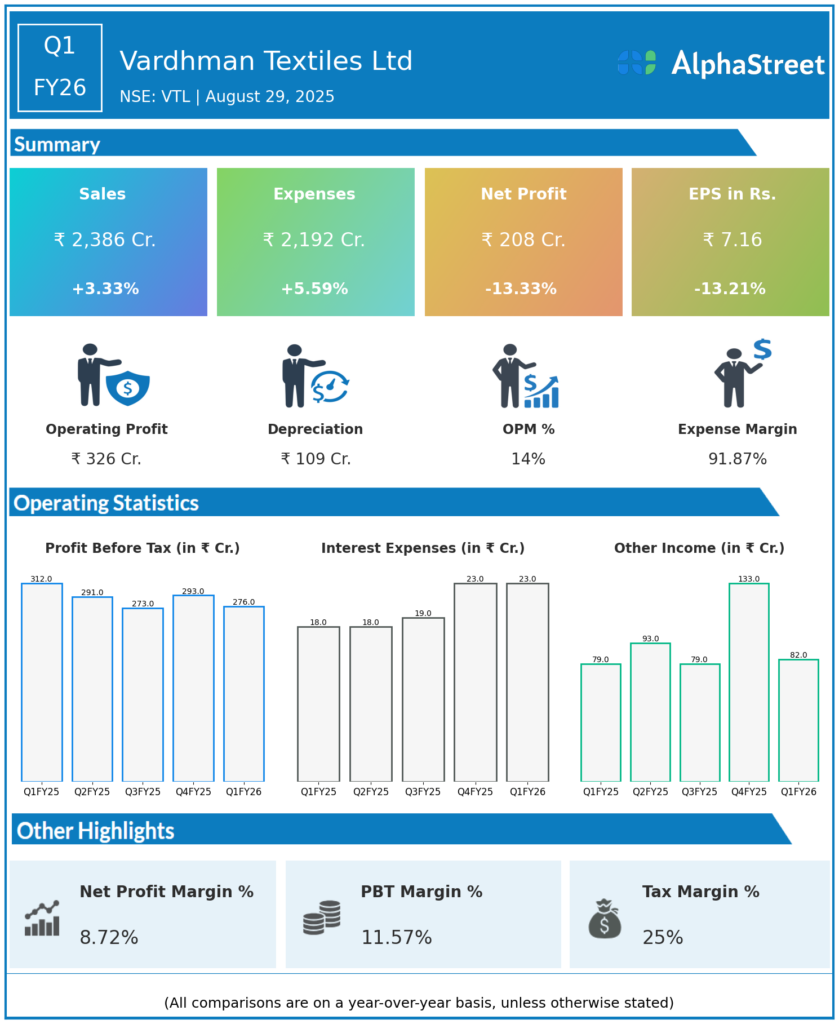

Vardhman textiles is engaged in the business of manufacturing Yarn, Fabric, Acrylic Fiber and Garments, the Group has over the years developed as a business conglomerate with a presence in India and in 75 countries across the globe. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Total Income: ₹2,386 crores, up 11.2% QoQ (Q4 FY25: ₹1,863 crores) up 3.3% YoY (Q1 FY25: ₹2,309 crores).

-

Net Profit (PAT): ₹208 crores, up 10.1% QoQ (Q4 FY25: ₹188 crores) but down 13.3% YoY (Q1 FY25: ₹240 crores).

-

EBITDA: ₹335 crores, up 9.8% QoQ (Q4 FY25: ₹305 crores) but down 10.6% YoY (Q1 FY25: ₹375 crores).

-

EBITDA Margin: 16.2% (Q1 FY25: 17.6%; Q4 FY25: 16.4%).

-

EPS: ₹7.16 for Q1 FY26.

-

Revenue (TTM): ₹9,785 crores.

-

Net Income (TTM): ₹883 crores.

-

Book Value: ₹342.19 per share.

-

P/E Ratio: 13.3.

-

Dividend Yield: 1.1%.

-

Debt-to-Equity: 0.13, indicating a strong balance sheet.

Management Commentary & Strategic Highlights

-

Management cited persistent global demand volatility and margin pressure, especially in export-oriented yarn and fabric segments.

-

Domestic volumes and blended fabric product lines helped cushion margin declines with resilient sales in India.

-

Focus remains on cost optimization and operational efficiencies, with strategic investment in blending, processing, and new garment units driving medium-term competitiveness.

-

Dividend policy remains stable, with a ₹4/share dividend paid recently and continued shareholder returns promised.

Q4 FY25 Earnings Results

-

Total Income: ₹2,509 crores.

-

Net Profit (PAT): ₹238 crores.

-

EBITDA: ₹305 crores.

-

EBITDA Margin: 16.4%.

-

EPS: ₹8.21.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.