Vijaya Diagnostics Centre limited is a leading diagnostic medicare services provider in Southern India and offers comprehensive services that include nuclear medicine, radiology, laboratory, health check-ups and medical services. The company provides its services across 13 cities through its 81 diagnostic centers and 11 reference laboratories. The company is the largest integrated diagnostic chain in South India. It was among the first in South India to offer PET-CT scans. In Q1 FY25, the company registered a revenue growth of 29% YoY, with approximately 20% of this growth achieved organically. This growth was largely driven by increases in both footfall and test volume. Total footfall grew by about 22% YoY to 0.79 million, while the total number of tests increased by approximately 29% to 3.38 million in Q1 FY25. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

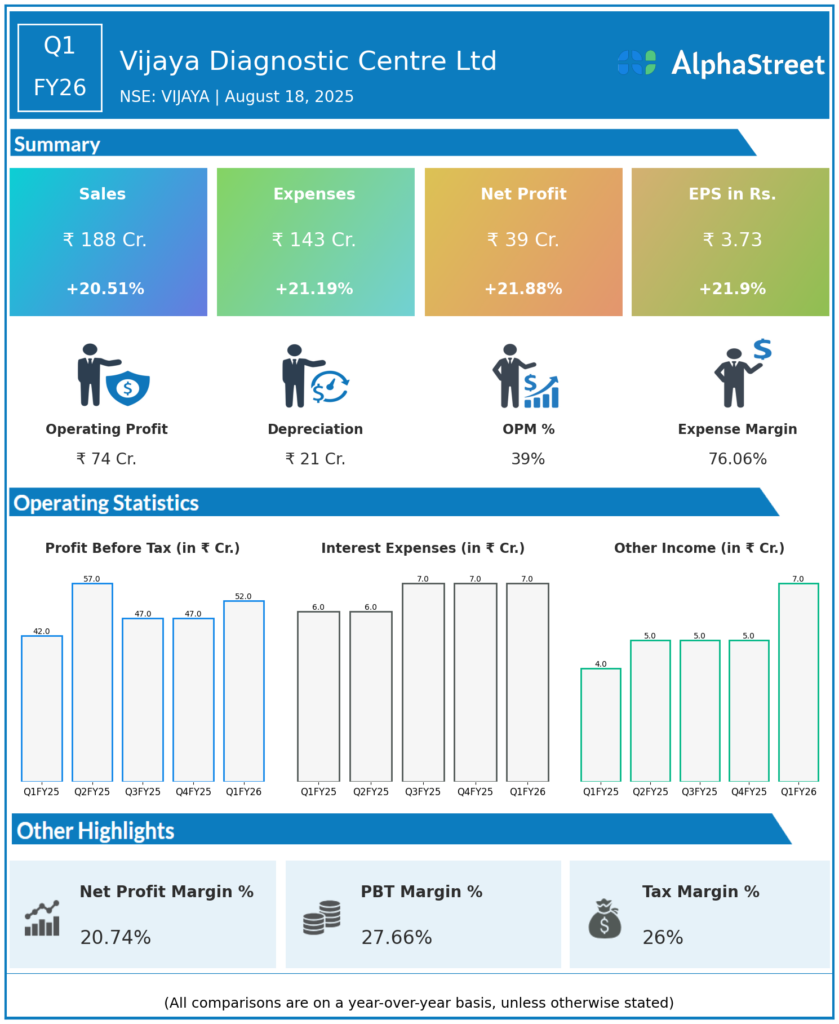

Revenue from Operations: ₹188.05 crore, up 20.5% year-over-year (YoY) from ₹156.22 crore in Q1 FY25.

-

Net Profit (PAT): ₹38.59 crore, up 21.8% YoY from ₹31.35 crore.

-

EBITDA: ₹73.50 crore, up 20.1% YoY; EBITDA margin steady at 39.1% (vs 39.2% last year).

-

EPS (Basic): ₹3.73, up 21.9% YoY.

-

PAT Margin: 20.4%, up 32bps YoY.

-

Tests performed: 3.94 million (vs 3.38 million last year); footfalls increased to 1.10 million (from 0.96 million); revenue per test: ₹477 (up from ₹462); revenue per footfall: ₹1,707.

Management Commentary & Strategic Highlights

-

CEO highlighted strong financial performance and double-digit growth in Hyderabad, plus new hub launches in Pune, Bengaluru, and West Bengal.

-

Nizamabad hub achieved break-even in two quarters.

-

Planned commissioning of more hubs in Andhra Pradesh, Telangana, and West Bengal in Q2 FY26.

-

Strategic expansion continues, including acquisition of Pune’s largest B2C integrated diagnostic chain and rollout of new hubs in Bengaluru.

Q4 FY25 Earnings Results

-

Revenue: ₹173.24 crore, up 11.6% on the YoY basis.

-

Net Profit: ₹35 crore, up 3 percent over the same quarter last year.

-

Results show sequential growth in revenue and profit, underlining operational momentum.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.