Vedanta Ltd is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminium, iron ore and oil & gas. It has presence across India, South Africa, Namibia, Ireland, Liberia & UAE. Its other businesses includes commercial power generation, steel manufacturing & port operations in India and manufacturing of glass substrate in South Korea and Taiwan.

Q2 FY26 Earnings Results:

-

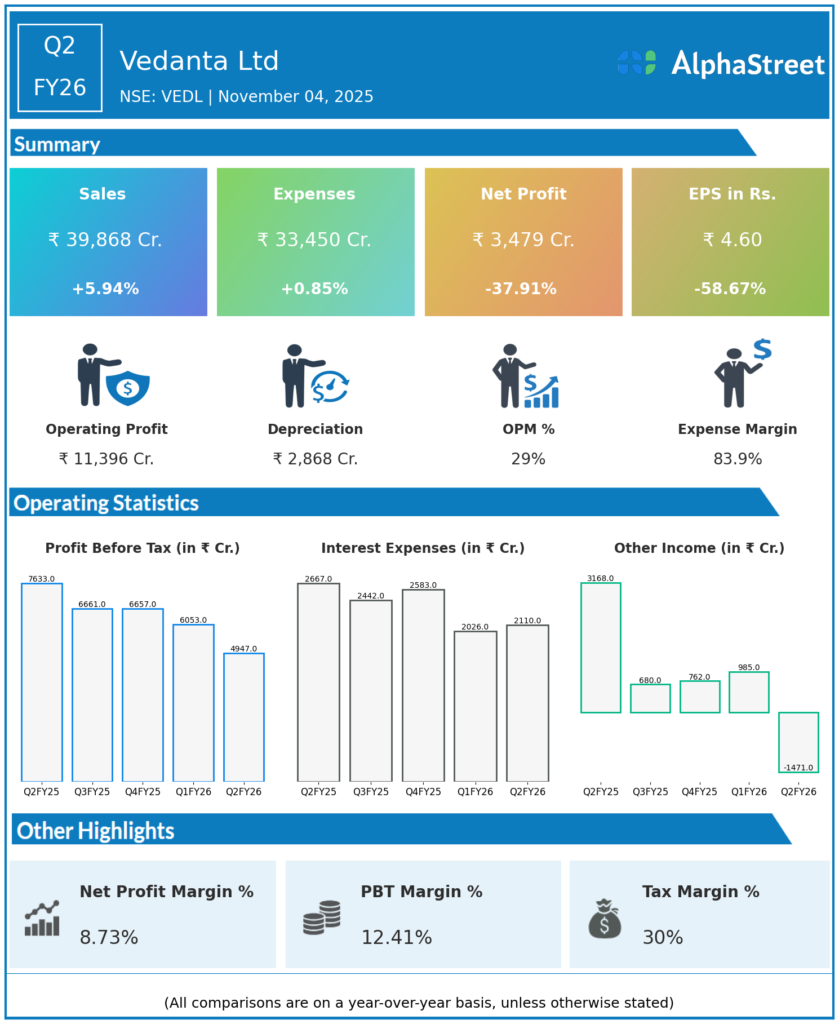

Consolidated Revenue from Operations: ₹39,868 crore, up 5.9% YoY from ₹37,634 crore in Q2 FY25.

-

Consolidated Profit After Tax (PAT): ₹3,479 crore, declined 37.9% YoY from ₹5,603 crore mainly due to an exceptional loss of ₹2,067 crore this quarter compared to gains last year.

-

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): ₹11,612 crore, up 12% YoY.

-

EBITDA Margin: Expanded to 28.6% from 26.1% YoY, reflecting good cost control and operational efficiency.

-

Net Debt to EBITDA ratio improved to 1.37x.

-

Standalone Revenue: ₹19,988 crore, up 9.3% YoY.

-

Standalone PAT: ₹2,195 crore, down 79.2% YoY due to exceptional items.

-

Capex for H1 FY26: $0.9 billion.

-

Record production noted for Aluminium, Alumina, Zinc MIC, Pig iron, and power generation.

Management Commentary & Strategic Insights:

-

Executive Director Arun Misra highlighted operational resilience despite volatile commodity prices and geopolitical uncertainties.

-

Strong production volumes and project commissioning including new power plants and refinery expansions.

-

Confident forecast for FY26 with EBITDA expected to surpass $6 billion (historical best in FY22).

-

Focus on disciplined cost management, volume growth, and capacity expansion.

-

Credit rating reaffirmed at AA by rating agencies.

-

Company facing concerns regarding free cash flow decline due to dividend payments funded by increased debt, adjusting dividend guidance to 4-5% for next three years.

Q1 FY26 Earnings Results:

-

Consolidated Revenue: ₹37,824 crore, up 6% YoY.

-

Consolidated PAT: ₹4,457 crore, down 13% YoY but up 96% QoQ after adjusting for one-time items.

-

EBITDA: ₹10,746 crore, up 6% YoY.

-

EBITDA Margin: 35%, highest in 13 quarters.

-

Strong volume growth and lower raw material expenses contributed to margin expansion.

-

Interim dividend of ₹7 per share declared.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.