V-Mart Retail is engaged in the business of Value Retailing through the chain of stores situated at various cities in India. Leading Value Retail Chain Operator, VMRL is in value retailing of apparel with a minor presence in non-apparel (footwear, accessories, toys/ games, home textile, furnishing, décor, and appliances, etc.) and Kirana bazaar. It is one of the largest value retail chains in India in terms of store count and retail area. As of December 2024, the company operates 488 stores with a total retail area of ~42 lakh sq. ft. Most V-Mart stores are located in tier-II, III, and IV cities across India. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

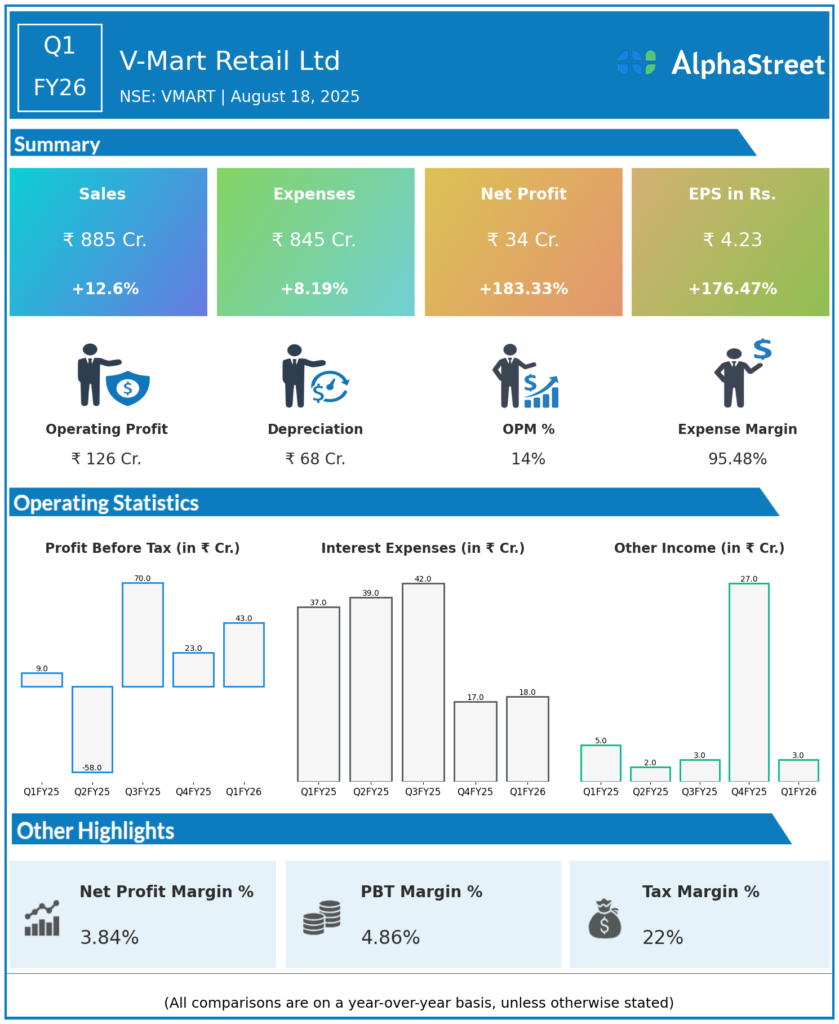

Revenue: ₹885 crore, up 12.6% year-over-year (YoY) from ₹786 crore in Q1 FY25.

-

Net Profit (PAT): ₹34 crore, surged 183% YoY from ₹12 crore.

-

EBITDA: ₹126 crore, up 27% YoY; EBITDA margin expanded to 14.3% from 12.6% YoY.

-

Same-store Sales Growth (SSSG): 1% YoY. Adjusted for preponement of Eid to previous quarter, normalized SSSG was 5%, driven equally by V-Mart and Unlimited store formats.

-

Store Expansion: Added 15 new stores and closed 2 underperforming ones, totaling 510 stores across 27 states & UTs.

-

Inventory Management: Days of Inventory improved by 5% YoY to 93 days, aiding profitability.

-

Digital Revenue: ₹8.13 crore, down 40.8% YoY, but focus on omni-channel retailing continues.

Management Commentary & Strategic Highlights

-

The company focused on value retailing primarily in Tier II and III cities with average store sizes of about 8,000 sq. ft.

-

V-Mart leverages omni-channel presence with platforms like LimeRoad and leading marketplaces.

-

Despite digital revenue decline, physical retail expansion and improved operational efficiency have driven strong profitability.

-

Management remains confident in expanding footprint and market share through store expansion and product mix improvements.

Q4 FY25 Earnings Results

-

Revenue: ₹780 crore, up by 16.59 percent over the last year.

-

Net Profit (PAT): ₹19 crore, a steep rise of over 100 percent over the last year during the same quarter.

-

Higher than previous year; showing steady improvement and positive sequential trend.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.