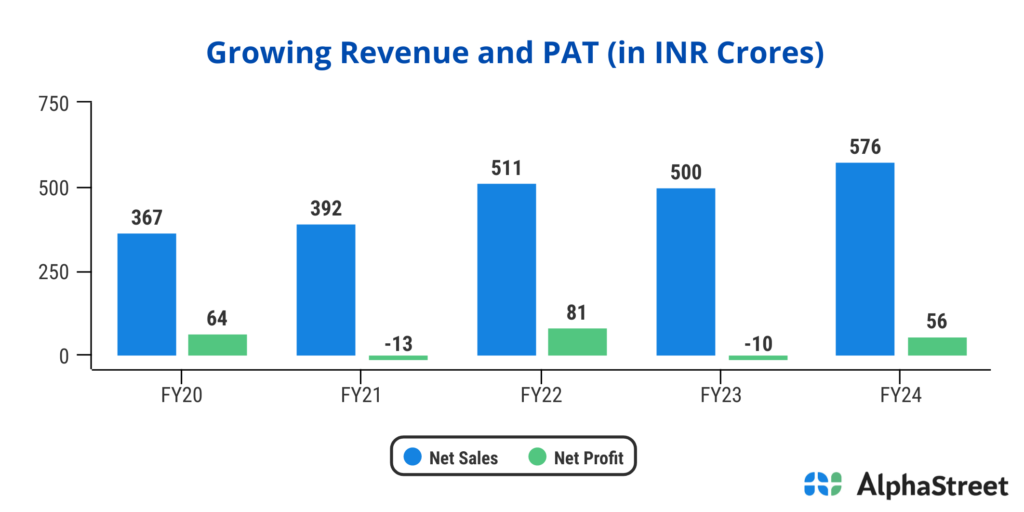

Recent Financial Performance

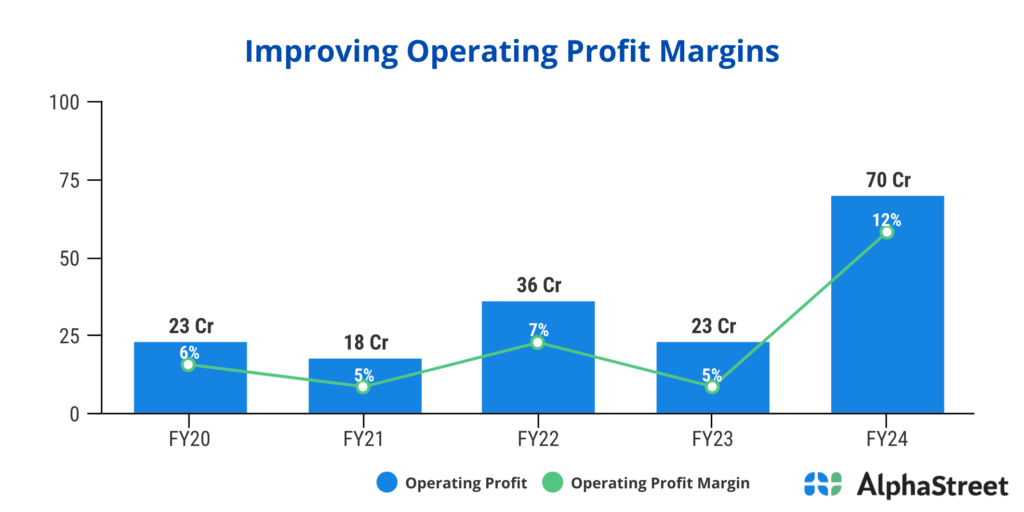

In the financial year 2023-2024, Wanbury Ltd. reported a revenue of INR 576 crore, a significant increase of 15% from the previous year’s INR 500 crore. The company’s Operating profit stood at INR 70 crore, up from INR 23 crore in the previous year, reflecting more than 200% increase in profitability. The net profit for the year was INR 56 crore, a whooping 1000% plus increase from INR -10 crore in the previous year.

For the recent quarter (Q1 FY2024), Wanbury reported revenue of INR 131 crore, a 10% drop from INR 146 crore in Q1 FY2023. The quarterly Operating Profit was INR 11 crore, compared to INR 13 crore in the same period last year, showing a 15% decreament. Net profit for the quarter stood at INR 1 crore, down from INR 5 crore, reflecting a 80% decrease.

