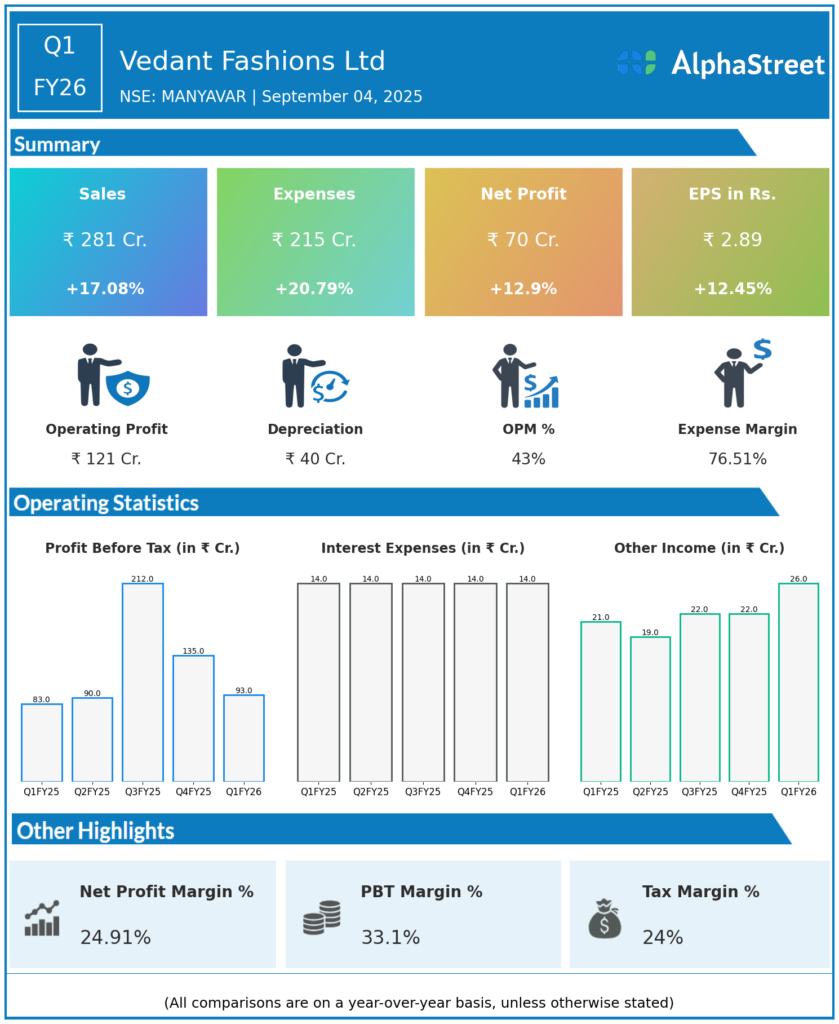

Vedant Fashions Limited caters to the Indian celebration wear market with a diverse portfolio of brands. The company offers its customers a one-stop destination for every celebratory occasion and the largest men’s Indian wedding and celebration wear by revenue. VFL commands a dominant position in conventionally unorganized market segment. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹281.19 crores, up 17% YoY (Q1 FY25: ₹239.82 crores), down 23.4% QoQ (Q4 FY25: ₹367.43 crores).

-

Total Income: ₹307.02 crores, up 17.5% YoY.

-

Profit After Tax (PAT): ₹70.26 crores, up 12.9% YoY (Q1 FY25: ₹62.49 crores).

-

EPS: ₹2.89, up 12.45% YoY (Q1 FY25: ₹2.51).

-

Gross Margin: 66.9%, healthy for the sector but slightly lower YoY due to higher marketing spend.

-

EBITDA Margin: 43.2%, down slightly YoY as marketing spend normalized after an unusually low Q1 last year.

-

PAT Margin: About 25% (Q1 FY25: 26.1%).

-

Marketing Spend: Rose to 5.6% of revenue (up from 2.3% last year) with strong campaigns for Manyavar, Mohey, and Twamev.

-

Retail Network: Store footprint at 1.78 million sq.ft.; expansion focused on quality and consolidation, not rapid net additions.

-

Same Store Sales Growth (SSG): 17.6% YoY, driven by improved conversion rates and higher average selling prices.

-

Brand Growth: Emerging brands Mohey and Twamev outperformed company averages.

Management Commentary & Strategic Highlights

-

Management cited strong wedding season demand, rebound in AP and Telangana, and improvements in SSG as key Q1 drivers.

-

The slight contraction in margins is not structural; management expects full-year margins to remain stable.

-

Focus is on innovation, inventory prep, new designs, and robust marketing initiatives, supported by strong infrastructure and auto replenishment systems.

-

Competitive intensity from unorganized players is moderating, allowing Manyavar’s branded retail strategy to thrive.

Q4 FY25 Earnings Results

-

Revenue from Operations: ₹367.43 crores.

-

PAT: ₹101.11 crores.

-

EPS: ₹4.16.

-

Gross Margin: 68%.

-

EBITDA Margin: 44%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.