Tide Water Oil Company Ltd. is a leading manufacturer and marketer of lubricants in over 65 countries around the globe. In India, it has been catering to both automotive and industrial segments since 1928 under the brand “Veedol”. The Co. has a PAN India presence through its extensive distribution network consisting of 50 distributors and over 650 direct dealers servicing over 50,000 retail outlets. The company has 5 manufacturing facilities in India located in Faridabad, Ramkrishnapur, Turbhe, Silvassa and Oragadam. It has a total installed capacity of 105,000 KLPA for lubricants and 6,160 MTPA of grease. Veedol also has 2 in-house research and development centres. It does not manufacture outside India directly but Granville Oil & Chemicals Ltd., a step-down subsidiary of the Veedol owns a manufacturing facility in Rotherham, UK. Presenting below are its Q1 FY26 earnings results.

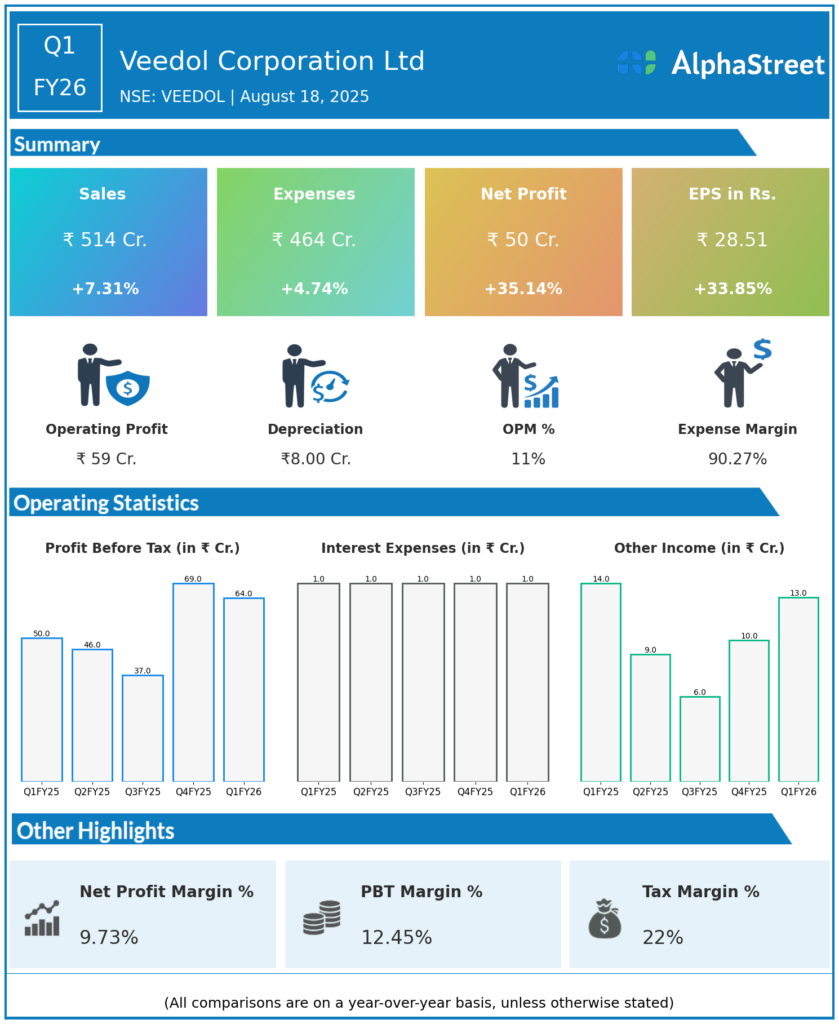

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹513.62 crore, up 7.3% year-over-year (YoY).

-

Total Income: ₹519.37 crore, up 6.7% YoY and 4.9% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹49.67 crore, up 35.1% YoY and 15.7% QoQ (Q1 FY25: ₹37.11 crore; Q4 FY25: ₹42.92 crore).

-

Profit Before Tax (PBT): ₹63.72 crore, up 27.7% YoY.

-

EPS: ₹28.51, up 33.9% YoY.

-

Total Expenses: ₹464 crore, up 4.7% YoY.

-

EBITDA: ₹58.8 crore, up 42% YoY (EBITDA margin 11.44%, up 279bps YoY).

-

Margins: PAT margin 9.7%, up from 7.8% YoY.

-

Standalone Performance: Standalone results are weaker, but consolidated performance drives growth.

Management Commentary & Strategic Highlights

-

Veedol maintained strong growth in both revenue and profitability, with EPS and EBITDA margins expanding significantly YoY.

-

The company managed operational costs effectively relative to income, with cost of materials at ₹276.10 crore and employee costs rising 24.4% YoY.

-

Lubricants demand and market share expansion continues to support robust financials; strong distribution network and market engagement.

-

Management noted stable operational performance and ongoing process improvement.

-

The significant improvement in consolidated profit versus standalone numbers highlights success in group-wide cost and sales management.

-

Share price saw little change, indicating results were in line with expectations and sector trends.

Q4 FY25 Earnings Results

-

Total Income: ₹532 crore, up by 9.2 percent on the YoY basis.

-

Net Profit: ₹60 crore depicting a growth of 40 percent over the same quarter during last year.

-

EPS: ₹34.26 vs ₹24.63, during the same quarter last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.