Company Overview:

Va Tech Wabag stands as a premier global water technology company with a robust 25-year legacy in India. Specializing in bespoke water solutions, our expertise encompasses wastewater treatment, drinking water purification, water recycling, industrial water treatment, and desalination. With a comprehensive presence across the water solutions value chain, from R&D to operations and maintenance, we’ve successfully executed over 1450 projects worldwide, including 450+ sewage treatment plants and 320+ water treatment plants. Notably, our foray into desalination has seen over 60 completed plants, establishing us as a top 10 global player. Operating in 25+ countries, we boast a diverse clientele and a substantial order book, reflecting our technological prowess and commitment to sustainable water management.

Q3FY24 Financial Result:

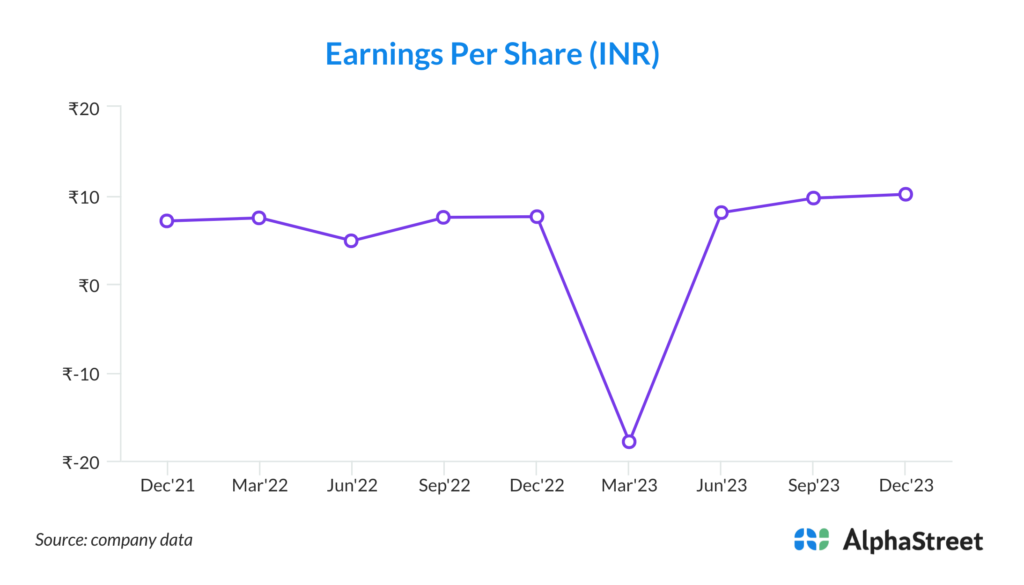

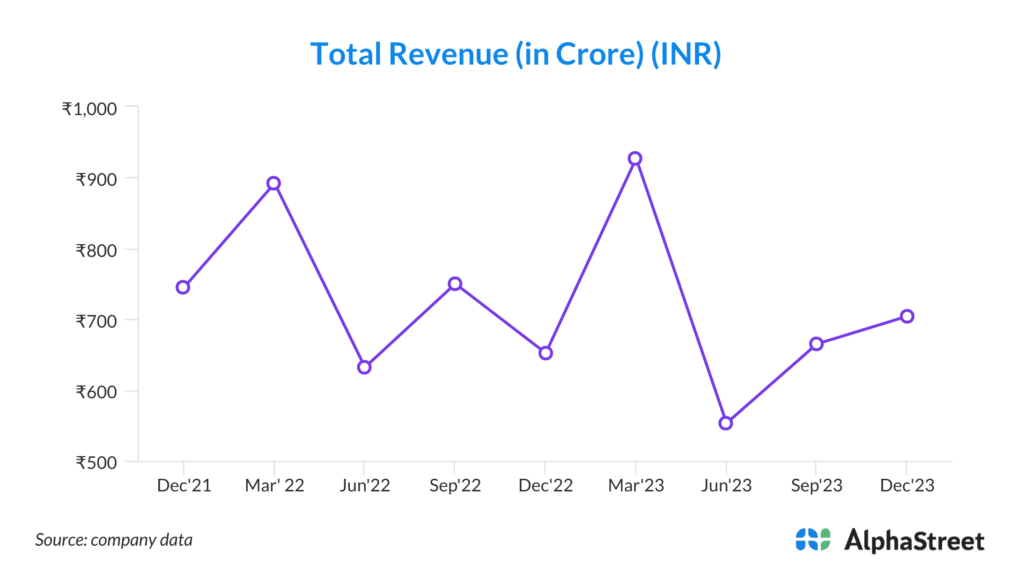

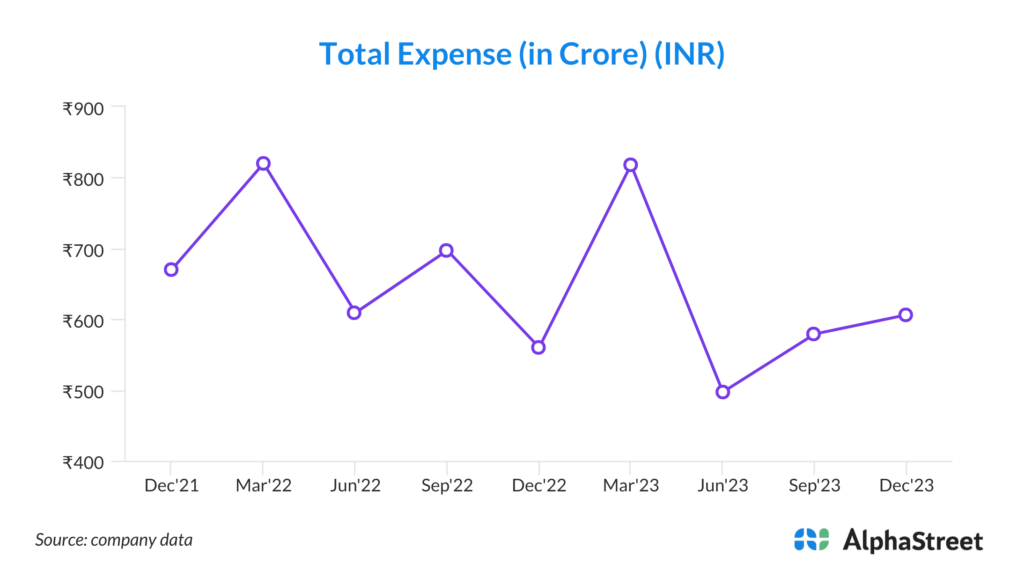

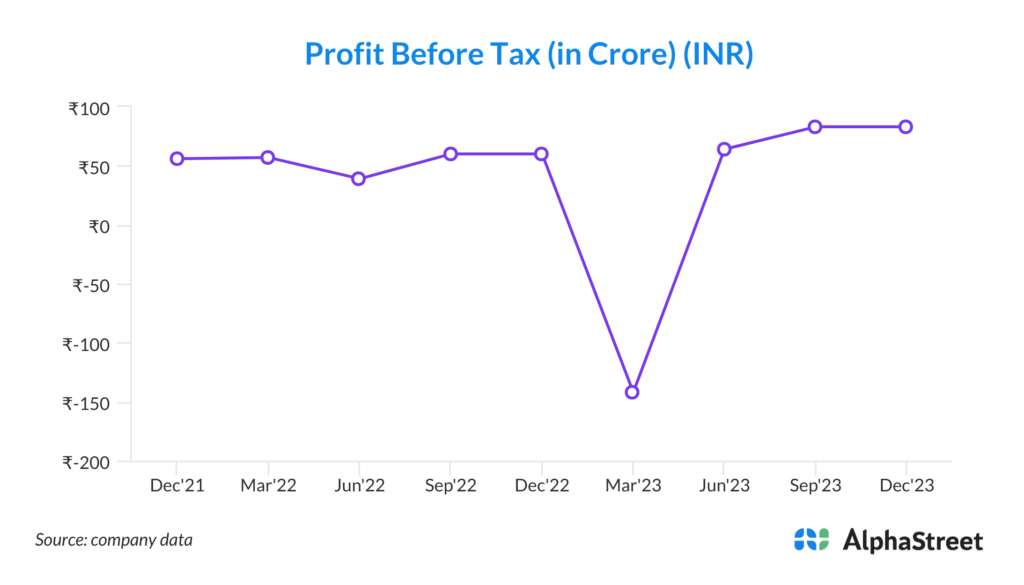

In the third quarter of fiscal year 2024, Va Tech Wabag showcased strong financial performance. Consolidated Operating Revenue reached Rs.704 crores, marking an 8% increase year-on-year and a 6% rise quarter-on-quarter. Consolidated EBITDA surged to Rs.99 crores, up by 32% year-on-year and 15% quarter-on-quarter, with an EBITDA margin of 14%. Notably, 9MFY24 revenue highlights a significant contribution from the EPC segment at Rs.1577 crores (82%) and the O&M segment at Rs.340 crores (18%), with 56% of revenue stemming from India and 44% from international projects. The company’s strategic shift towards higher margin projects in the E&P segment has driven improved EBITDA margins. With a focus on enhancing margins and fostering positive cash flows, the company is poised for sustained growth. Maintaining this trajectory, Va Tech Wabag aims to prioritize higher margin projects over revenue maximization, as evidenced by their guidance to uphold EBITDA margins. Consolidated PAT for Q3FY24 surged to Rs.63 crores, reflecting a robust 34% year-on-year increase and a 4% uptick quarter-on-quarter.

