VIP Industries is engaged interalia, in the business of manufacturing and marketing of luggage, bags and accessories.

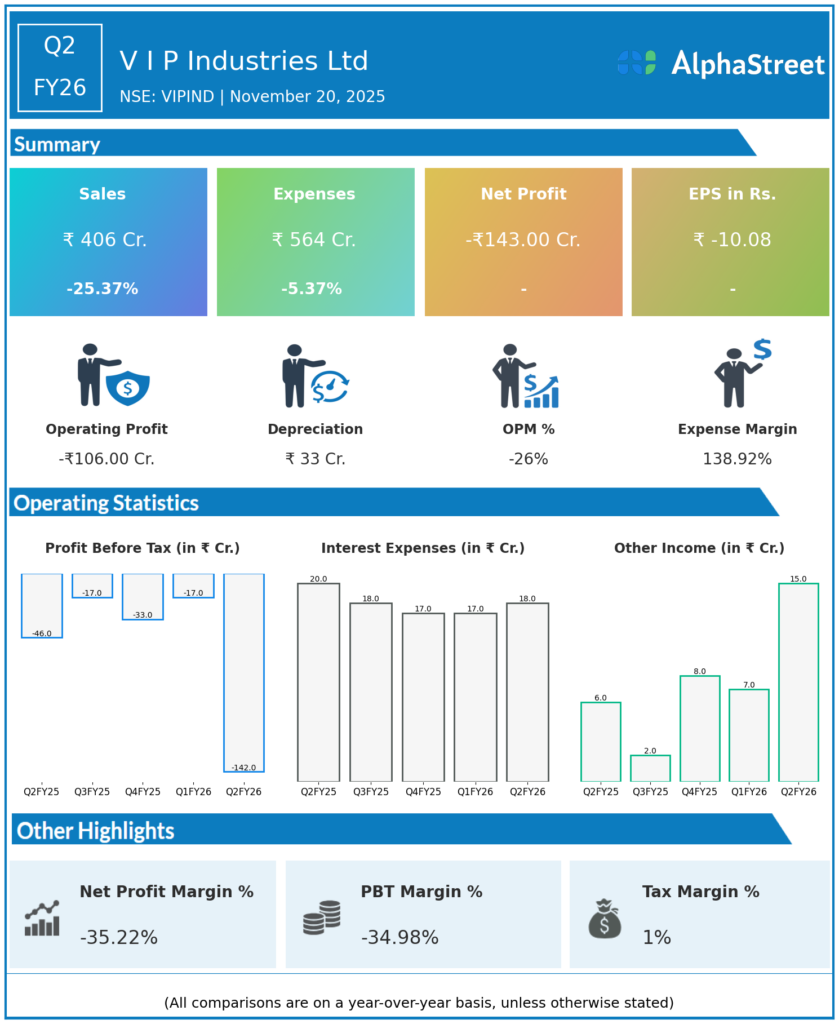

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹406.34 crore, down 25.34% YoY from ₹544.26 crore, and a substantial decline of 27.62% QoQ from ₹561.43 crore in Q1 FY26, indicating significant profit erosion amid challenging demand conditions.

-

Net Loss (PAT): ₹143.14 crore, sharply widening from a loss of ₹33 crore in Q2 FY25, representing a 333.10% YoY deterioration and a 992.67% decline from the smaller loss in Q1 FY26.

-

EBITDA Margin: Margin turned deeply negative at -26.81% in Q2 FY26, compared to 2.59% in Q1 FY26 and -2.95% in Q2 FY25, driven by gross margin compression and operating losses.

-

Gross Profit Margin: Deep contraction to -26.81% from 2.59% QoQ, reflecting inventory write-downs, raw material cost escalation, and intense discounting.

-

Employee Benefits Expenses: ₹52.81 crore, a YoY increase in expenses as a percentage of sales, indicating limited ability to control costs during revenue decline.

-

Operating Efficiency: Operating loss of ₹106.39 crore, the worst performance recorded, primarily due to gross margin erosion and high operating expenses.

-

Capital and Financial Metrics:

-

ROCE: -12.07% for H1 FY26, indicative of severe operating distress.

-

Interest Coverage Ratio: -6.04 times, the weakest in recent history, reflecting unserviceable debts and operational losses.

-

Debt: Increased to ₹477 crore, with a high inventory of ₹245 crore and receivables of ₹132 crore.

-

Management Commentary & Strategic Insights

-

The management highlighted a catastrophic performance driven by a sharp decline in demand for casual and formal luggage amid subdued travel and consumer spending.

-

The company is undertaking aggressive cost-cutting, inventory rationalization, and product portfolio restructuring to curb losses.

-

Market share pressures intensified due to price competition, inventory pile-up, and channel disruptions during the quarter.

-

Despite mounting losses, the management maintains focus on long-term brand rebuilding, supply chain efficiency, and product innovation.

-

Recovery will depend on macro demand revival, easing raw material costs, and strategic cost management initiatives.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹566 crore, a YoY decline of 11.6%, but QoQ increased 13.6% over ₹498 crore in Q4 FY25.

-

Net Profit: ₹56 crore, down 58% YoY from ₹134 crore, and declined from ₹80 crore in Q4 FY25.

-

EBITDA Margin: 5.2%, down from 10.2% YoY, reflecting aggressive discounting and inventory clearance pressures.

-

The company’s performance indicates a challenging demand environment with initial signs of operational stabilization.

-

Management continues to focus on cost control, distribution realignments, and new product launches to rebound in H2 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.