Company Description

Virtuoso Optoelectronics Limited (VOEPL) is an India-based Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) specializing in white goods. The company manufactures light-emitting diode (LED) lighting, water heaters, and air conditioners (ACs). It also provides electronic manufacturing services (EMS) and has recently diversified into commercial refrigeration and washing machine assembly. Its primary end markets include major domestic consumer appliance brands.

Market Data and Valuation

- Current Stock Price: 359.95 INR

- Market Capitalization: 1,114.20 crore INR

- 52-Week Context: The stock has faced significant volatility, trading between a 52-week high of 622.65 INR and a low of 311.50 INR. The current price represents a decline of approximately 27% over the past 12 months, with the stock currently trading below its 200-day simple moving average (SMA) of 482.20 INR.

- Valuation: The stock carries a trailing twelve-month (TTM) P/E ratio of approximately 132.39x. This is significantly higher than the consumer durables industry average of 51.84x, suggesting a high growth premium despite recent earnings pressure.

Latest Earnings Summary

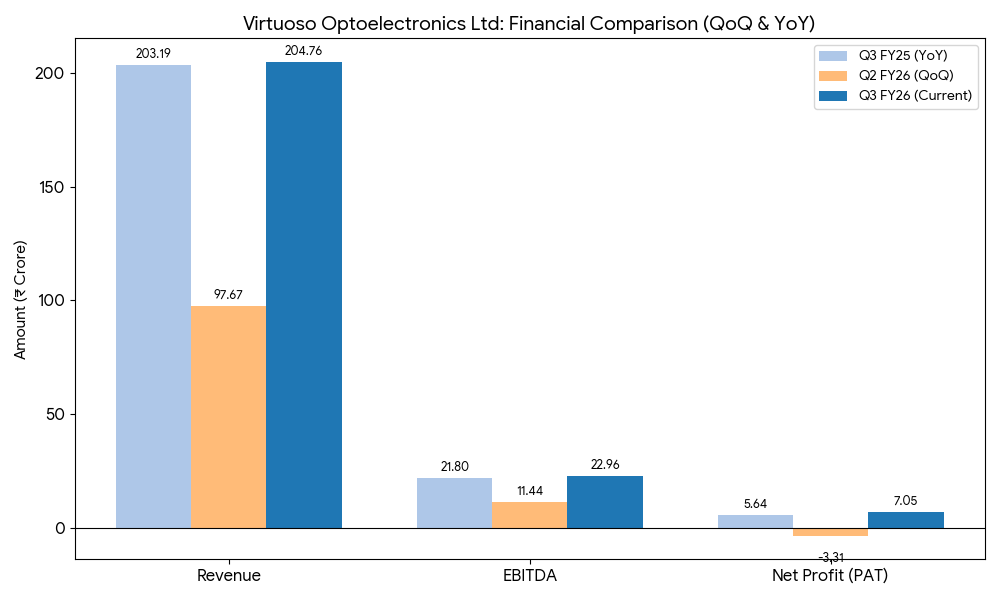

Virtuoso Optoelectronics reported a sequential recovery in the third quarter ended December 31, 2025 (Q3 FY26), following a loss-making second quarter.

- Quarterly Revenue: Revenue for Q3 FY26 stood at 204.55 crore INR, a 110.7% increase from 97.07 crore INR in Q2 FY26.

- Profitability: The company reported a Net Profit (PAT) of 7.05 crore INR for the quarter, compared to a net loss of 3.31 crore INR in the preceding quarter (Q2 FY26).

- EBITDA: Quarterly EBITDA was recorded at 22.96 crore INR.

- Year-to-Date (9M FY26): Consolidated revenue for the first nine months of the fiscal year reached 503.52 crore INR. The company maintained its full-year FY26 revenue guidance of 800-900 crore INR.

Macro Pressures and Challenges

The company continues to navigate high raw material costs, specifically copper and aluminum, which have pressured margins in the AC segment. A key company-specific challenge remains its high seasonal dependence on air conditioning, which previously accounted for 75% of revenue. While management is diversifying into commercial refrigeration and compressors to balance seasonality, high inventory levels and a shift toward “Just-in-Time” purchasing by clients have led to flattish year-on-year growth in some segments. Geopolitical risks are centered on the supply of specialized electronic components, though the company’s new Nashik facility for compressors aims to increase backward integration and reduce import reliance.

SWOT Analysis

| Strengths | Weaknesses |

| Strong backward integration with new compressor and plastic molding units. | High customer concentration (historically dependent on single major clients). |

| High revenue growth history (3-year CAGR > 50%). | Low net profit margins (TTM approx. 1.32%). |

| Opportunities | Threats |

| Capacity expansion from 1M to 1.8M AC units by FY27. | Volatile commodity prices (Copper/Aluminum). |

| Migration from BSE SME to the Main Board to increase institutional liquidity. | Intense competition from large-scale EMS players like Dixon Technologies. |