Varun Beverages Ltd has been associated with PepsiCo since the 1990s and is a key player in beverage industry and one of the largest franchisee of PepsiCo in the world. The company produces and distributes a wide range of carbonated soft drinks, non-carbonated drinks and packaged water sold under trademarks owned by PepsiCo. PepsiCo brands produced and sold by the company include Pepsi, Seven-up, Mirinda Orange, Mountain Dew, Tropicana Juices and many more.

Q2 FY26 Earnings Results

-

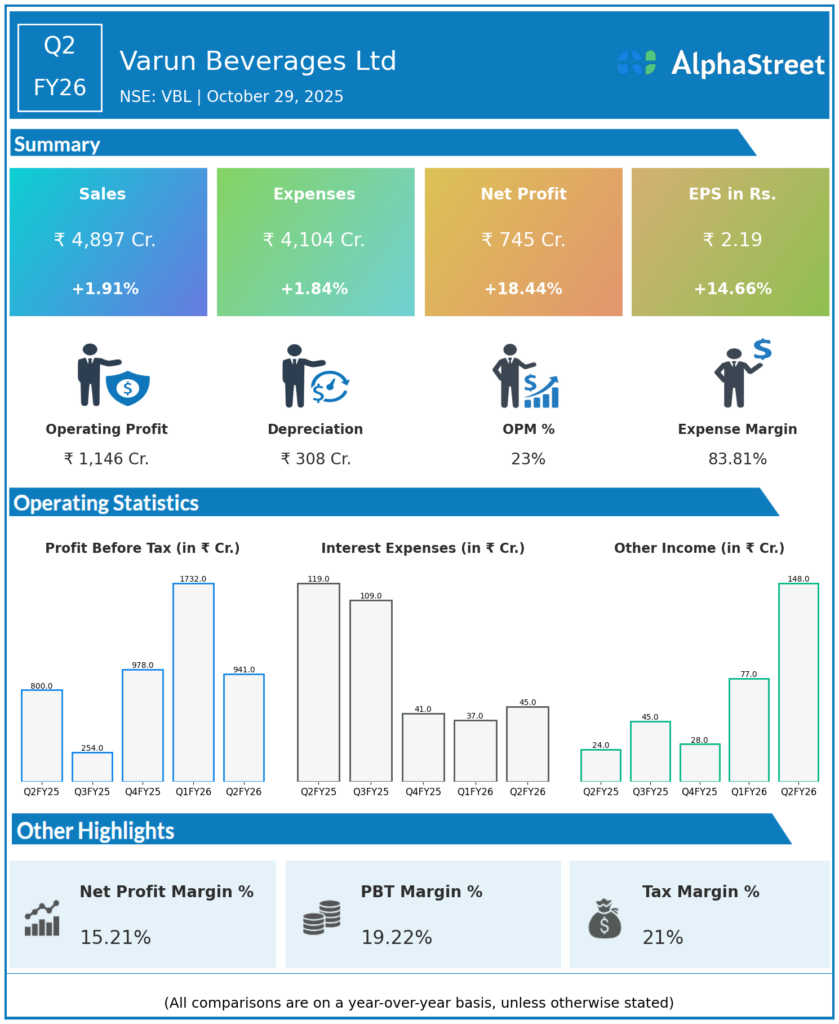

Revenue from Operations: ₹4,897 crore, up 1.9% YoY from ₹4,805 crore in Q2 CY24.

-

Net Profit (PAT): ₹745 crore, up 18.4% YoY from ₹628.8 crore in Q2 CY24.

-

EBITDA: ₹1,998.77 crore, EBITDA margin 28.5%, margin improved by 82 bps YoY.

-

Consolidated sales volume: 389.7 million cases, down 3.0% YoY.

-

International market volumes grew by 15.1%, partially offsetting domestic volumes decline due to rainfall.

-

Gross margin steady at 54.5%.

-

Operational efficiencies, capacity ramp-up, and product mix optimization contributed to margin expansion.

-

Four new greenfield plants commissioned in India, ready for volume growth.

-

Dividend: Interim dividend of ₹0.50 per share declared.

Management Commentary & Strategic Decisions

-

Focus on operational excellence, capacity enhancement, and expansion in premium and health product segments.

-

Sustained improvement in international markets, especially in Africa.

-

Emphasis on ESG initiatives including water and energy management.

-

Marketing and product innovation remain key focus areas to capture evolving consumer preferences.

-

Long-term confident outlook on domestic beverage market potential despite volume headwinds caused by weather conditions.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹7,017 crore, down 2.5% YoY from ₹7,513 crore in Q1 FY25.

-

Profit After Tax (PAT): ₹1,325.49 crore, up 5% YoY from ₹1,261.83 crore.

-

EBITDA: ₹1,998.77 crore, with margin expansion of 82 basis points YoY to 28.5%.

-

Stable gross margin at 54.5%.

-

Sequential PAT growth of 81.2% QoQ.

-

Management highlights capacity ramp-up and international expansion as key growth drivers.

-

Continued dividend payouts underlining strong cash generation and financial health.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.