VIP Industries is engaged interalia, in the business of manufacturing and marketing of luggage, bags and accessories. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

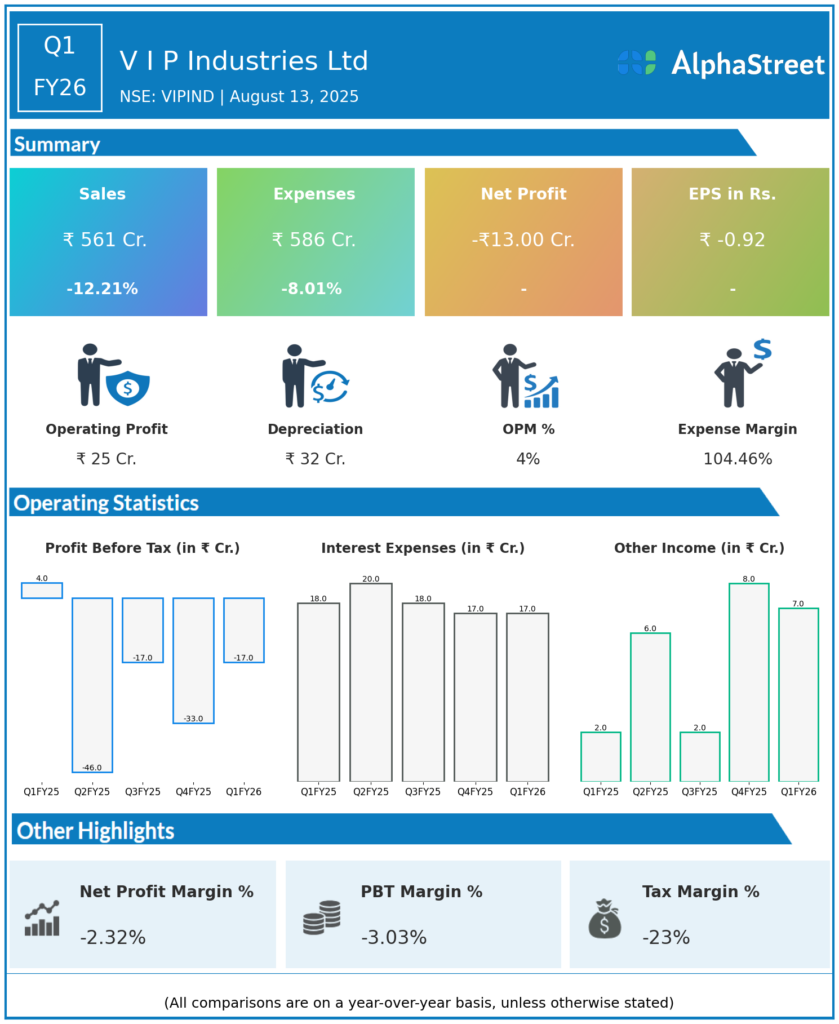

Revenue: ₹561 crore, down 12% year-over-year (YoY) from ₹640 crore in Q1 FY25. Quarter-on-quarter (QoQ), revenue improved by 8.8% over Q4 FY25.

-

Sales Volume: 4.55 million units, an 8% drop YoY—the first volume de-growth in five quarters.

-

Net Profit (PAT): Net loss of ₹13.1 crore compared to a profit of ₹4 crore in Q1 FY25, but an improvement from the previous quarter’s loss of ₹23.9 crore.

-

EBITDA: ₹31.2 crore (down from ₹50 crore YoY). EBITDA margin: 5.2% (vs 8% YoY); normalized margin 10.2% adjusting for one-time inventory provisions.

-

Gross Margin: 45% (normalized: 48% without provisions).

-

Earnings Per Share (EPS): –₹0.92, down from ₹0.30 in Q1 FY25.

Key Operational and Segmental Highlights

-

Hard Luggage Category: Share grew to 63% (from 56% YoY), showing consumer pivot to more durable products.

-

Channel Mix:

-

General Trade – 26%

-

Modern Trade – 26%

-

E-commerce – 19%

(With notable resilience in general trade against softer e-commerce trends).

-

-

Bangladesh Operations: Reported a profit of ₹8 crore versus a ₹11 crore loss YoY, showing operational improvement.

-

Exceptional items:

-

Fire loss at Guwahati warehouse: –₹5.07 crore

-

Insurance claim income (Bangladesh): ₹7 crore

-

Net exceptional gain: ₹1.93 crore.

-

Management Commentary & Strategic Highlights

-

Management attributed the weak quarter mainly to subdued travel demand and market headwinds following regulatory changes and competitive discounting. Inventory rationalisation led to one-off margin impact, but normalization expected in coming quarters.

-

The company is focusing on cost control, product mix optimization (leaning into hard luggage), and channel strengthening, particularly in general trade and profitable international markets.

-

Capacity utilization and operational efficiency initiatives are expected to offset lost volume and margin headwinds as the travel sector recovers.

Q4 FY25 Earnings Results

-

Revenue: ₹494 Crore, down by 4.2% on the YoY basis.

-

Net Loss (PAT): ₹27 crore, a decline of 12.5% as compared to the same quarter previous year.

-

EBITDA Margin: Lower than Q1 FY26, reflecting sequential recovery but annual decline.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.