Valor Estate Ltd was incorporated in 2007 and is primarily engaged in real estate construction, development, and related activities. The company focuses on projects in and around Mumbai, which are at various stages of planning and construction.

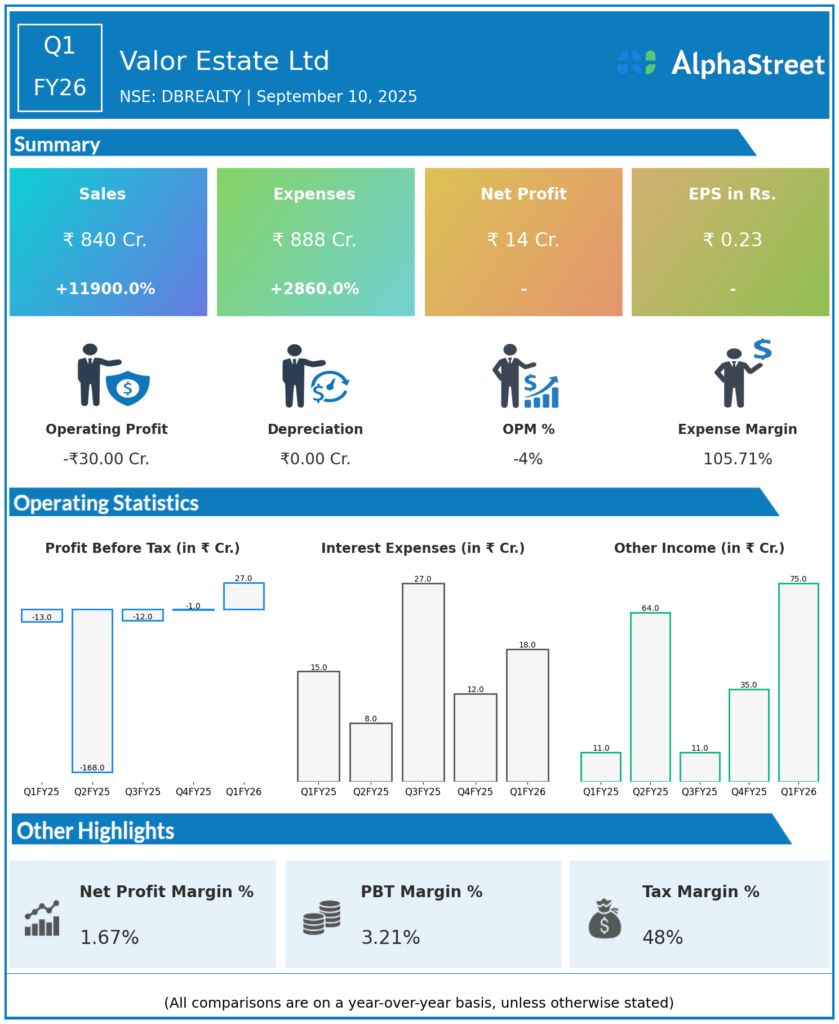

Q1 FY26 Earnings Results:

