Va Tech Wabag Ltd is engaged in the business of water treatment field. Its principal activities include design, supply, installation, construction and operational management of drinking water, waste water treatment, industrial water treatment and desalination plants.

Q2 FY26 Earnings Results

-

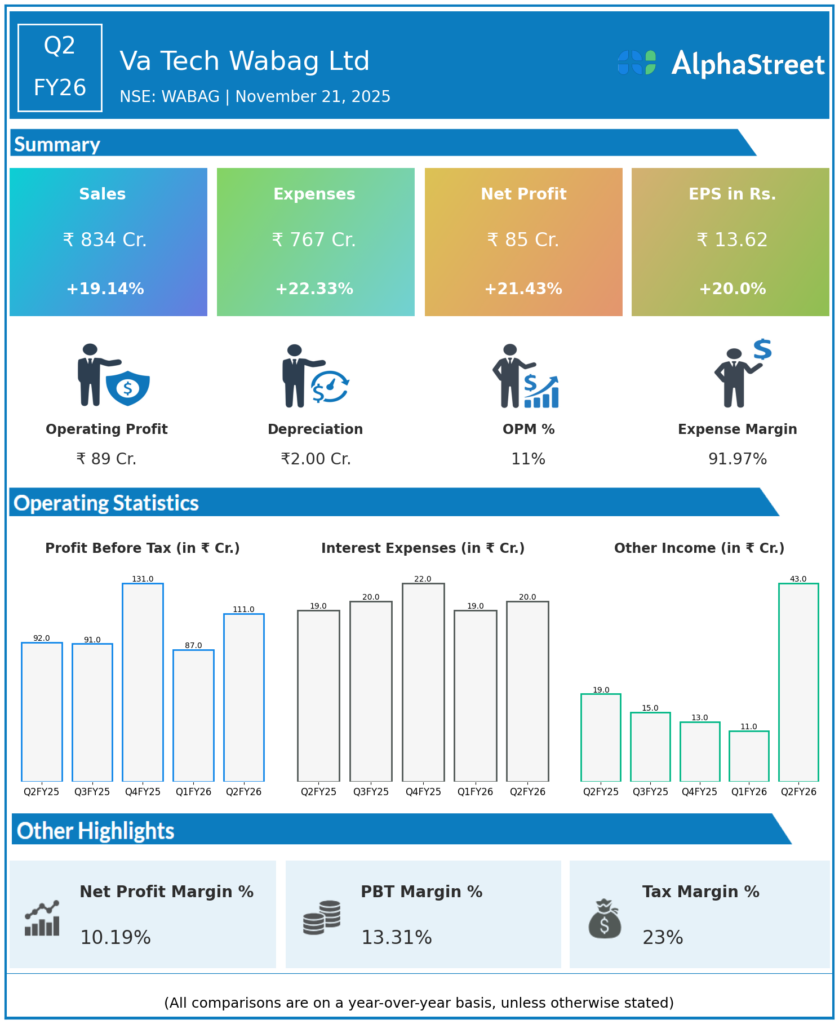

Consolidated Revenue from Operations: ₹834.50 crore, up 19.16% YoY and 13.69% QoQ from ₹734 crore in Q1 FY26.

-

Operating Profit (EBITDA excluding other income): ₹89.30 crore, with margin compression to 10.70%, the lowest in eight quarters, reflecting margin pressures despite strong revenue growth.

-

Profit After Tax (PAT): ₹84.80 crore, up 20.11% YoY and 28.88% QoQ, demonstrating robust bottom-line growth.

-

Profit Before Tax (PBT): ₹95.60 crore, up 22.09% YoY.

-

Other Income: ₹41.60 crore, contributing 37.55% of PBT, a point of concern for profitability sustainability.

-

Tax Rate: Approximately 25.58%, consistent with previous periods.

-

Fixed Assets: Increased to ₹345.16 crore from ₹228.04 crore YoY, indicating ongoing capital investment.

-

Return on Capital Employed (ROCE): 26.35%, significantly higher than the five-year average of 17.74% showing improving capital efficiency.

-

Cash Flow: Operating cash flow strong with ₹219 crore generated for the fiscal year despite some working capital investments.

Management Commentary & Strategic Insights

-

Management highlighted strong demand in municipal and industrial water treatment projects, supported by technological capabilities and execution efficiency.

-

Margin challenges due to competitive pricing and raw material inflation partially offset by pricing power and operational leverage.

-

Focus remains on accelerating execution of the robust order book of approximately ₹16,000 crore with improved working capital management.

-

Strategic investments continue in innovation, capacity addition, and entering new energy sectors like solar manufacturing and bio-gas projects.

-

Management confident of sustaining double-digit revenue growth and sees margin recovery in the coming quarters.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹734.00 crore, up 16.9% YoY from ₹629.50 crore in Q1 FY25.

-

Profit After Tax (PAT): ₹65.80 crore, up 20.1% YoY but down 15.7% QoQ from ₹78.10 crore in Q4 FY25.

-

EBITDA: ₹106.90 crore, up 18% YoY; EBITDA margin improved to 14.40% from 14.10% YoY.

-

Strong order inflow of ₹2,600 crore in Q1 and a total order book of ₹15,800 crore underscores growth potential.

-

The company maintains a net cash position of ₹627 crore reflecting a solid balance sheet.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.