Vardhman textiles is engaged in the business of manufacturing Yarn, Fabric, Acrylic Fiber and Garments, the Group has over the years developed as a business conglomerate with a presence in India and in 75 countries across the globe. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

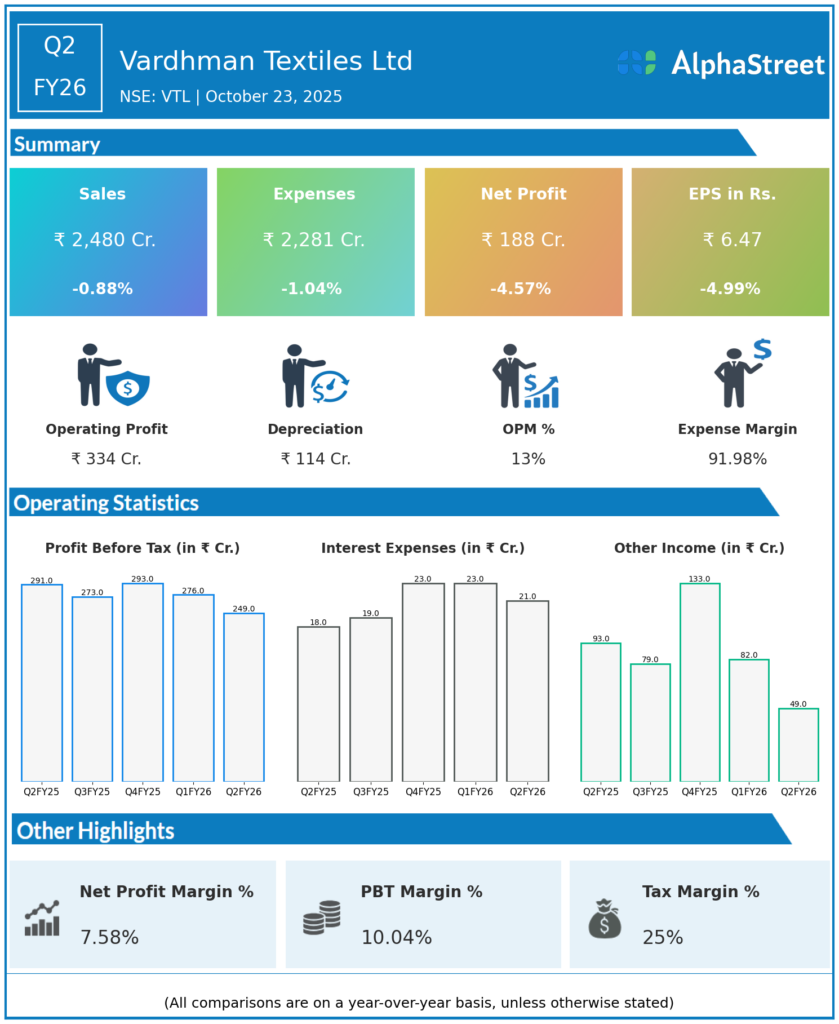

Revenue from Operations: ₹2,480.1 crore, marginally down 0.9% YoY from ₹2,502.4 crore, and up 4% QoQ from ₹2,386 crore in Q1 FY26.

-

EBITDA: ₹334 crore, up 6% YoY from ₹315 crore and 2% QoQ from ₹326 crore, highlighting improved operational performance.

-

EBITDA Margin: 13.5%, up 90 basis points YoY from 12.6%, driven by enhanced product mix and cost management.

-

Profit Before Tax (PBT): ₹187.76 crore, down 4.8% YoY compared with ₹197.29 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹187.03 crore, down 4.8% YoY and 10% QoQ from ₹208 crore in Q1 FY26.

-

EPS: ₹6.47, down from ₹6.81 in Q2 FY25 and ₹7.16 in Q1 FY26.

-

Total Expenses: ₹2,281 crore (down 1.1% YoY), reflecting cost discipline amid demand moderation.

Segmental & Operational Overview

-

Yarn Segment: Continued to contribute the majority of sales but faced margin pressure due to fluctuating cotton prices and muted export demand.

-

Fabric & Garments: Volumes remained steady with moderate growth in value-added and blended fabric categories.

-

Acrylic Fibre Segment: Outperformed with 27% YoY growth, rising to ₹89.4 crore due to improved realizations in specialty fabrics.

-

Exports: Accounted for approximately 43% of total revenue, with exposure to U.S. brands remaining indirect; global demand normalization expected in H2 FY26.

Management Commentary & Strategic Outlook

Company’s statement (as per exchange filing):

“The company maintained operational stability despite the challenges in global markets. Our focus on efficiency, sustainable production, and value-added product lines supported profitability. We remain cautiously optimistic for the second half of FY26 as demand recovery in domestic and US markets is anticipated.”.

Strategic updates:

-

Announced ₹3,535 crore CAPEX plan to upgrade spinning and fabric manufacturing capacity by FY28, focusing on automation and sustainability initiatives.

-

Plans to expand renewable energy usage to 60% across facilities by FY27.

-

Continued emphasis on premium and export quality yarns for apparel and technical textiles.

Q1 FY26 Earnings Results

-

Revenue: ₹2,386 crore.

-

EBITDA: ₹326 crore (margin 13.7%).

-

PAT: ₹208 crore.

-

EPS: ₹7.16.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.