Incorporated in December 1990, Waaree Energies Limited is an Indian manufacturer of solar PV modules with an aggregate installed capacity of 12 GW.WEL has five solar module manufacturing facilities in India, with international presence. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

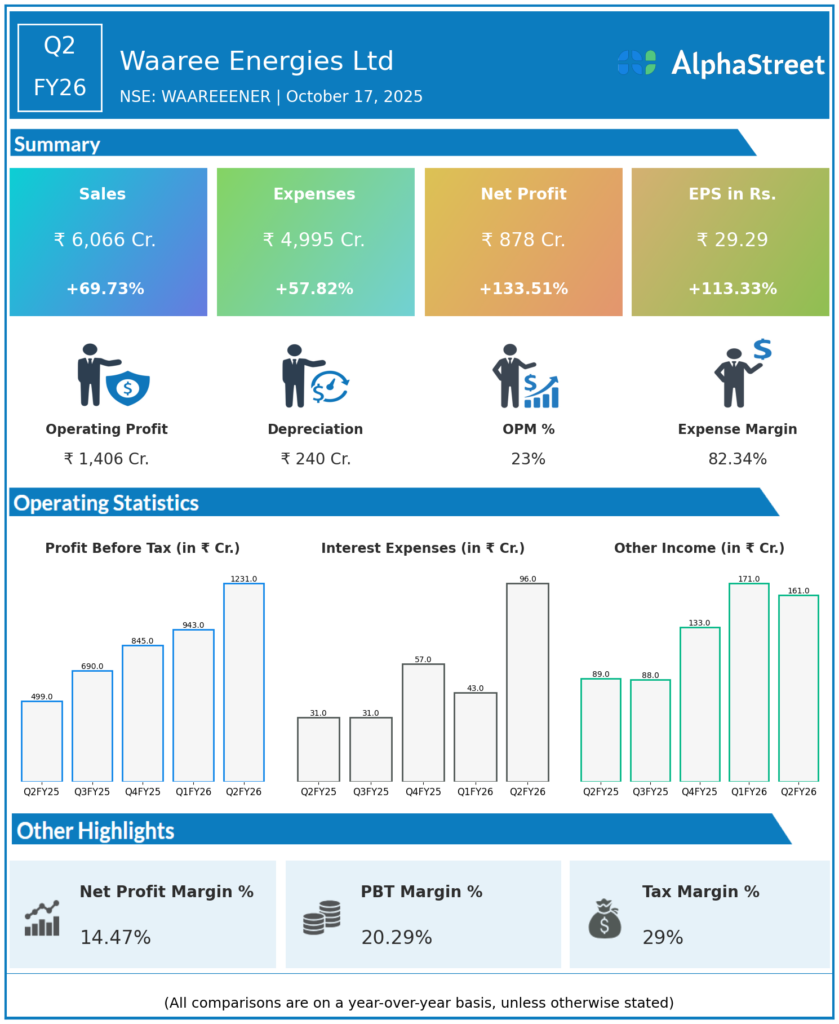

Revenue from Operations: ₹6,065.6 crore, up 69.7% YoY from ₹3,574.4 crore and up 37% QoQ from ₹4,425.8 crore in Q1 FY26.

-

Net Profit (PAT): ₹878 crore, up 133.5% YoY from ₹375.7 crore and up 13% QoQ from ₹745 crore in Q1 FY26.

-

EBITDA: ₹1,567.3 crore, up 156.5% YoY from ₹610.9 crore, and the highest in the company’s history; EBITDA Margin: 25.8%, up 876 basis points YoY.

-

Profit Before Tax (PBT): ₹1,231 crore, compared to ₹492 crore in Q2 FY25 and ₹943 crore in Q1 FY26.

-

PAT Margin: 13.9% vs. 10.5% in Q2 FY25.

-

Expenses: ₹4,995 crore (vs ₹3,165 crore in Q2 FY25), with increases in raw material and manpower costs offset by higher realizations.

-

Interim Dividend: ₹2 per equity share; record date October 24, 2025, payout November 6, 2025.

-

ROE: 19.7%; ROCE: 80.9%, both among the best in the renewable manufacturing sector.

-

Segment: Solar PV modules accounted for over 90% of sales, with robust domestic and export traction backed by government mission tenders.

-

Order Book: Estimated above ₹14,000 crore, with strong pipeline visibility into FY27.

Management Commentary & Strategic Highlights

-

Dr. Amit Paithankar, CEO & Whole-time Director:

“Q2 FY26 marks another record quarter for Waaree Energies, with robust revenue growth and margin expansion reinforcing our leadership position in solar PV manufacturing. Our vertically integrated model and continued capacity optimization have supported profitability despite raw material fluctuations.”

He also stated that the focus remains on scaling renewable energy solutions across India and overseas, maintaining disciplined capital expenditure, and driving deeper energy transition projects. -

Strategic Developments:

-

Acquisition of 64% in Kotsons Pvt Ltd (transformer maker).

-

In discussions to acquire Enel Green Power India and 76% in Racemosa Energy, aimed at portfolio diversification into solar EPC and hybrid renewable solutions.

-

U.S. Customs and Border Protection investigation initiated into component origin for certain solar module exports, with management assuring full compliance and negligible financial impact.

-

Expansion of manufacturing capacity beyond 12 GW to support India’s solar capacity targets.

-

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹4,597.2 crore, up 31.5% YoY from ₹3,496 crore.

-

Net Profit (PAT): ₹772.9 crore, up 92.7% YoY from ₹401 crore.

-

EBITDA: ₹1,168.7 crore, up 82.6% YoY; EBITDA margin stood at 25.4%.

-

EPS: ₹25.94 vs ₹14.98 YoY.

-

Guidance: FY26 EBITDA expected between ₹5,500–₹6,000 crore; capacity utilization near full scale.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.