Founded in 1977, V-Guard Industries Ltd. (‘V-Guard’) is a reputed Indian company manufacturing innovative and experiential products in the categories of Electronics, Electricals and Consumer Durables. It has grown from being a brand synonymous with voltage stabilizers across South India, to a brand offering a wide array of thoughtfully engineered products to consumers across the length and breadth of the country. Underpinned by its continuous quest to enrich consumer lives and power a stronger tomorrow.

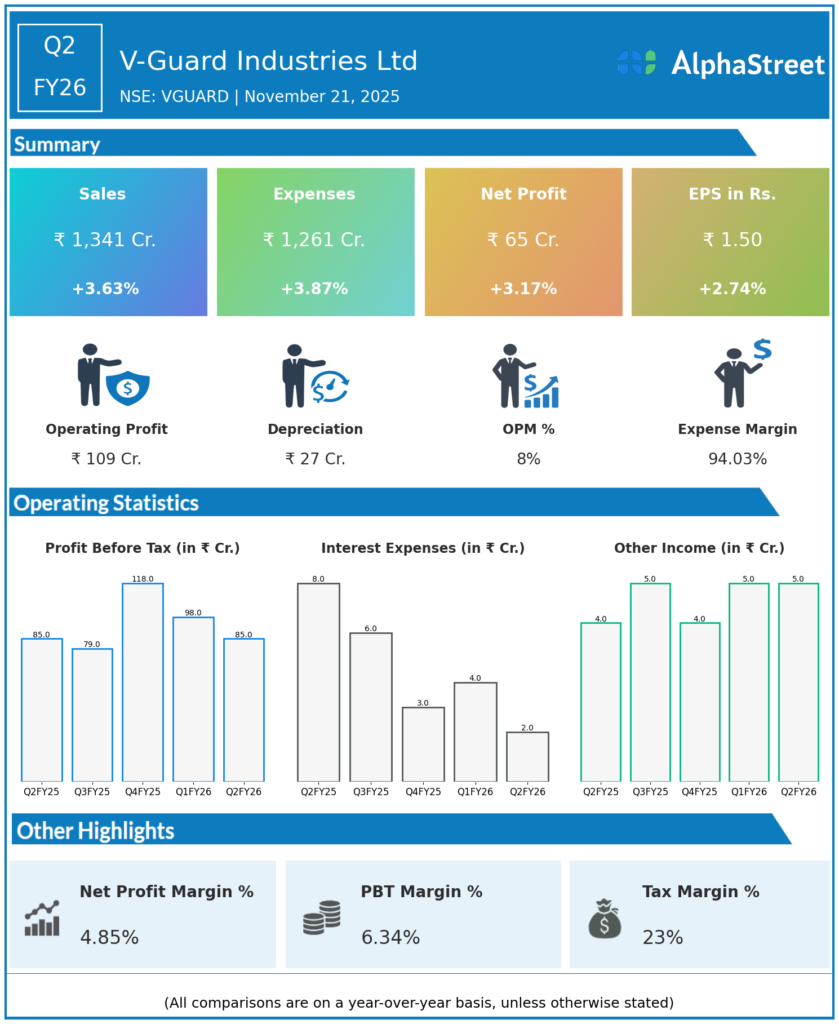

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹1,340.92 crore, up 3.6% YoY from ₹1,293.99 crore, but down 8.5% QoQ from ₹1,471.33 crore in Q1 FY26, reflecting seasonal softness.

-

EBITDA: ₹109 crore, down 1% YoY with margin at 8.15%, the lowest in eight quarters, pressured by raw material cost increases and higher employee costs as a percentage of sales.

-

Profit Before Tax (PBT): ₹85.08 crore, up marginally YoY but down 13.4% QoQ.

-

Profit After Tax (PAT): ₹65.29 crore, up 3.0% YoY but down 11.6% sequentially; PAT margin at 4.87%, down from 6.7% YoY due to margin compression.

-

Earnings per Share (EPS): ₹1.48, up 2.8% YoY but down 11.9% QoQ.

-

Gross margin expanded by 140 bps YoY to 37.6% as premium product mix offset some inflation.

-

Return on capital employed (ROCE): 19.36%, remains industry-leading, with a strong EBIT to interest coverage ratio above 25x.

-

The company retained negligible debt, maintaining a fortress balance sheet.

Management Commentary & Strategic Insights

-

Management cited steady revenue growth driven by premiumization, supply chain digitization, and expanding rural and urban distribution.

-

Margin pressures called out as a key risk, with operating margins at multi-year lows due to inflation and under-absorption in manufacturing.

-

Capital allocation remains conservative, with a focus on maximizing return on capital and scalable growth, especially in non-south markets which now contribute over 50% of revenue.

-

Management expects moderate rebound in margins and volume growth in H2 as demand normalizes and cost-saving initiatives take hold.

-

Continued investment in product innovation, premium appliances, and expansion in tier II–III cities is expected to drive future profitable growth.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹1,466.08 crore, down 0.7% YoY from ₹1,477.1 crore.

-

EBITDA: ₹123.59 crore (margin 8.4%), slightly lower YoY due to muted consumer demand and higher operational costs.

-

PAT: ₹73.85 crore, down 25.4% YoY from ₹98.97 crore.

-

PAT margin: 5.0%.

-

Performance was impacted by weak summer season demand and a higher base effect from the prior year.

-

EBIT to interest coverage and capital efficiency both remain strong, reflecting the company’s robust financial positioning

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.