Vijaya Diagnostics Centre limited is a leading diagnostic medicare services provider in Southern India and offers comprehensive services that include nuclear medicine, radiology, laboratory, health check-ups and medical services. The company provides its services across 13 cities through its 81 diagnostic centers and 11 reference laboratories.

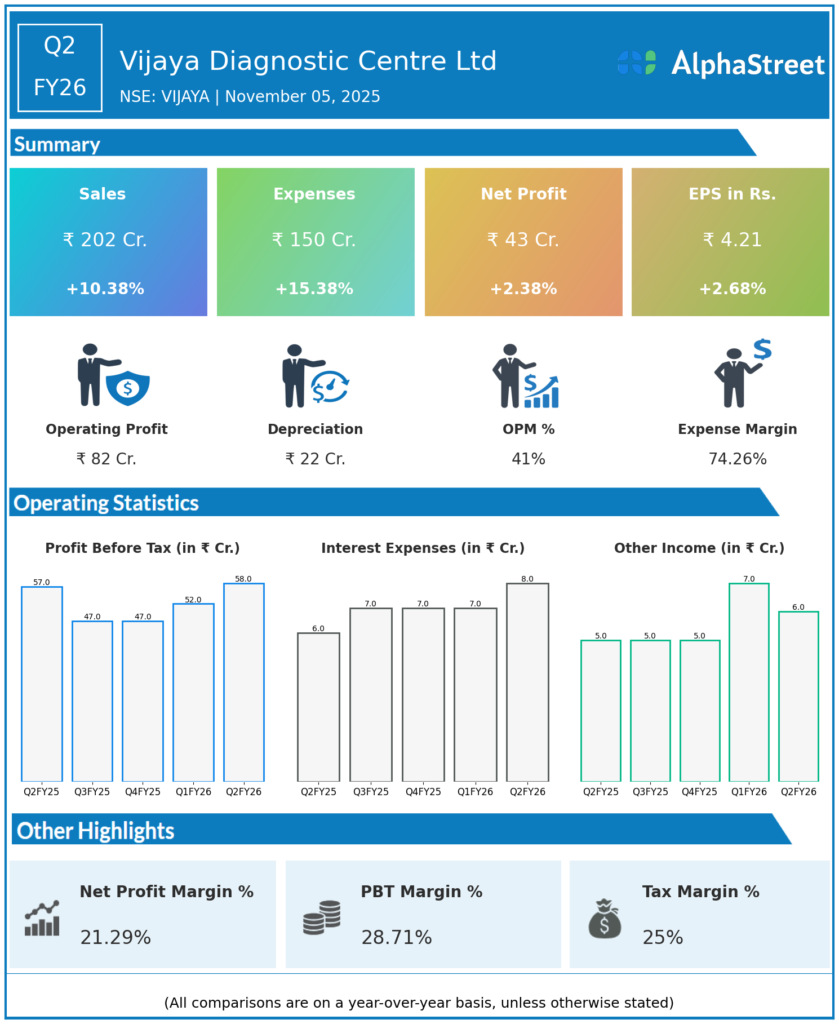

Q2 FY26 Earnings Results:

-

Consolidated Revenue: ₹201.56 crore, up 10.17% YoY and 7.18% QoQ.

-

Profit After Tax (PAT): ₹43.28 crore, up 2.75% YoY and 12.15% QoQ.

-

EBITDA: ₹81.83 crore, margin at 40.6%.

-

Employee costs increased to ₹32.26 crore from ₹31.61 crore QoQ.

-

Depreciation costs: ₹22.27 crore, up QoQ.

-

Interest costs: ₹7.83 crore, slightly higher QoQ.

-

Strong operational cash flow with ₹224 crore cash flow from operations in FY25.

-

Continued capital expenditure focus on new centres and equipment upgrades.

-

Commissioned new hub centres in Kasba, Kolkata; Nandyal, AP; Khammam, Telangana; and a new spoke in Alwal, Hyderabad.

-

Merger of Medinova Diagnostic Services Ltd with Vijaya approved by NCLT effective April 1, 2024.

-

Future expansions planned with two more hubs in West Bengal and a flagship centre at Bannerghatta, Bengaluru.

Management Commentary & Strategic Insights:

-

MD & CEO Suprita Reddy expressed confidence in sustained growth driven by volume increases, operational efficiencies, and regional expansion.

-

Rapid break-even achieved in new hubs, indicating strong market demand.

-

Significant focus on integrated diagnostics and application of advanced technologies such as PET-CT.

-

The company is strategically positioned to capitalize on growing demand in key markets including Bengaluru and West Bengal.

-

Maintaining disciplined cost management amid growth investments.

Q1 FY26 Earnings Results:

-

Revenue: ₹188.05 crore, up 20.5% YoY.

-

PAT: ₹38.59 crore, up 23.1% YoY.

-

EBITDA: ₹73.5 crore, margin at 39.1%.

-

Average realization per test and per footfall improved YoY.

-

Successful operation of new hubs in Pune, Bengaluru and West Bengal.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.