Varun Beverages Ltd has been associated with PepsiCo since the 1990s and is a key player in beverage industry and one of the largest franchisee of PepsiCo in the world. The company produces and distributes a wide range of carbonated soft drinks, non-carbonated drinks and packaged water sold under trademarks owned by PepsiCo. PepsiCo brands produced and sold by the company include Pepsi, Seven-up, Mirinda Orange, Mountain Dew, Tropicana Juices and many more.

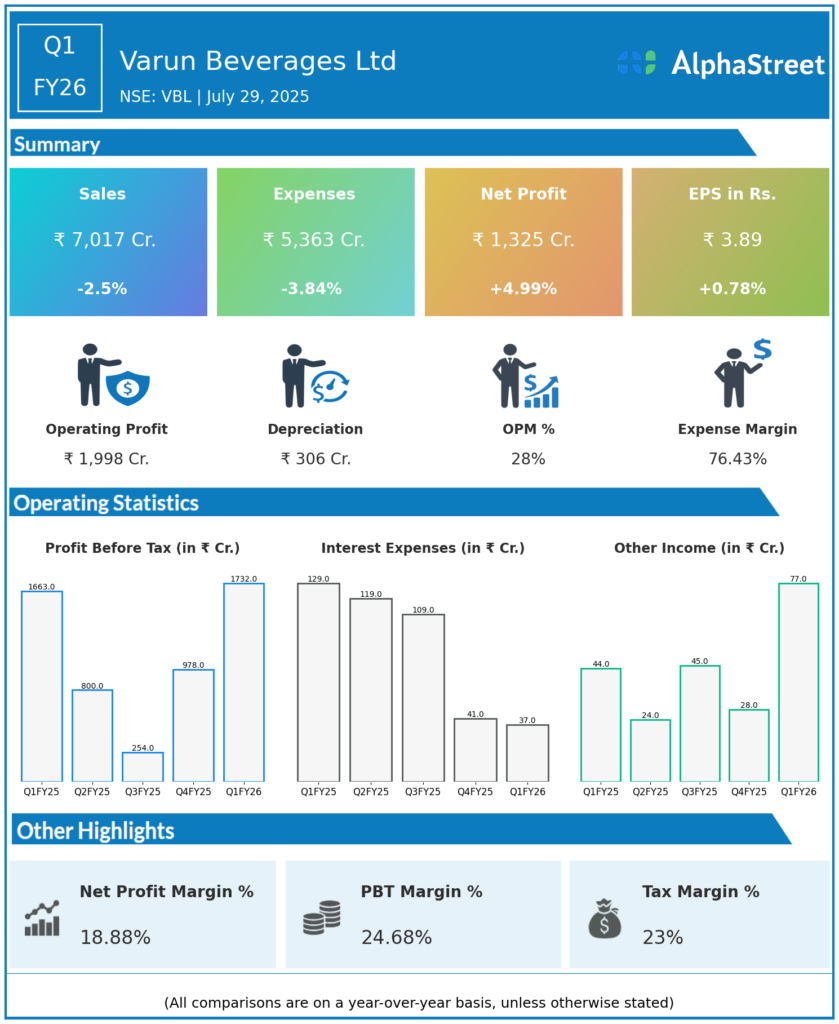

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Revenue from Operations: ₹7,017 crore, down 2.5% YoY from ₹7,513 crore in Q1 FY25.

-

Net Profit (PAT): ₹1,325.49 crore, up 5% YoY from ₹1,261.83 crore in Q1 FY25.

-

Sequential (QoQ) Growth: PAT increased 81.2% QoQ (from Q4 FY25 to Q1 FY26).

-

EBITDA: ₹1,998.77 crore; margin expanded by 82 bps YoY to 28.5% (from 27.7% in Q1 FY25).

-

Gross Margin: Stable at 54.5%.

-

Dividend: Interim dividend of ₹0.50 per share announced again in July 2025 (cash outflow: ₹169.1 crore).

-

Profit Drivers: Margin expansion supported by operational efficiency, currency moves in international markets, and strong cost control despite a decrease in revenue.

-

Capacity: Higher fixed overheads from newly commissioned capacity at four greenfield plants, ready to contribute to future volume growth.

-

Management Commentary: Focus continues on operational excellence, capacity ramp-up, and product mix optimization; international expansion also supported earnings resilience.

Key Management & Strategic Decisions

-

Capacity & Expansion: Commissioned four greenfield plants in India in the last year, focusing on increased production for peak season as well as future scaling.

-

Operational Efficiency: Achieved margin improvement through better route-to-market execution, scale economies, and currency tailwinds in exports.

-

Product Portfolio: Ongoing rollout of new products fitting premium and health segments (including low-sugar/value packs) to address changing consumer preferences.

-

Shareholder Returns: Continued regular dividend payouts reflect strong cash generation and balance sheet health.

-

International Strategy: Volumes from Africa, especially South Africa, and DRC made meaningful contributions to growth, with a focus on expanding overseas footprint.

-

Sustainability: Stepped-up ESG initiatives, especially water and energy management, remain a management priority.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue from Operations: ₹5,680 crore, up 29% year-on-year from ₹4,398 crore in Q4FY24.

-

Consolidated Net Profit (PAT): ₹731.3 crore, registering a 33.4% YoY jump.

-

EBITDA: ₹1,263.96 crore, up 27.8% YoY.

-

India Margins: Improved by 111 basis points due to operational gains.

-

EPS: ₹4.10.

-

Interim dividend of ₹0.5 per share was declared in May.

-

Strong double-digit volume growth driven both by organic performance in India and growing presence in international markets, especially South Africa.

-

Enhanced distribution reach and operational efficiency, with new greenfield plants commissioned in Prayagraj and upcoming in Bihar and Meghalaya.

-

Net debt position improved due to QIP fundraise, with robust expansion in distribution and backward integration supporting profitability