V-Mart Retail is engaged in the business of Value Retailing through the chain of stores situated at various cities in India.

Q2 FY26 Earnings Results

-

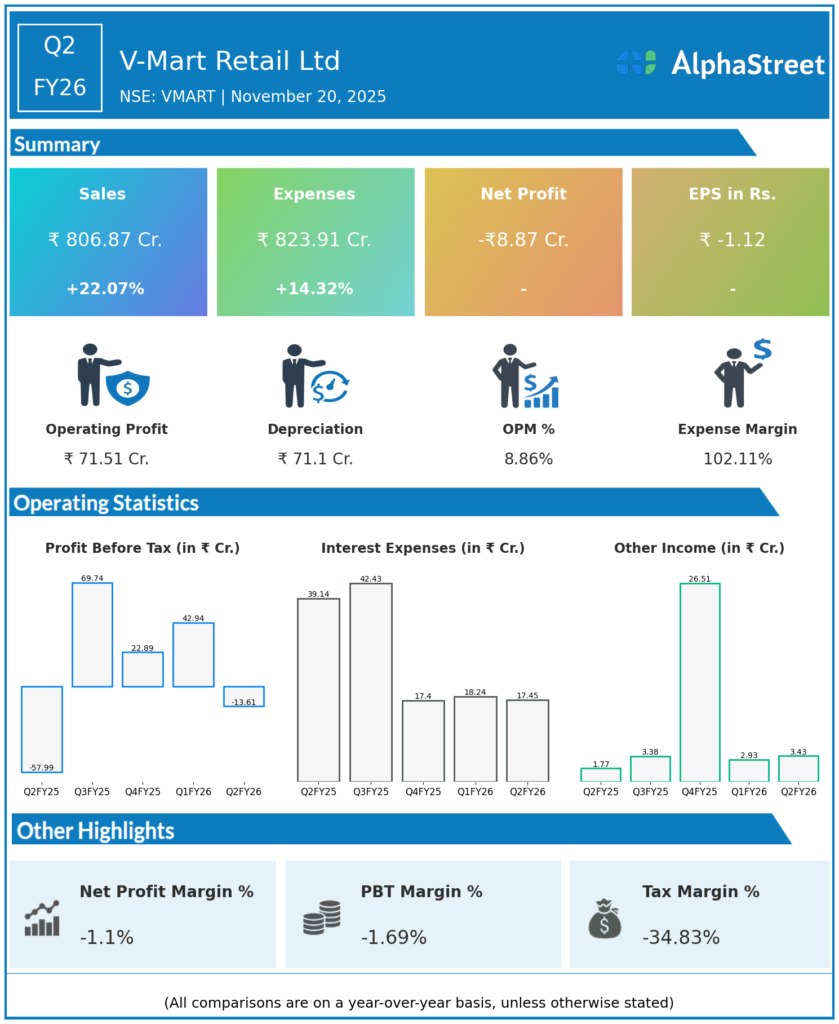

Revenue from Operations: ₹806.9 crore, up 22.0% YoY from ₹660.9 crore in Q2 FY25, though down sequentially from ₹885.2 crore in Q1 FY26.

-

Total Income: ₹810.3 crore, up from ₹662.7 crore a year earlier.

-

EBITDA: ₹71.51 crore, up 85.16% YoY from ₹38.62 crore in Q2 FY25; EBITDA margin improved from ~6% to ~9% YoY.

-

Net Loss: ₹8.87 crore, significantly narrowed from a loss of ₹56.51 crore in Q2 FY25, indicating improved cost management.

-

Expenses: Increased 14.32% YoY to ₹823.91 crore, growth lower than revenue growth showing operational leverage.

-

Same-store sales growth: 11% YoY, with 25 new store openings in Q2 FY26 (total 40 for H1 FY26), enhancing footprint and sales capacity.

-

Digital marketplace segment declined ~33% YoY, highlighting challenges in the e-commerce channel.

Management Commentary & Strategic Insights

-

Management described demand as healthy overall, supported by stable inflation and government GST reductions, though the online segment was weak.

-

The company is emphasizing its ‘Value Fashion’ strategy targeting rural markets and continues to improve supply chain digitization and inventory efficiency.

-

Focus on profitable growth by optimizing store mix, reducing inventory days, and enhancing operational efficiencies.

-

Strategic store expansion, coupled with improving same-store sales, is expected to sustain revenue growth.

-

Management remains cautiously optimistic about demand recovery and profitability improvements in the coming quarters.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹885 crore, up 12.6% YoY from ₹786 crore in Q1 FY25.

-

Net Profit (PAT): ₹34 crore, a strong 177% YoY increase from ₹12 crore in Q1 FY25, showing recovery momentum.

-

EBITDA: ₹126 crore, up 27% YoY; EBITDA margin expanded to 14.3% from 12.6% YoY.

-

Same-store sales growth: 1% YoY, normalized to 5% adjusting for preponed festivities.

-

Added 15 new stores in Q1 FY26.

-

Management highlighted improvements in footfalls, transaction values, and inventory management.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.