Incorporated in 1990, Vakrangee Ltd provides diverse solutions, and activities in the e-commerce sector, including bullion and jewellery, through its Vakrangee Kendra (on B2B and B2C basis), and handles multi-state data digitization, software, and licence. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

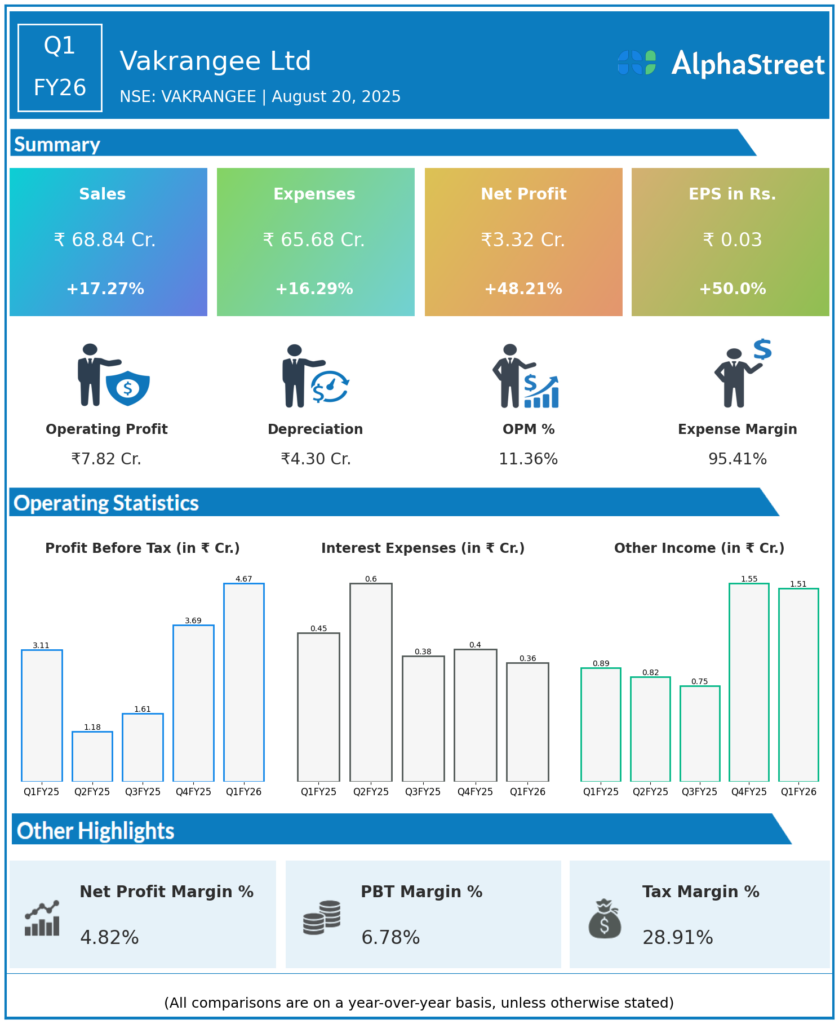

Consolidated Revenue: ₹68.8 crore, up 17.2% year-over-year (YoY) from ₹58.7 crore in Q1 FY25.

-

Profit After Tax (PAT): ₹3.32 crore, up 48.2% YoY from ₹2.24 crore in Q1 FY25.

-

EBIT: ₹5.03 crore, up 22.9% YoY.

-

EBIT Margin: 7.16%.

-

Net Profit Margin: 4.82%, up from 3.75% YoY.

-

Basic EPS: ₹0.03, up by 50 percent on the YoY basis

- Cash Profit (PAT + Depreciation): ₹7.62 crore, up 24.3% YoY.

-

Gross Transaction Value (GTV): ₹13,928.4 crore; transaction count 2.6 crore.

-

Vortex Engineering subsidiary: revenue up 23.2% YoY; ATM shipments grew 57.6% YoY to 657 units.

-

The company remains virtually debt-free, with robust balance sheet positioning for expansion.

Strategic & Operational Highlights

-

Transitioning business mix toward non-cash banking (account opening, loans, insurance, FDs, mutual funds, NPA recovery) to increase financial inclusion and margin expansion.

-

Vortex Engineering secured major strategic deals in Caribbean islands and Africa, with a large order from Punjab & Sind Bank for 600 ATMs.

-

Focused on high-margin offerings with plans to phase out low-margin business lines.

-

Vakrangee continues network expansion via its pan-India digital/physical “Vakrangee Kendra” and BharatEasy mobile super app.

Q4 FY25 Earnings Results

-

Revenue: ₹63.18 crore, up by 17.2 percent on the YoY basis.

-

PAT: ₹2.52 crore, depicting a growth of 15 percent, during the same quarter, last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.