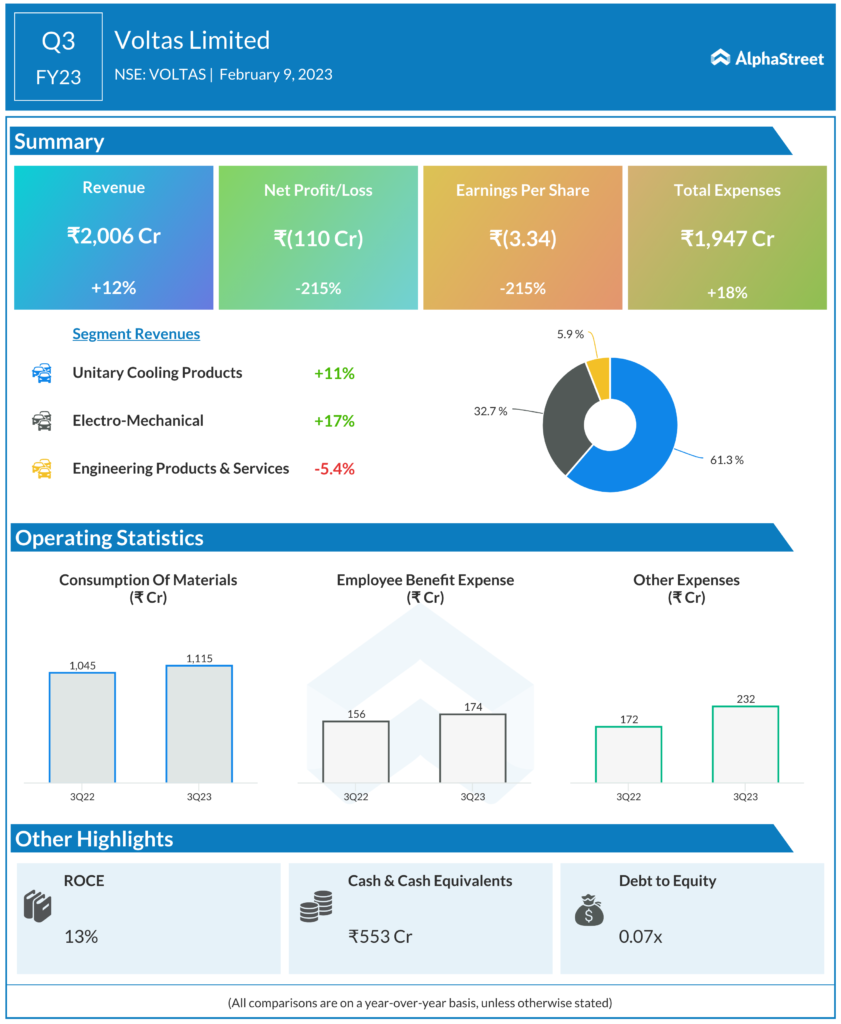

The Consolidated Total Income for the quarter ended 31st December, 2022 was higher by 12% at INR 2036

crores as compared to INR1822 crores in the corresponding quarter last year. Profit before share of profit I (loss)

of joint ventures/associates, exceptional items and tax was INR 90 crores as compared to INR l71 crores in the

corresponding quarter last year. The Profit was impacted due to provision of INR 137 crores (Exceptional item)

made on an overseas project. Earnings per Share (Face Value per share of Re. 1) as at 31st December, 2022 was therefore INR (3.34) compared to INR 2.90 last year.

The Revenue of Unitary Cooling Products business was better despite muted festival sale amidst inflation woes and subdued consumer sentiments. Nevertheless, Voltas continues to be the market leader and has sustained its No.1 position in the overall Room Air conditioner business with its YTD December 2022 market share at 22.5%. Segment Revenue increased by 11% and was at INR 1216 crores as compared to INR 1094 crores in the corresponding quarter last year. Segment Result was however lower at INR 89 crores as compared to INR 102 crores in the corresponding quarter last year.

Meanwhile in Electro-mechanical segment, the revenue for the quarter was higher by 17%, at INR 648 crores as compared to INR 554 crores in the corresponding quarter last year. Segment Result before exceptional item was negative INR 46 crores as compared to profit of INR 36 crores last year owing to delay in collections and settlements which led to making provisions in line with the requirements of Accounting Standards. Segment Results after exceptional item was negative INR 183 crores. Carry forward order book of the Segment was substantially higher at INR 7,543 crores as compared to INR 5,600 crores in the corresponding quarter last year. Domestic projects booked orders of INR 1,040 crores during the quarter as compared to INR 185 crores in the corresponding quarter last year.

In Engineering Products and Services, the segment revenue and result for the quarter were at INR 118 crores

and INR 46 crores as compared to INR 125 crores and INR 40 crores, respectively in the corresponding quarter last

year.