Revenue: ₹840 crore, up 11,900% year-on-year YoY from ₹7 crore

Total Expenses: ₹888 crore, up 2,860% YoY from ₹30 crore

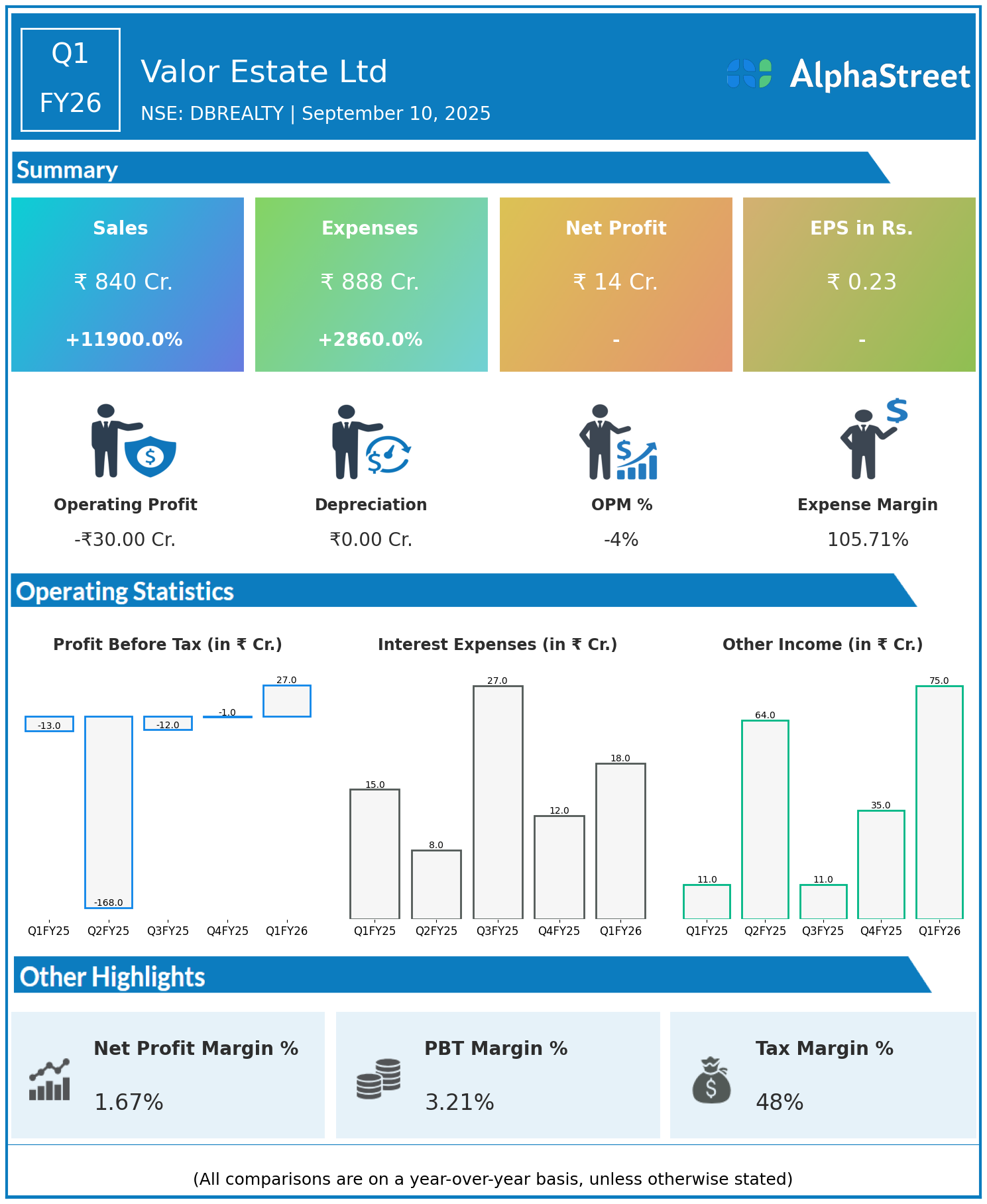

Consolidated Net Profit PAT: ₹14 crore, compared to a net loss of -₹13 crore in the same quarter last year

Earnings Per Share EPS: ₹0.23, compared to -₹0.25 YoY

Operational & Strategic Update:

Revenue Surge: Revenue increased exponentially due to significant project execution, new launches, or accelerated construction and billing compared to the previous year

Expense Growth: Total expenses also saw a massive increase as a result of scaling construction activities, procurement, and project mobilization

Profitability Turnaround: The company swung to a net profit from a loss last year, reflecting strong operational leverage from higher revenues despite elevated cost base

Business Focus: Concentration on large-scale Mumbai-based projects was the primary driver of topline and profitability improvement

Strategic Initiatives: Valor Estate continued to ramp up execution, unlock new project phases, and deepen its presence in the Mumbai real estate market

Corporate Developments in Q1 FY26:

Valor Estate reported a spectacular increase in revenues and turned profitable in Q1 FY26, underpinned by successful project execution and aggressive scale-up across its development pipeline.

Looking Ahead:

The company plans to leverage its strong momentum by advancing project completions, efficiently managing costs, and capitalizing on further real estate opportunities in Mumbai and adjoining markets in FY26 and beyond.

Explore the company’s past earnings and latest concall transcripts, click here to visit the AlphaStreet India News Channel.