Quarterly Revenue (Q1 FY2024): INR 131 crore

Quarterly Operating Profit (Q1 FY2024): INR 11 crore

Quarterly Net Profit (Q1 FY2024): INR 1 crore

Moat and Key Strengths

Focus on High-Growth Therapeutic Areas:

Wanbury’s strategic focus on anti-diabetic and gastroenterological drugs positions it well in the high-growth therapeutic areas. The company’s anti-diabetic segment, in particular, has seen robust growth in FY2024. This focus allows Wanbury to leverage its expertise and cater to the rising global demand for these medications.

Strong Export Market Presence:

Wanbury has a well-established presence in the international markets, with exports accounting for 60% of its total revenue in FY2023. The company has built a strong distribution network across over 50 countries, including regulated markets like the US and Europe. This diversification helps mitigate risks associated with domestic market fluctuations and regulatory changes.

Robust Product Pipeline:

Wanbury has a basket of over 13 API products. It is the largest manufacturer of Metformin with over ~8500 tons per year. It has a customer base in Europe & US for Tramadol & Sertraline (API)Wanbury exports to over 50 countries, 65% of which comprises of regulated markets. Company has 2 US-FDA approved multi-product API facilities and 1 plant under operation for semi-regulated markets

Cost-Efficient Manufacturing:

Wanbury’s focus on cost efficiency in its manufacturing processes has enabled it to maintain competitive pricing while ensuring healthy margins. The company’s manufacturing facilities, located in Maharashtra and Gujarat, operate at a capacity utilization rate of 75%, with scope for expansion to meet future demand without significant capital expenditure.

Key Risks or Concerns

Regulatory Risks:

Operating in highly regulated markets like the US and Europe exposes Wanbury to stringent regulatory scrutiny. Any adverse findings or delays in product approvals could impact the company’s market access and revenue. For example, in FY2022, the USFDA issued a warning letter to one of Wanbury’s facilities, which led to a temporary suspension of exports and a revenue loss of approximately INR 20 crore.

Dependence on Key Markets:

Wanbury’s heavy reliance on a few key markets poses a risk if there are adverse market conditions or changes in regulatory landscapes. In FY2023, the US market alone accounted for more than 20% of the company’s total revenue. A significant downturn in any of these key markets could materially affect Wanbury’s financial performance.

Foreign Exchange Fluctuations:

Given that a substantial portion of Wanbury’s revenues come from exports, the company is exposed to foreign exchange risks. Fluctuations in currency exchange rates can impact the profitability of its export sales.

Competitive Pressures:

The pharmaceutical industry is highly competitive, with several players offering similar products. Wanbury faces stiff competition from both domestic and international firms, which could lead to pricing pressures and impact market share. The company’s ability to innovate and maintain cost leadership will be crucial to sustaining its competitive edge.

Industrial Overview

The global pharmaceutical industry is expected to grow at a CAGR of 6% over the next five years, driven by aging populations, rising prevalence of chronic diseases, and increasing access to healthcare in emerging markets. The Indian pharmaceutical sector is projected to grow at a faster rate of 10-12% annually, supported by government initiatives to boost domestic production, export incentives, and a strong generics market.

Generic Drugs Segment: The global generic drugs market is anticipated to expand significantly, driven by patent expirations of major drugs and increasing demand for affordable medications. India, being the largest provider of generic drugs globally, is well-positioned to benefit from this trend. Wanbury, with its focus on high-growth therapeutic areas and strong product pipeline, stands to capitalize on the expanding generics market.

Analysis

Wanbury Ltd. is well-positioned to benefit from the growth opportunities in the pharmaceutical sector, supported by its focus on high-growth therapeutic areas, strong export market presence, and robust product pipeline. The company’s strategic initiatives, including the acquisition of additional manufacturing capacity and the launch of new products, are expected to drive revenue growth and enhance market positioning.

However, regulatory risks and dependence on key markets pose significant challenges. Wanbury must continue to diversify its market presence and maintain regulatory compliance to sustain its growth trajectory. The company’s proactive approach to capacity expansion and product innovation is likely to support its competitive edge in the dynamic pharmaceutical landscape.

Conclusion

Wanbury Ltd. offers a compelling investment opportunity in the pharmaceutical sector, backed by its focus on high-growth therapeutic areas, strong export market presence, and robust product pipeline. However, potential investors should remain cautious of regulatory risks and market dependencies. Overall, Wanbury’s strategic initiatives and solid financial performance provide a positive outlook for future growth.