Vaibhav Global Limited (VGL), through its distinctive business model, has created a niche for itself in the global retail space, especially in the jewellery, accessories and lifestyle product segments of two of the largest economies of the world – the US and UK. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

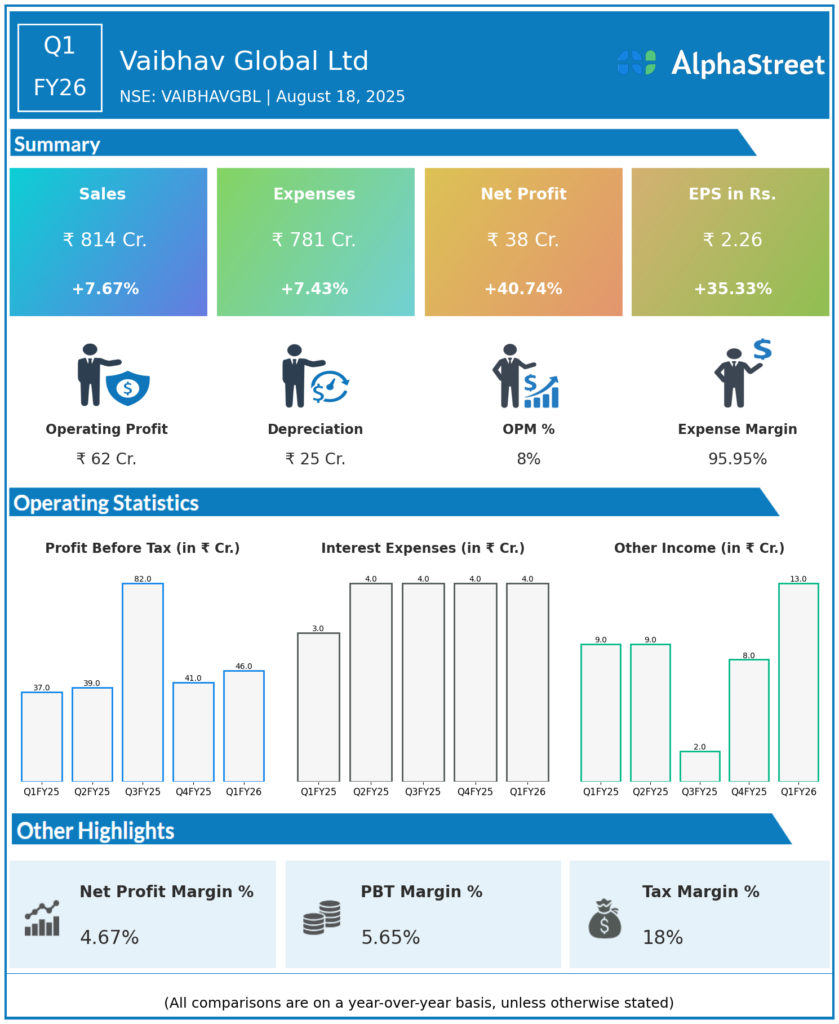

Revenue: ₹814 crore, up 8% year-over-year (YoY) and about 3% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹37.6 crore, up 41% YoY and 79% QoQ.

-

EBITDA Margin: 63.8% (gross margin; company continued strong operational performance).

-

EPS: ₹2.26, up 37.3% YoY and 69% QoQ.

-

Digital Business: Now accounts for 43% of B2C revenue, reflecting continuous scale-up.

-

Customer Base: Unique customer base reached an all-time high of 713,000.

-

Geographic Trends: US revenue grew 1.3% YoY (USD terms), UK 2.3% YoY, Germany 7.2% YoY. Germany saw a turnaround, with management confident of FY26 EBITDA profitability for that market.

Management Commentary & Strategic Highlights

-

CEO Sunil Agrawal noted revenue and profit growth, highlighting operational agility and digital expansion amid macro and tariff challenges.

-

The company’s B2B business and digital channels were key growth drivers, alongside improvements in operational costs.

-

Revised FY26 revenue growth guidance to 7–9% in light of evolving macro environment and recent tariff developments, but remains optimistic about upside potential if conditions normalize.

-

Vaibhav Global is leveraging AI for operational efficiency and customer engagement, expanding product categories, and maintaining its commitment to community-driven initiatives like its meal donation program.

-

The business is confident of scalable growth, supported by integrated operations and a resilient model.

Q4 FY25 Earnings Results

-

Revenue: ₹850 crore, up by 7.8 percent on the YoY basis.

-

Net Profit: ₹34 crore, depicting a rise of over 62 percent during the same period last year.

-

EPS: ₹2.05 vs ₹1.29 during the same quarter last year.

-

Q4 had a lower margin and profit base; Q1 FY26 established momentum on both topline and bottom-line.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.