Incorporated in December 1990, Waaree Energies Limited is an Indian manufacturer of solar PV modules with an aggregate installed capacity of 12 GW.WEL has five solar module manufacturing facilities in India, with international presence. Waaree Energies is India’s largest manufacturer and exporter of solar modules. As of FY24, they hold 21% share of the domestic market for solar modules and 44% share in India’s solar module exports. Its installed capacity surged from 2GW in FY21 to 13.3GW by FY24. Waaree Renewables operates 5 manufacturing facilities in India. These are located in Gujarat (Surat, Tumb, Nandigram, and Chikhli) and Uttar Pradesh (Indosolar Facility, Noida). With a total installed capacity of 12 GW as of June 2024, the company is expanding its facilities to reach 20.9 GW by 2027, including backward integration into solar cell, ingot, and wafer production. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

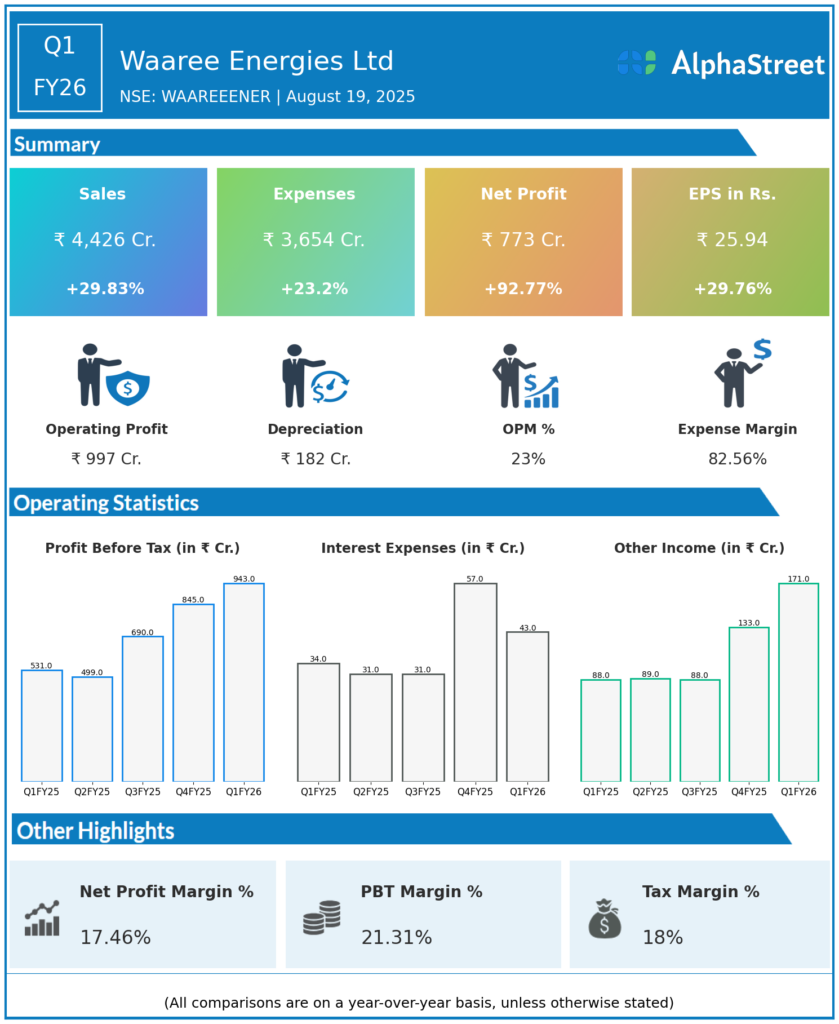

Consolidated Revenue: ₹4,426 crore, up 29.8% year-over-year (YoY) from ₹3,409 crore in Q1 FY25.

-

EBITDA: ₹1,168.67 crore, up 82.61% YoY; EBITDA margin expanded to 25.42%.

-

Profit After Tax (PAT): ₹772.89 crore, surged 92.7% YoY from ₹401.13 crore.

-

PAT Margin: 17.4%.

-

Earnings Per Share (EPS): ₹25.94, up from ₹19.9 last year.

-

Highest ever module production: 2.3 GW in Q1 FY26, reflecting strong operational focus.

-

Order Book: Approximately ₹49,000 crore; global pipeline over 100 GW.

-

Segment Revenue Highlights:

-

Solar Photovoltaic Modules: ₹3,872.35 crore (22% YoY growth).

-

EPC Contracts: ₹589.27 crore (160% YoY growth).

-

Generation of Power: ₹11.10 crore, stable YoY.

-

-

Expansion: Factory build-out projects in India and the US on track; additional capex ₹2,754 crore approved for capacity expansions in Gujarat and Maharashtra.

-

Green Hydrogen, inverter, and battery energy storage system facilities under construction and progressing well.

Management Commentary

Dr. Amit Paithankar, CEO:

“We continue to deliver strong operational performance building on last year’s momentum. Our highest-ever quarterly module production of 2.3 GW signifies production efficiencies. Our factory expansions in India and the US are progressing as planned. We maintain our guidance for FY26 EBITDA of ₹5,500 to ₹6,000 crore, supported by a robust order book and global opportunities.”

Q4 FY25 Earnings Results

-

Revenue: ₹4,004 crore, up by 36 percent on the YoY basis

-

Profit: ₹644 crore, up by 35.5 percent during the same quarter, last year

-

Sequential revenue and earnings growth continue from the previous year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.