VST Industries is engaged inter-alia in manufacture and trading of Cigarettes, Tobacco and Tobacco products. The company is the 3rd largest player in the domestic cigarette market, with a significant presence in West Bengal, Andhra Pradesh, Telangana, Bihar, and UP with a 8% market share based on volume. [1] Its cigarette brand Total is among the top 10 brands in the industry. In FY24, the company has launched 4 new products including the Editions Trio brand. The company has a network of 835 wholesale dealers and over 11 lakh retail outlets, covering more than 80% of the Indian markets. The company has 2 manufacturing facilities in Azamabad, Hyderabad, and Toopran, Telangana. It has 7 regional offices in Hyderabad, Mumbai, Delhi, Kolkata, Chennai, Guwahati, and Lucknow. In October 2024, it shifted its manufacturing operations from the Azamabad Industrial Area to Toopran. It is exploring options to monetize the Azamabad property. Presenting below are its Q1 FY26 earnings results.

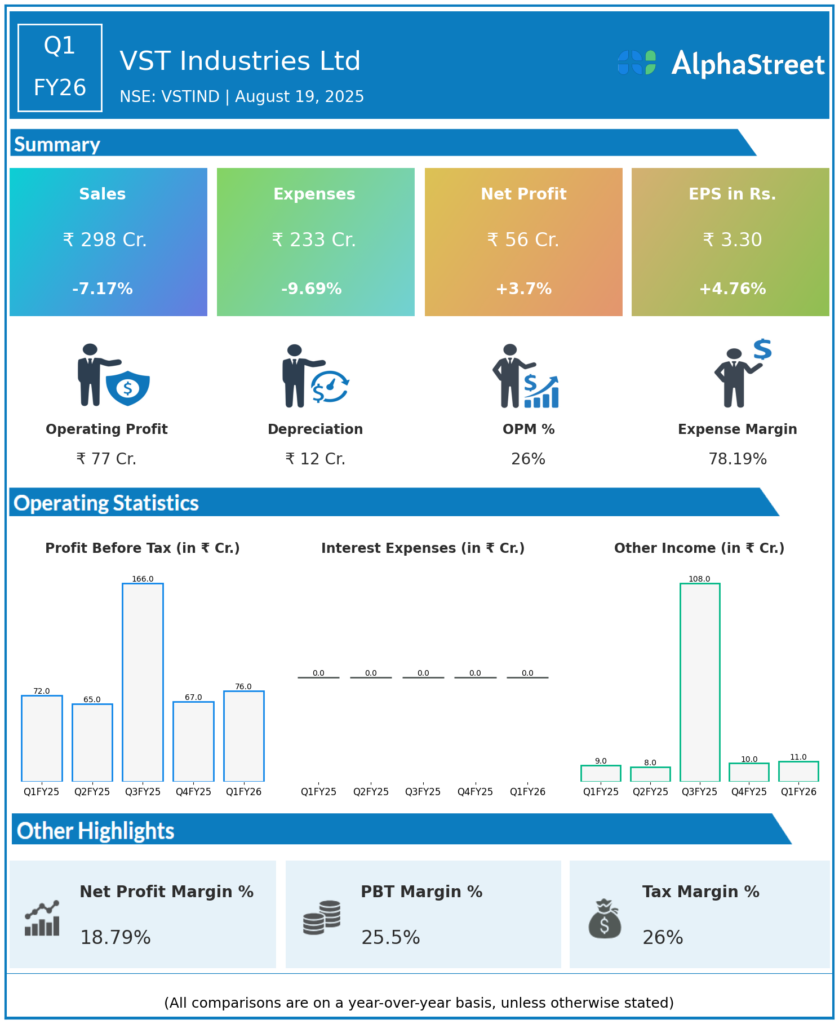

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹297.9 crore, down 7.1% year-over-year (YoY).

-

Total Income: ₹308.7 crore, down 10.1% YoY.

-

Profit Before Tax (PBT): ₹75.99 crore, up 5.1% YoY.

-

Profit After Tax (PAT): ₹56.13 crore, up 3.7% YoY.

-

EPS (Basic/Diluted): ₹3.30, up from ₹3.13 last year.

-

Total Expenses: ₹232.72 crore, down 10.8% YoY.

-

Net Profit Margin: 18.2%, up from 16.2% YoY.

-

EBIT: ₹75.99 crore, up 5.2% YoY (margin: 24.6%).

-

Employee Cost: ₹33.39 crore, down 7.8% YoY.

-

Raw Material Cost: ₹145.64 crore, down 7.3% YoY.

Management Commentary & Strategic Highlights

-

VST Industries maintained profitability and improved margins in spite of a revenue decline—primarily due to cost discipline and a favorable product mix.

-

Cigarette volumes saw a 10% growth YoY, aiding operational leverage.

-

Margin improvement, cost control, and improved outlook for the rest of FY26.

-

The company continues to manufacture and distribute a wide range of cigarettes and tobacco products.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹349.24 crore, down by 6.9 percent on the YoY basis.

-

PAT: ₹53 crore depicting a decline of 39.7 percent on the YoY basis.

-

Sequential decline in revenue and expense, but improved profit in Q1 FY26 due to margin gains.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.