Incorporated in 1989, Vishnu Chemicals Limited is in the business of manufacturing, marketing and export of Chromium chemicals and Barium compounds across the world. Located in Hyderabad, the company is serving more than 12 industries across 57 countries globally.

Q2 FY26 Earnings Results

-

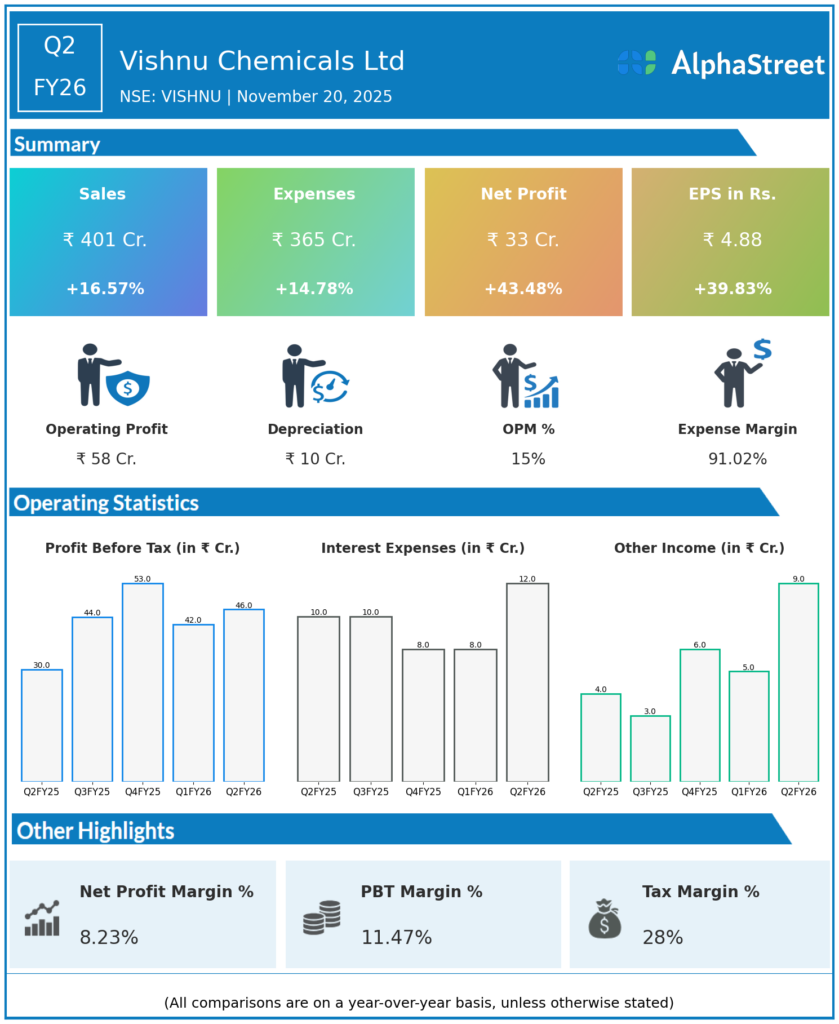

Revenue from Operations: ₹401.15 crore, up 16.7% YoY from ₹343.8 crore and 15.6% QoQ from ₹346.92 crore in Q1 FY26. This represents the highest-ever quarterly revenue for Vishnu Chemicals.

-

EBITDA: ₹58.2 crore, up 55.7% YoY and 4.5% QoQ, with an operating margin of 14.56%, though this marks a sequential decline in margin from 16.11% in Q1 FY26 mainly due to rising operational costs.

-

Profit After Tax (PAT): ₹32.88 crore, up 44% YoY and 2% QoQ, supported by increased other income and favorable tax rates with an effective tax rate of 28.17%.

-

Operating Profit (PBDIT excl Other Income): ₹58.2 crore, up significantly YoY.

-

Employee cost: ₹17.45 crore, stable compared to ₹18.44 crore in Q1 FY26.

-

The company achieved a consolidated EPS of ₹2.90, up from ₹2.59 YoY.

Management Commentary & Strategic Insights

-

The management highlighted the strong volume-driven revenue growth and market share gains across sectors including steel, glass, pharmaceuticals, pigments, dyes, and leather industries.

-

Despite operational margin pressure due to escalating expenses, the company’s ability to sustain absolute profit growth was praised.

-

Management is focused on cost control, product mix enhancement, and maintaining strong tax discipline to sustain profitability.

-

Other income growth, possibly from treasury and investment income, provided key support to results.

-

Continuous efforts on capacity expansion, backward integration, and market diversification are ongoing to drive future growth.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹346.92 crore, up 2.4% YoY.

-

EBITDA: ₹55.7 crore, maintaining healthy margins around 16.1%.

-

Profit After Tax (PAT): ₹32.22 crore, up 5.7% YoY.

-

EPS: ₹2.90 in Q1 FY26, reflecting steady earnings.

-

Management emphasized steady growth with improving operational and cost efficiencies.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.