Incorporated in 1990, Vakrangee Ltd provides diverse solutions, and activities in the e-commerce sector, including bullion and jewellery, through its Vakrangee Kendra (on B2B and B2C basis), and handles multi-state data digitization, software, and licence. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

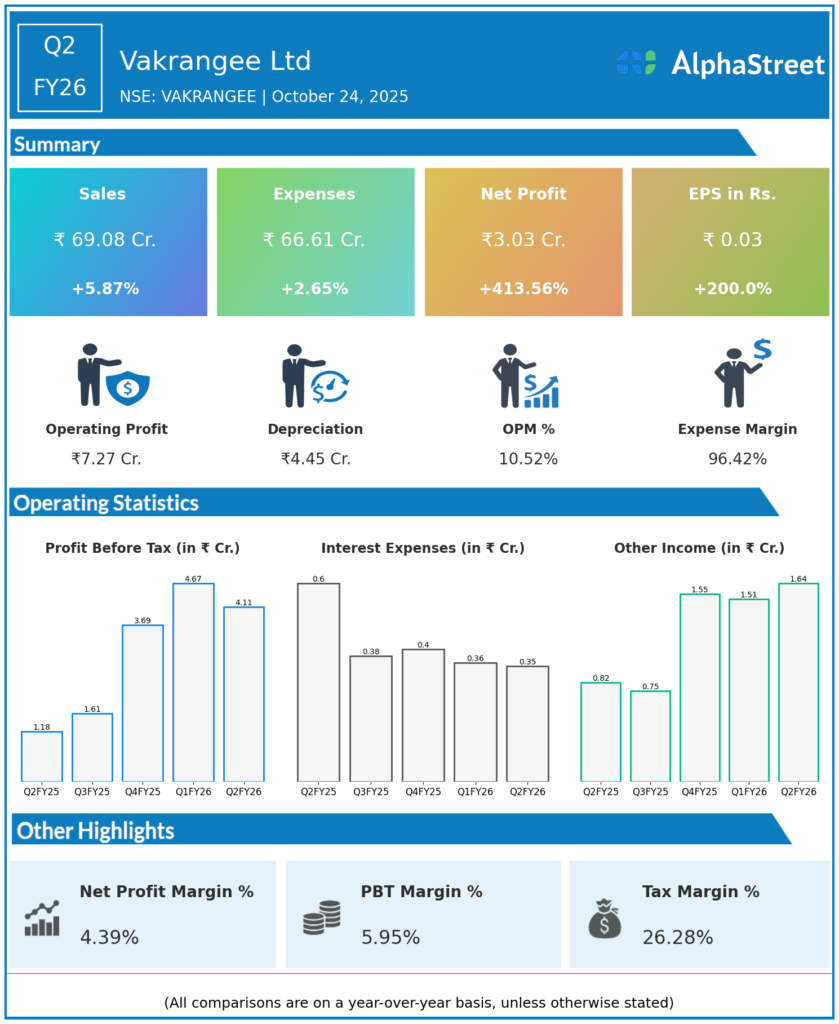

Revenue from Operations: ₹69.08 crore, up 6% YoY from ₹66.1 crore in Q2 FY25.

EBITDA: ₹8.77 crore, up 44.7% YoY from ₹6.06 crore in Q2 FY25.

EBITDA Margin: 12.4%, compared to 9.2% in Q2 FY25.

Profit Before Tax (PBT): ₹4.11 crore, up 248% YoY from ₹1.18 crore in Q2 FY25.

Profit After Tax (PAT): ₹3.03 crore, up 412.5% YoY (5x increase) from ₹0.59 crore in Q2 FY25.

Cash Profit (PAT + Depreciation): ₹7.48 crore, up 53.7% YoY.

Gross Transaction Value (GTV): ₹12,928.7 crore.

Transactions Executed: Over 3.1 crore in Q2 FY26.

EBITDA Growth Driver: Strong operating leverage and increased contribution from high-margin services such as financial and insurance products.

Subsidiary (Vortex Engineering):

-

Revenue up 56.6% YoY.

-

562 ATMs shipped (+43% YoY).

-

EBITDA increased ~12.5x YoY to ₹2.08 crore.

Management Commentary & Strategic Decisions

Vakrangee’s management, led by Dinesh Nandwana (Managing Director), emphasized that Q2 FY26 marked a strong return to consistent profitability, reflecting the company’s transformation toward sustainable, high-margin operations:

-

Financial Focus: Consolidated PAT up 5x YoY; EBITDA margin improved significantly from 9.2% to 12.4%.

-

Strategic Direction:

-

Continued shift to non-cash banking services, including account opening, loans, insurance, fixed deposits, mutual funds, and NPA recovery to deepen rural financial inclusion.

-

Phased exit from low-margin legacy businesses to optimize profitability.

-

Network Expansion: Focus on increasing Vakrangee Kendra outlets and BharatEasy mobile app reach to semi-urban and rural India.

-

-

Subsidiary Growth: Vortex Engineering achieved record growth across both hardware and software exports, including new contracts from Tanzania and Nigeria.

-

Operational Strength: Maintains a debt-free balance sheet, giving flexibility to fund growth and sustain long-term investments in technology and infrastructure.

-

Vision: The management reiterated their mission to build India’s largest “Phygital (Physical + Digital) Distribution Platform” serving financial, e-governance, and commerce needs across underserved regions.

Q1 FY26 Earnings Results

Revenue from Operations: ₹70.34 crore, up 18% YoY from ₹59.60 crore in Q1 FY25.

EBITDA: ₹9.33 crore, up 25% YoY from ₹7.45 crore.

EBITDA Margin: 13.3%.

Profit Before Tax (PBT): ₹4.67 crore, up 50% YoY from ₹3.11 crore.

Profit After Tax (PAT): ₹3.32 crore, up 48.5% YoY from ₹2.24 crore.

Total Expenses: ₹65.68 crore, up 16.3% YoY.

Key Financial Drivers: Growth in ATM operations and expansion of high-margin BFSI and e-commerce services

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.