Usha Martin Ltd is primarily engaged in manufacture and sale of steel wires, strands, wire ropes, cords, related accessories, etc. It is also involved in sale of other products such as wire drawing and allied machines.

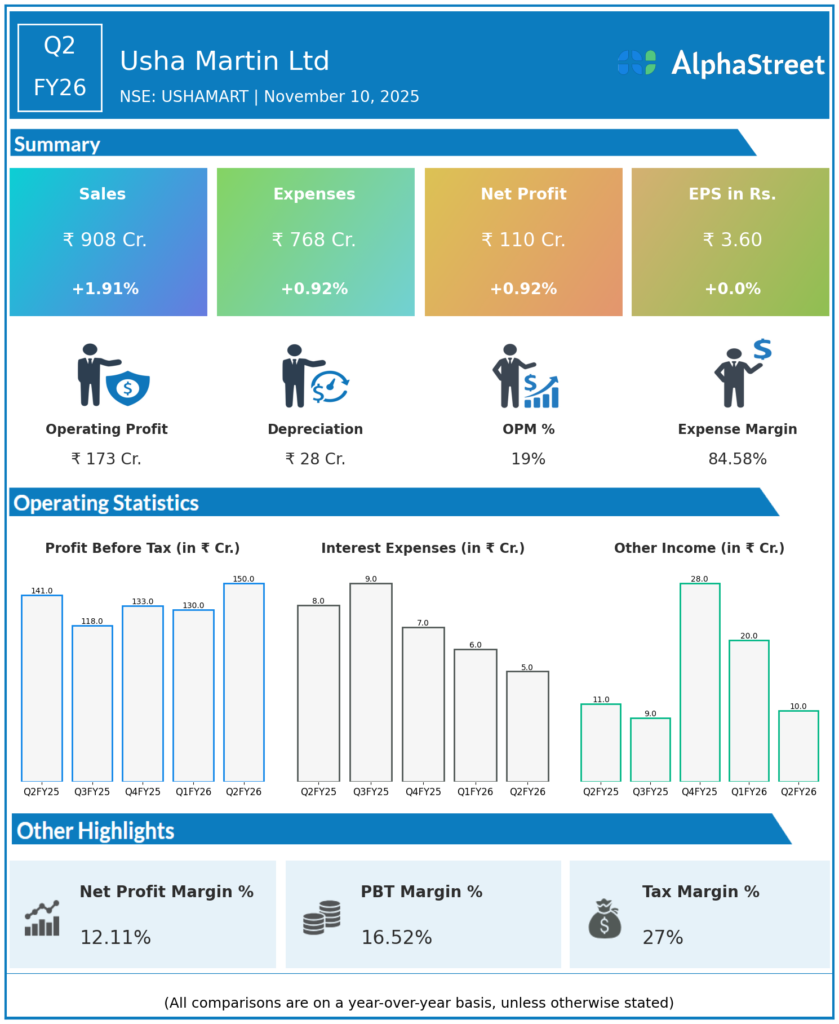

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹907.6 crore, up 1.8% YoY from ₹891.2 crore in Q2 FY25

-

Operating EBITDA: ₹173.0 crore, up 7.6% YoY, with a margin of 19.1% (vs 18.0% in Q2 FY25)

-

Profit Before Tax (PBT): ₹167.8 crore, up 18.7% YoY

-

Profit After Tax (PAT from continuing operations): ₹110 crore, up 1% YoY

-

PAT margin: 14% (vs 12.3% YoY)

-

Net cash position: ₹111 crore as of Q2 FY26 after debt reduction of ₹157 crore in the quarter

-

ROCE for H1 FY26: 20.3%

-

Wire Rope segment contributed 74% of total revenues

-

Employee costs declined sequentially, aiding margin expansion

Management Commentary & Strategic Insights

-

Management highlighted this was the highest EBITDA since the steel business exit, and cited stable global demand and cost discipline for strong performance

-

The ‘One Usha Martin’ initiative is credited with sharper cost controls, improved agility, and better execution

-

Continued focus on value-added products, working capital optimization, and expansion in international markets

-

Strong balance sheet with no net debt enables flexibility for capex and growth

-

Management remains optimistic but closely watches order book visibility, stabilization of promoter shareholding, and global steel/raw material prices

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹887 crore, up 7.3% YoY from ₹826.4 crore in Q1 FY25

-

Operating EBITDA: ₹160.1 crore (flat YoY), EBITDA margin of 16.3% (vs 18.6% YoY due to higher costs)

-

Profit After Tax (PAT): ₹100.8 crore, down 2.8% YoY

-

PAT margin: 11%

-

Volume growth of 10.4% YoY, driven by wires and wire ropes

-

Management commentary highlighted ongoing margin pressure from input costs but solid volume and operational improvement, with ongoing cost control and capital discipline.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.