Vedant Fashions Limited caters to the Indian celebration wear market with a diverse portfolio of brands. The company offers its customers a one-stop destination for every celebratory occasion and the largest men’s Indian wedding and celebration wear by revenue. VFL commands a dominant position in conventionally unorganized market segment.

Q2 FY26 Earnings Results:

-

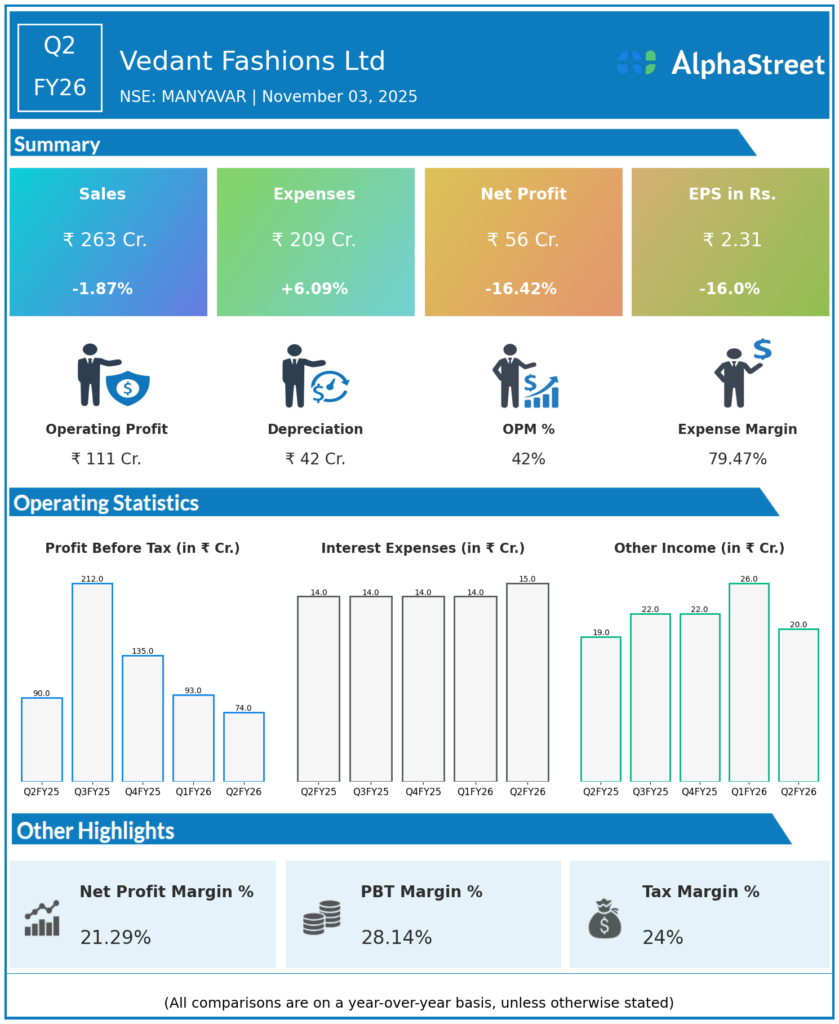

Revenue from Operations: ₹263 crore, down 1.8% YoY from ₹267 crore in Q2 FY25.

-

EBITDA: ₹110 crore, down 9.54% YoY from ₹121 crore.

-

EBITDA Margin: 42.10%, contracted from 45.54% YoY.

-

Profit After Tax (PAT): ₹56 crore, down 16.18% YoY from ₹66 crore.

-

Total Income: ₹283 crore, down 1.4% YoY.

-

Total Expenses: ₹209 crore, up 6.1% YoY, due to higher raw material and employee benefit costs.

-

Profit Before Tax (PBT): ₹74 crore, down 17.9% YoY.

-

Tax Expense: ₹17 crore, down 22.9% YoY.

-

Retail Sales: Increased 4.6% YoY.

-

The quarter saw operational challenges due to GST rate rationalization and related execution impacting dispatches for 15-20 days.

-

H1 FY26 revenue: ₹544 crore, up 7.2% YoY; H1 FY26 PAT: ₹126 crore, slightly down from last year.

Management Commentary & Strategic Insights:

-

Management highlighted a transitional quarter due to GST changes affecting operations.

-

Focus remains on strong brand positioning, premiumization, and healthy margins.

-

Effective management of cost structure despite external challenges.

-

Operational excellence and high cash conversion ratio (~79% in trailing 12 months).

-

Strong performance in Andhra Pradesh and Telangana regions noted.

-

Same-store sales grew positively, although Q2 faced a negative 2.0% same-store sales growth.

Q1 FY26 Earnings Results:

-

Revenue: ₹2,812 crore, up 17.2% YoY.

-

Profit After Tax: ₹703 crore, up 12.4% YoY.

-

Same Store Sales Growth (SSSG): 17.6%.

-

Strong recovery in key regions like AP & Telangana.

-

Retail area network about 1.78 million sq. ft., focusing on quality store expansions.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.