Incorporated in 1991, Vesuvius India Ltd manufactures and trades refractory goods. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

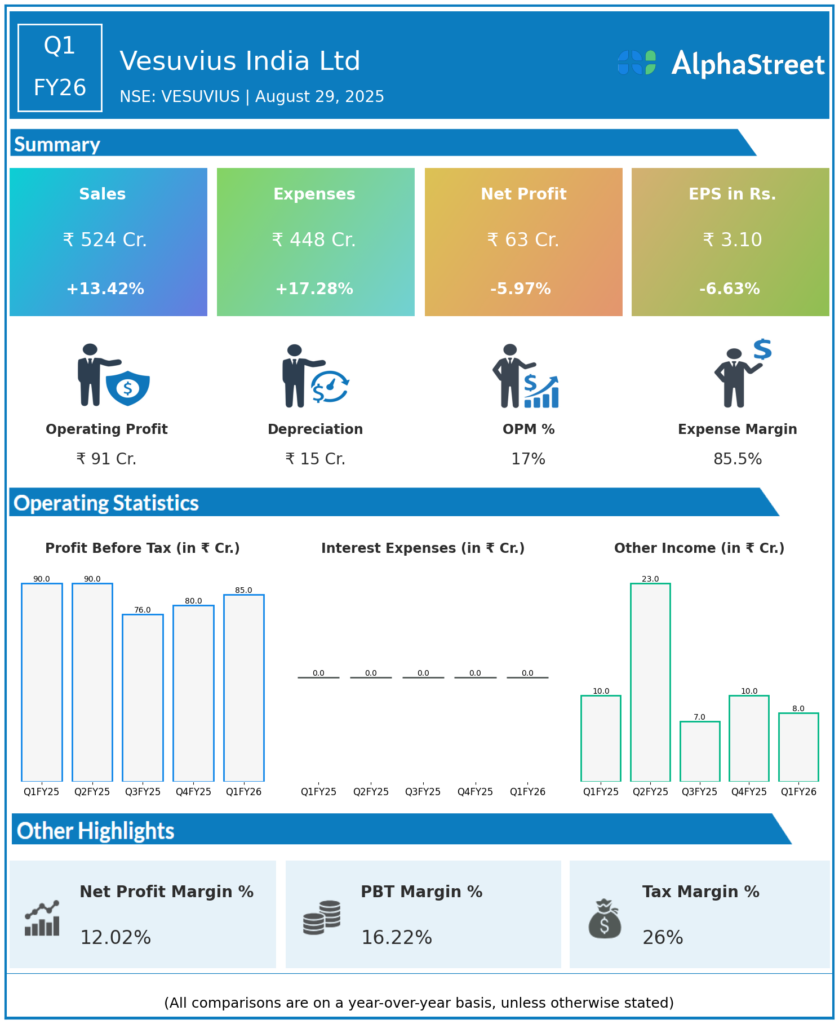

Total Revenue: ₹524.30 crores, up 13.4% YoY (Q1 FY25: ₹462.42 crores) and up 8.7% QoQ (Q4 FY25: ₹482 crores).

-

Operating Income (EBITDA): ₹91 crores, up 10% QoQ and flat YoY; operating margin at 17.4% (Q1 FY25: 19.8%).

-

Profit After Tax (PAT): ₹63 crores, up 6.2% QoQ (Q4 FY25: ₹59 crores) but down 5.97% YoY (Q1 FY25: ₹67 crores).

-

EPS: ₹3.10, up 6.2% QoQ and down 6.6% YoY (prior year included large exceptional profits).

-

Depreciation: ₹15 crores.

-

Tax Expense: ₹22 crores approx.

-

Key Drivers: Revenue growth driven by higher volumes and price increases; margin compression due to cost inflation and product mix changes.

-

Industry Position: Leader in refractory products serving steel and foundry sectors with focus on innovation and operational efficiency.

Management Commentary & Strategic Highlights

-

Management highlighted steady revenue growth amidst inflationary pressures and volatile raw material costs.

-

Focus on cost controls, productivity improvements, and innovation to maintain competitive positioning.

-

Continued investment in product development and capacity expansion targeted at high-growth sectors.

-

Operating income reflects margin pressure but a resilient profit base underpinned by strong volume and pricing.

Q4 FY25 Earnings Results

-

Total Revenue: ₹482 crores.

-

PAT: ₹59 crores.

-

EPS: ₹2.92.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.