Incorporated in 1989, Vinati Organics Ltd manufactures specialty organic intermediaries and Monomers.

Q3 FY26 Earnings Results

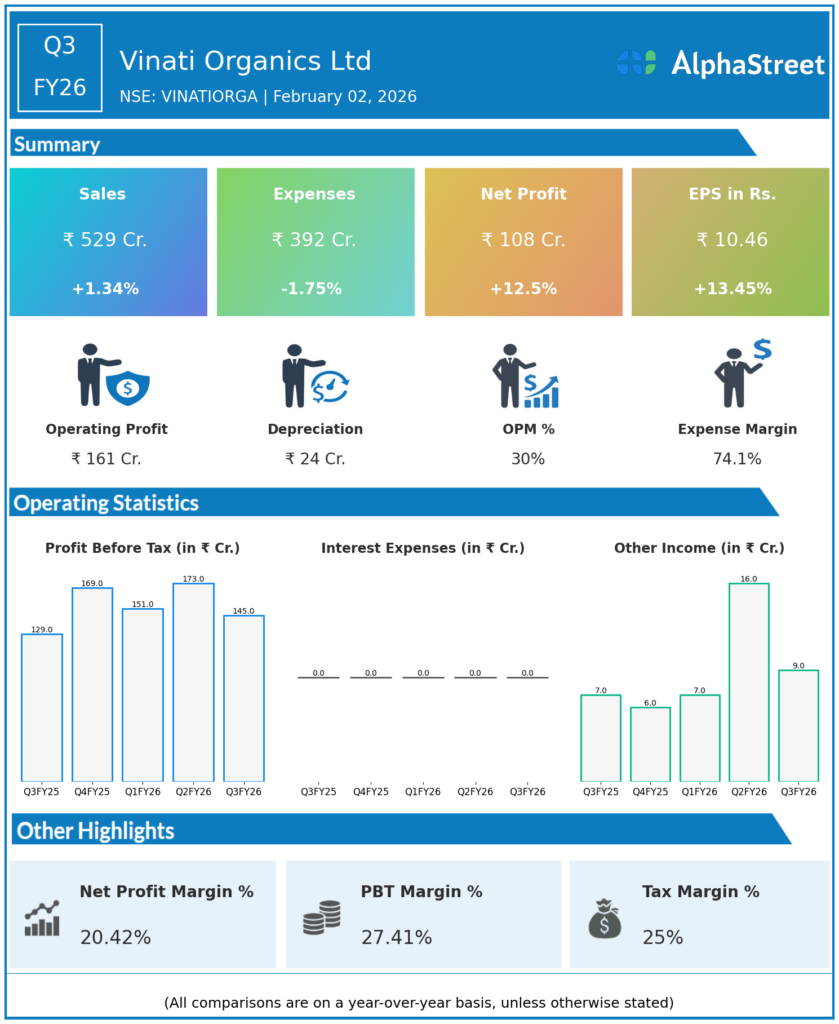

- Revenue from Operations: Consolidated ₹531 cr, +1.7% YoY vs ₹522 cr, +1.5% QoQ vs ₹523 cr; standalone ₹529 cr (+1.7% YoY); modest growth amid soft demand, stable volumes/pricing in specialty chemicals.

- EBITDA: Consolidated ₹156 cr, margin 29.4% (+216 bps YoY); PBDT ₹165 cr (+11% YoY); operational efficiencies offset costs.

- PAT: Consolidated ₹101 cr, +7.6% YoY vs ₹94 cr (+8% YoY), EPS ₹9.7 (+8% YoY); standalone ₹108 cr (+13.5% YoY vs ₹96 cr); 9M consolidated PAT ₹350 cr (+22% YoY).

- Other key metrics: 9M revenue ₹1,623 cr (+YoY); dividend policy updated.

Management Commentary & Strategic Decisions

- Steady performance in muted markets; margin expansion via cost control.

- Strategic moves: Policy updates; focus on resilient segments.

Q2 FY26 Earnings Results

- Revenue from Operations: Consolidated ₹550 cr (−0.6% YoY vs ₹553 cr, +1.5% QoQ); stable amid pricing headwinds.

- EBITDA: Margin 27.2%; PAT ₹115 cr (+10% YoY vs ₹104 cr).

- PAT: Strong YoY growth on efficiencies.

- Other key metrics: H1 trends positive.

Management Commentary Q2

- Revenue flat but profitability improved.

- Strategic moves: Operational leverage focus.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.