VST Industries is engaged inter-alia in manufacture and trading of Cigarettes, Tobacco and Tobacco products.

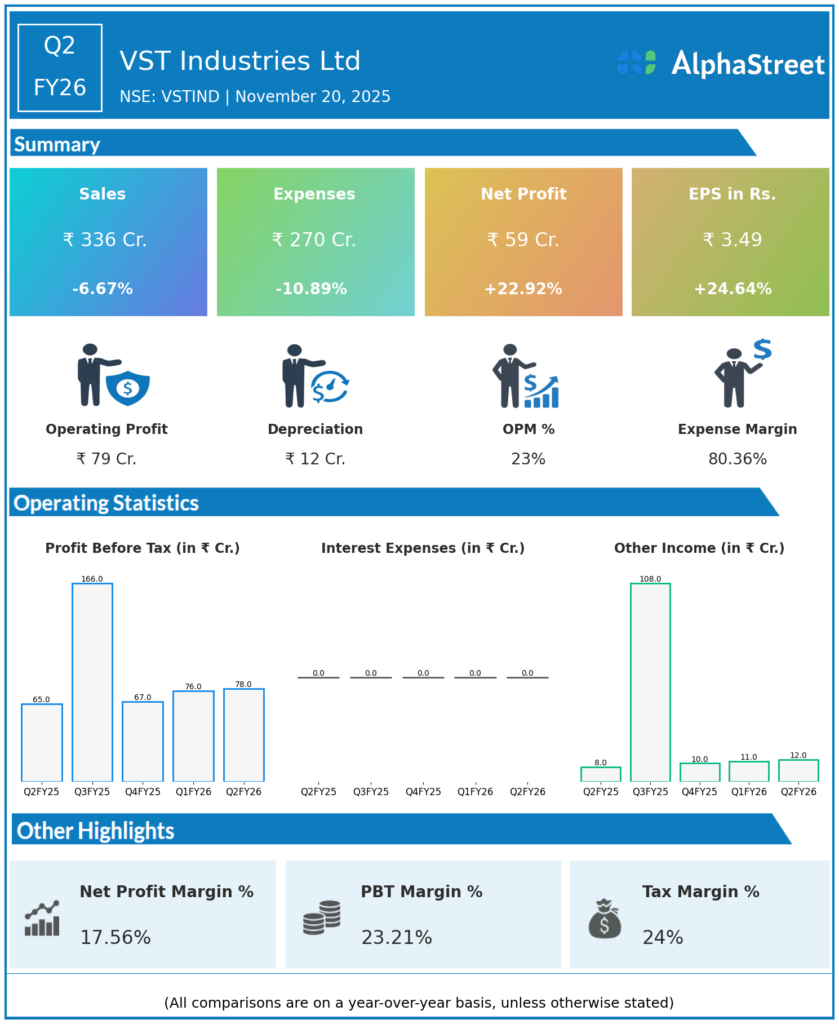

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹335.31 crore, down 6.59% YoY from ₹359.42 crore and up 13.31% QoQ from ₹296 crore in Q1 FY26.

-

EBITDA: ₹78.62 crore, up 16.25% YoY with a margin improvement to 23.45% from 18.66% YoY, reflecting better operational efficiency and cost management.

-

Profit After Tax (PAT): ₹59.21 crore, up 24.47% YoY and 5.49% QoQ, benefiting from operational leverage despite revenue decline.

-

Employee cost declined 6.77% YoY to ₹31.79 crore; depreciation steady at ₹12.16 crore.

-

Operating cash flow weakened compared to last year but capital light model sustains profitability.

-

ROE at 26.07% signifies strong capital efficiency amid growth challenges.

-

Structural headwinds persist including volume decline and regulatory environment but margin improvement offsets revenue pressures.

Management Commentary & Strategic Insights

-

Management highlighted disciplined cost control and portfolio mix improvement enabling margins expansion despite weak volume trend.

-

Outlook cautious with focus on sustained operational efficiency, capital allocation discipline and regulatory impact mitigation.

-

The company plans to maintain steady profitability and improve revenue growth with new product launches and market development.

-

Existing strong brand and capital efficiency provide resilience during challenging tobacco industry dynamics.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹296 crore, down 7.29% YoY.

-

PAT: ₹56.13 crore, up 3.7% YoY, reflecting margin gains and operational discipline.

-

EPS: ₹3.30, up from ₹3.13 in prior year.

-

Employee benefits expenses and raw material costs down YoY aiding profitability.

-

Management focused on revenue mix refinement and cost efficiency enhancements.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.