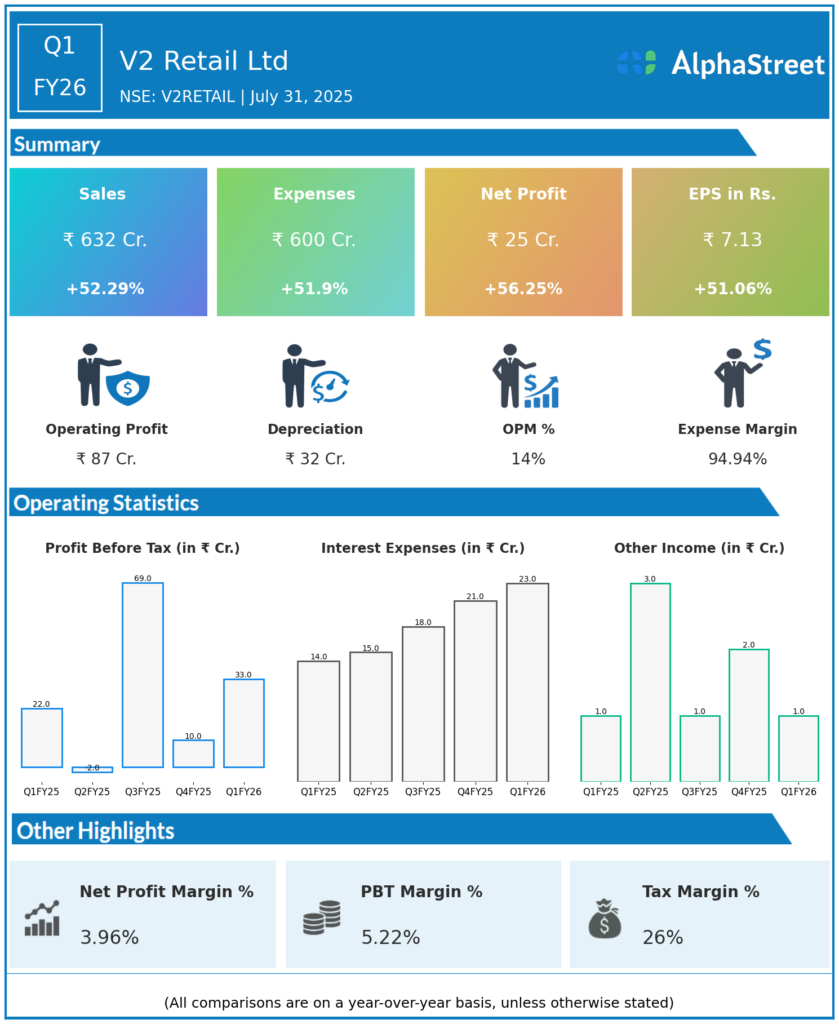

Company primarily operates in Tier-II and Tier-III cities, with a chain of “V2 Retail” stores offering apparel and general merchandise, catering to the entire family. Presenting below are its latest Q1 FY26 earnings.

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Consolidated Revenue from Operations: ₹632.2 crore, up 52% year-over-year (YoY) from ₹415 crore in Q1 FY25.

-

Gross Profit: ₹186.2 crore, up 55% YoY; gross margin at 29.5% (vs 29.0% in Q1 FY25).

-

EBITDA: ₹87.2 crore, up 57% YoY; EBITDA margin at 13.8% (vs 13.4% in Q1 FY25); some impact from ₹2.14 crore loss on sale of fixed assets of subsidiary.

-

Net Profit (PAT): ₹24.7 crore, up 56% YoY from ₹16.3 crore in Q1 FY25.

-

Same Store Sales Growth (SSSG): 5% (strong May and June offset a dip in April due to Eid’s timing).

-

Sales Per Sq. Ft.: ₹957 (reflects operational productivity despite larger share from new stores).

-

Store Network: 216 stores (added 28 stores and closed 1 underperforming store); retail area expanded to 23.48 lakh sq. ft.

-

Key Drivers: Sharper merchandising, disciplined inventory management, and deeper tier 2/3 penetration propelled revenue and margin gains.

Key Management Commentary & Strategic Highlights

-

Expansion Focus: Accelerated network growth in Tier 2 and Tier 3 cities to democratize fashion for emerging India.

-

Operational Productivity: Growth driven by “product-first” strategy, improved full-price sell-throughs, and better inventory/merchandising discipline.

-

Profitability Initiatives: Continued efficiency in working capital, cost management, and private label mix.

-

Outlook: Management sees a strong foundation for a transformational FY26, aided by ongoing expansion and process discipline.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Revenue from Operations: ₹498.5 crore, up 68.4% YoY from ₹296 crore in Q4 FY24.

-

Net Profit (PAT): ₹6.44 crore, up 78.9% YoY from ₹3.6 crore in Q4 FY24.

-

Gross Profit: ₹137.7 crore; gross margin at 27.6%.

-

EBITDA: ₹57.8 crore (implied ~11.6% margin).

-

Same Store Sales Growth (full FY25): 29%, with volume growth of 43%.

-

Operational Initiatives: Focus on private label (now ~85% of business), increased design-led products, improving inventory turns and reducing aged stock.

-

Network Development: 74 stores opened, 2 closed in FY25 (ending March 2025 with 189 stores—grew to 216 by July)

To know more about the company, please click here