Founded in 1977, V-Guard Industries Ltd. (‘V-Guard’) is a reputed Indian company manufacturing innovative and experiential products in the categories of Electronics, Electricals and Consumer Durables. It has grown from being a brand synonymous with voltage stabilizers across South India, to a brand offering a wide array of thoughtfully engineered products to consumers across the length and breadth of the country. Underpinned by its continuous quest to enrich consumer lives and power a stronger tomorrow.

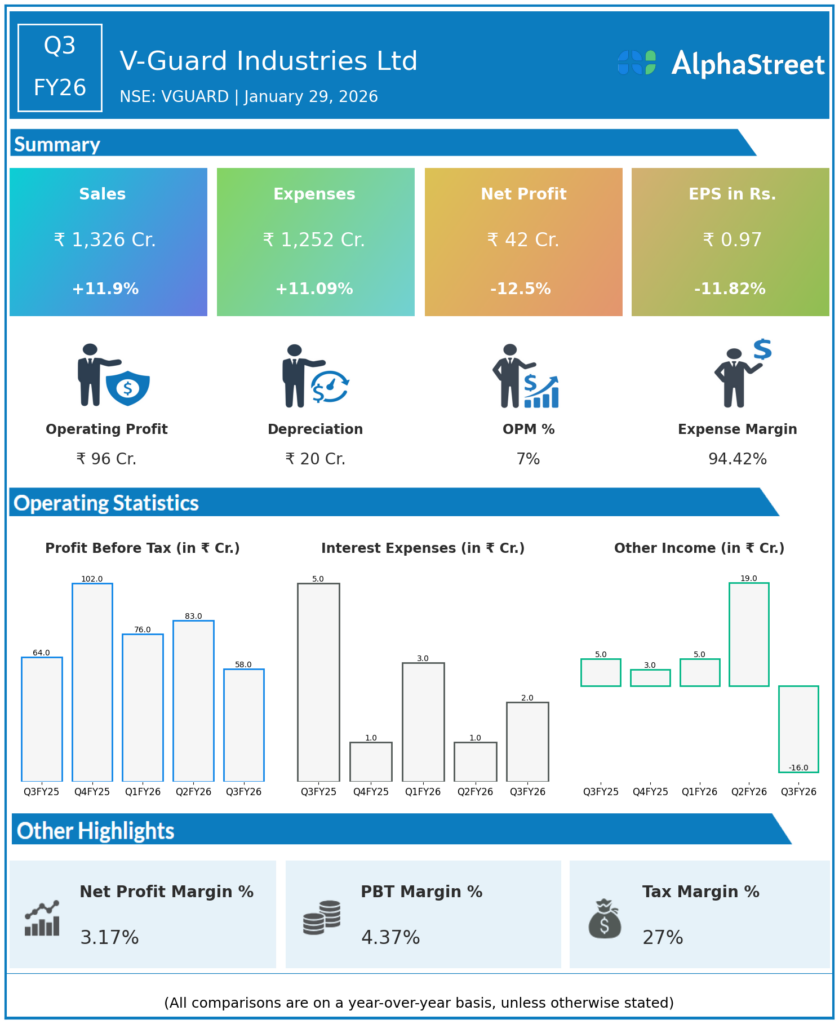

Q3 FY26 Earnings Results

- Revenue from Operations: ₹1,404 cr, up 10.6% YoY vs ₹1,269 cr, up 4.8% QoQ vs ₹1,341 cr; driven by 26% YoY growth in electricals (₹602 cr) and 5% in consumer durables (₹444 cr), offset by Sunflame dip (−10% YoY); South India +20% YoY, non-South +3% (44.6% share).

- EBITDA: ₹129 cr, up 21% YoY, margin 8.8% (+60 bps YoY, +60 bps QoQ); gross margin 35.9%; efficiencies countered commodity inflation.

- PAT: ₹57 cr, down 5% YoY vs ₹60 cr (−5% YoY) due to one-time ₹34 cr Labour Code provision (exceptional); underlying PAT up 22% YoY; EPS ₹1.30 (−5% YoY); 9M revenue ₹4,211 cr (+4% YoY), PAT ₹196 cr (−12% YoY).

- Other key metrics: 9M CFO ₹457 cr, net cash ₹294 cr; electricals double-digit, summer categories muted but offset by others; Non-South markets growing steadily.

Management Commentary & Strategic Decisions

- Double-digit revenue growth led by electricals amid commodity inflation; underlying profitability strong despite one-time Labour Code hit; optimistic for summer season.

- Strategic moves: Reappointed Prof. Biju Varkkey (Ind Dir) for 5 yrs; Dr. Reena Agrawal as Additional Ind Dir; channel expansion, product premiumisation focus.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹1,341 cr, +3.6% YoY vs ₹1,294 cr, −8.5% QoQ vs ₹1,466 cr; H1 +4% YoY.

- EBITDA: ₹109 cr (−12% QoQ), margin 8.2%; gross margin 37.6% (+140 bps YoY).

- PAT: ₹65 cr (+3% YoY vs ₹63 cr, −12% QoQ vs ₹74 cr); PAT margin 4.9% (−3 bps YoY); standalone PAT ₹66 cr (+26% YoY).

- Other key metrics: H1 revenue ₹2,807 cr (+4% YoY); expenses ₹1,232 cr (−8% QoQ).

Management Commentary Q2

- Steady growth with margin resilience; cost control amid volume challenges.

- Strategic moves: Distribution strengthening; summer optimism.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.