Key strengths of the company:

1. Strong Order Inflow and Diversified Order Book Mix: Va Tech Wabag’s robust order inflow, totaling Rs. 6,844 crores in FY23 and Rs.1761 crores in 9MFY24, coupled with its emergence as the L1 bidder in desalination and industrial water treatment projects, showcases its prowess in securing projects. With a diversified order book mix, encompassing domestic and international projects, the company mitigates risk and capitalizes on the increasing demand for water-related projects, especially driven by stricter government norms. Additionally, a focus on securing projects funded by multinational agencies reduces cash flow risk, ensuring sustained growth.

2. Improvement in Operating Margins & Profitability: By strategically shifting focus from EPC to E&P contracts and prioritizing higher margin projects, Va Tech Wabag has significantly enhanced its operating margins. Maintaining a keen eye on generating cash rather than merely chasing revenue, the company has seen a substantial increase in EBITDA margins, reaching 14% in Q3. With prudent debt management and a focus on debt reduction, the company anticipates improved PAT margins, further bolstering profitability.

3. New Initiatives: Va Tech Wabag’s strategic partnership with Peak Sustainability Ventures to establish 100 Bio-CNG plants across multiple regions underscores its commitment to innovation and sustainability. Leveraging its expertise in clean water production, the company is poised to contribute positively to industries like Green Hydrogen and Semiconductors, where ultra-pure water is vital. Collaborations with entities like ‘Pani Energy’ to implement AI in water treatment plants showcase the company’s forward-thinking approach to technology adoption and efficiency enhancement.

4. Long Term Strategy “Wriddhi”: With its “Wriddhi” strategy, Va Tech Wabag demonstrates a clear vision for sustainable growth, particularly in international markets, focusing on E&P and industrial sectors. By emphasizing marketing and job development over tendered jobs and implementing an efficient global delivery model, the company positions itself for long-term success. Additionally, its asset-light approach and emphasis on operations and maintenance ensure enhanced customer satisfaction and resilience in changing market dynamics.

5. Resilient Financial Performance: Despite facing challenges, Va Tech Wabag has maintained a resilient financial performance, marked by consistent cash flow positivity and efficient debt management. With a net cash position of Rs. 100 crores as of December 31st, 2023, and a strong order book of around Rs. 12,000 crores, the company is well-positioned for sustained growth. The focus on delivering profitable growth, particularly through international projects, advanced technology plants, and long-term operation and maintenance contracts, underscores its commitment to shareholder value and sustainable development.

Key risks and concerns for the company:

1. More Exposure towards Municipal Orders: Va Tech Wabag’s heavy reliance on municipal and governmental orders, constituting 87% of its order book as of December ’23, poses a significant risk. Slow execution of these projects could lead to delayed revenue recognition and increased receivables, thereby amplifying the need for higher working capital. Any slowdown in government spending or bureaucratic delays could exacerbate this concern, impacting the company’s financial performance and liquidity.

2. Currency Risk: With approximately 60% of order intake in 9MFY24 originating from international projects, Va Tech Wabag faces exposure to currency risk. Fluctuations in exchange rates can adversely affect the company’s margins, as revenues earned in foreign currencies may translate differently into the reporting currency. This volatility in currency rates poses a challenge in accurately forecasting and managing the company’s financial performance, potentially impacting profitability and investor confidence.

3. Low Promoter Holding: Va Tech Wabag’s relatively low promoter holding of 19.1% raises concerns among public shareholders regarding governance and long-term strategic direction. A small promoter stake may indicate a lack of alignment of interests between management and shareholders, potentially leading to conflicts of interest or uncertainty about the company’s future direction. This lower promoter holding could undermine investor confidence and hinder the company’s ability to attract long-term investment.

4. Elongated Working Capital Cycle: The company’s persistent challenge with an elongated working capital cycle, primarily driven by high debtors from municipal projects, poses a risk to its financial health. Delayed payments from clients can strain liquidity and hinder the company’s ability to meet its short-term obligations or invest in growth opportunities. This prolonged working capital cycle not only ties up capital but also increases financing costs, potentially affecting profitability and overall financial stability.

5. Global Economic Slowdown: As Va Tech Wabag expands its international footprint, with 44% of its 9MFY24 topline coming from international business and 60% of the existing order book comprising international projects, it becomes vulnerable to global economic downturns. Any slowdown in key markets such as Europe, the Middle East, or Russia could adversely impact project demand, order intake, and revenue growth. Economic uncertainties, geopolitical tensions, or regulatory changes in these regions could disrupt operations and undermine the company’s growth prospects, posing a significant risk to its financial performance and market position.

6. No Dividend Since FY19: Va Tech Wabag’s decision to not declare dividends since FY19, citing the need for working capital, may concern investors seeking income from their investments. This prolonged absence of dividends raises questions about the company’s financial management and allocation of capital. While retaining earnings for reinvestment can signal growth opportunities, the lack of dividends may deter income-oriented investors and weaken shareholder confidence. Additionally, a consistent failure to distribute dividends may reflect poorly on the company’s financial stability and ability to generate sustainable returns for shareholders.