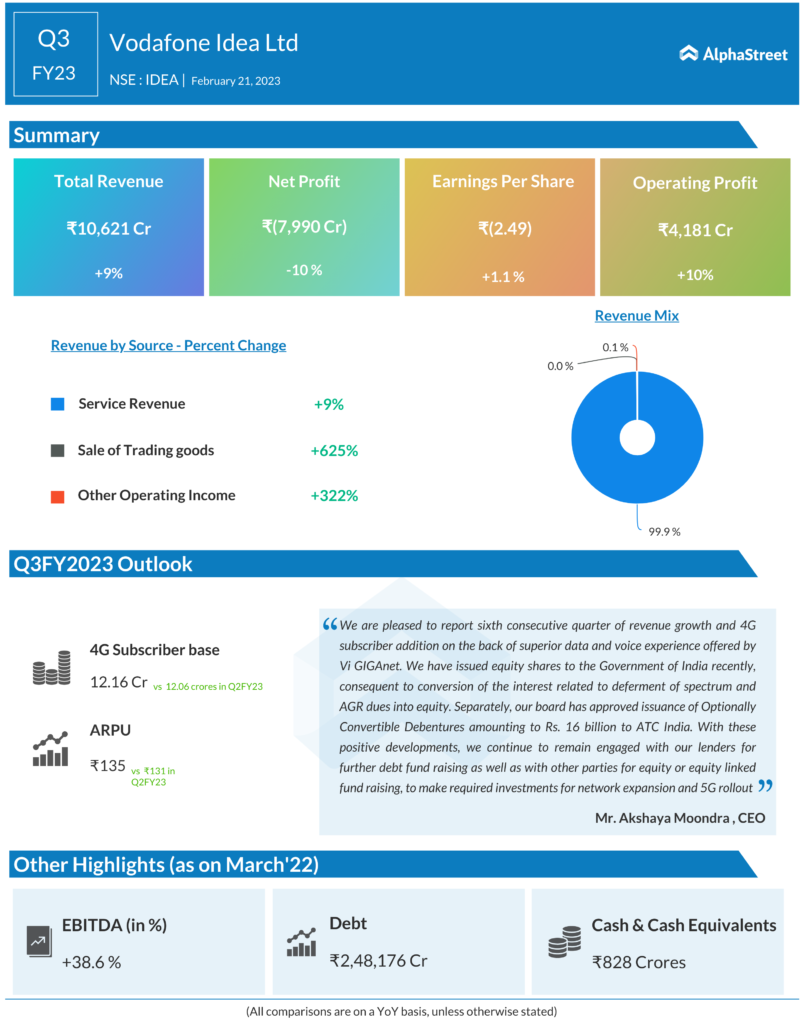

Telecom firm Vodafone Idea’s net loss widened to INR 7,990 crore in the quarter ended December 31, 2022 as against INR 7,595.5 crore in the year-ago period. The company’s revenue rose 9% to INR 10,621 crore in Q3FY23 as compared to INR 9,717 crore in Q3FY22. ARPU (average revenue per user) for the quarter stood at INR 135 vs INR 131 in Q2FY23 and INR 115 in Q3FY22, a YoY growth of 17.4%.

Akshaya Moondra, CEO, Vodafone Idea Limited, said: “We are pleased to report sixth consecutive quarter of revenue growth and 4G subscriber addition on the back of superior data and voice experience offered by Vi GIGAnet. We have issued equity shares to the Government of India recently, consequent to conversion of the interest related to deferment of spectrum and AGR dues into equity. Separately, our board has approved issuance of Optionally Convertible Debentures amounting to INR 1,600 crore to ATC India. With these positive developments, we continue to remain engaged with our lenders for further debt fund raising as well as with other parties for equity or equity linked fund raising, to make required investments for network expansion and 5G rollout.”

The company’s board approved Murthy GVAS as interim CFO with effect from February 15. On Tuesday, the company’s scrip on BSE closed trading 1.2% lower at INR 7.75. Earlier this month, debt-ridden Vodafone Idea approved the allotment of equity shares worth INR 16,133 crore to the government, which post-allocation has become the largest shareholder with a 33.44 per cent stake in the company.

The shares have been allocated to the government in lieu of conversion of interest dues arising from deferment of adjusted gross revenue and spectrum auction payments, the company said in a regulatory filing. The government cleared conversion of INR 16,133 crore interest dues of debt-ridden Vodafone Idea into equity after receiving a firm commitment from Aditya Birla Group to run the company and bring necessary investment.