VST Tillers Tractors Ltd. was established in the year 1967 by the VST Group of companies, a well-known century-old business house in South India. The founder of the group was Sri V.S. Thiruvengadaswamy Mudaliar. VST Tillers Tractors Ltd. was promoted by VST Motors as a joint venture since 1966 with Mitsubishi Heavy Industries Ltd, Japan. The company is now the largest manufacturer of Power Tillers in India.

Q2 FY26 Earnings Results

-

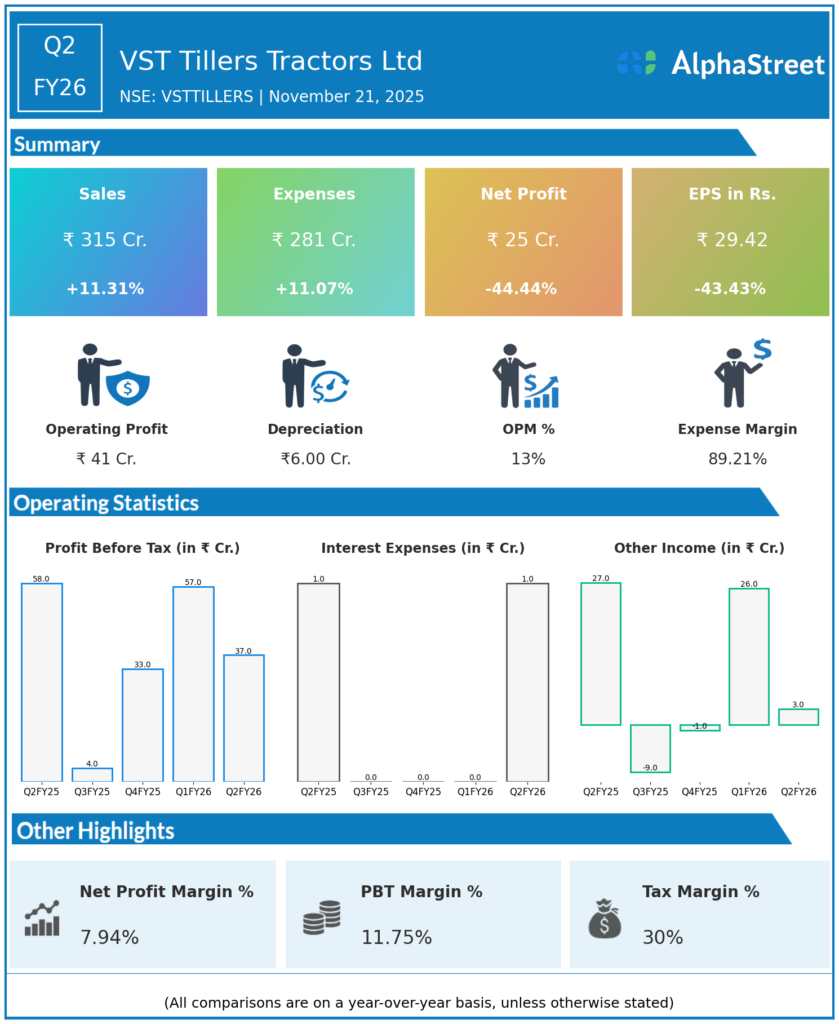

Revenue from Operations: ₹315 crore, up 3.1% QoQ from ₹308.34 crore in Q1 FY26 but down 6.3% sequentially from ₹301.43 crore in Q1 FY26; a strong YoY increase of 11.3% from ₹283.43 crore in Q2 FY25.

-

Profit Before Tax (PBT): ₹36.51 crore, down 35.5% QoQ and 36.5% YoY from ₹56.60 crore in Q1 FY26 and ₹57.53 crore in Q2 FY25, respectively.

-

Profit After Tax (PAT): ₹24.98 crore, decreased 43.5% QoQ and 44.2% YoY from ₹44.22 crore in Q1 FY26 and ₹44.80 crore in Q2 FY25.

-

Earnings Per Share (EPS): ₹29.42, down from prior quarters, reflecting the profit decline.

-

EBITDA margin: Stable at around 13.28% excluding other income, though core operations faced cost pressures.

-

Other income contributed ₹25.89 crore to profit before tax, cushioning operating profit decline.

-

Power tiller sales rose 16.8% in Q2, with 13,128 units sold; domestic tractor sales increased nearly 16%.

-

Export market volumes declined with logistical delays; company exploring Europe operations to streamline supply chain within 6-9 months.

-

Cash flow improved with ₹62.5 crore generated during the quarter despite a challenging environment.

Management Commentary & Strategic Insights

-

Management focused on product innovation, retail finance penetration, and small farm mechanization opportunities to drive future growth.

-

Export constraints and MTM losses on investments impacted quarterly profitability.

-

Strategic initiatives include expanding tractor production capacity targeting 6,400–7,000 units in FY26.

-

Continued emphasis on operational efficiencies and cost management amid export market and logistic challenges.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹308.34 crore, up 8.6% QoQ and 45.5% YoY from ₹211.91 crore in Q1 FY25.

-

Profit Before Tax (PBT): ₹56.60 crore, increased 31.5% QoQ and 102.6% YoY.

-

Profit After Tax (PAT): ₹44.22 crore, up 27.3% QoQ and 96.8% YoY.

-

Earnings Per Share (EPS): ₹51.5, showing significant growth.

-

Highest ever power tiller sales achieved in Q1 FY26 with 11,701 units, demonstrating strong market demand.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.