Usha Martin Ltd is primarily engaged in manufacture and sale of steel wires, strands, wire ropes, cords, related accessories, etc. It is also involved in sale of other products such as wire drawing and allied machines. The company is the leading player in India’s wire and wire rope industry, holding the top position as a provider of specialty steel wire rope solutions in the country. Globally, it ranks among the top five manufacturers in the sector. The company has 6 manufacturing facilities at Ranchi, Hoshiarpur, Dubai, Bangkok, and the UK with a total production capacity of 2,98,540 TPA. Its facility at Ranchi, spread across 100 acres, is one of the world’s largest wire rope manufacturing facilities. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

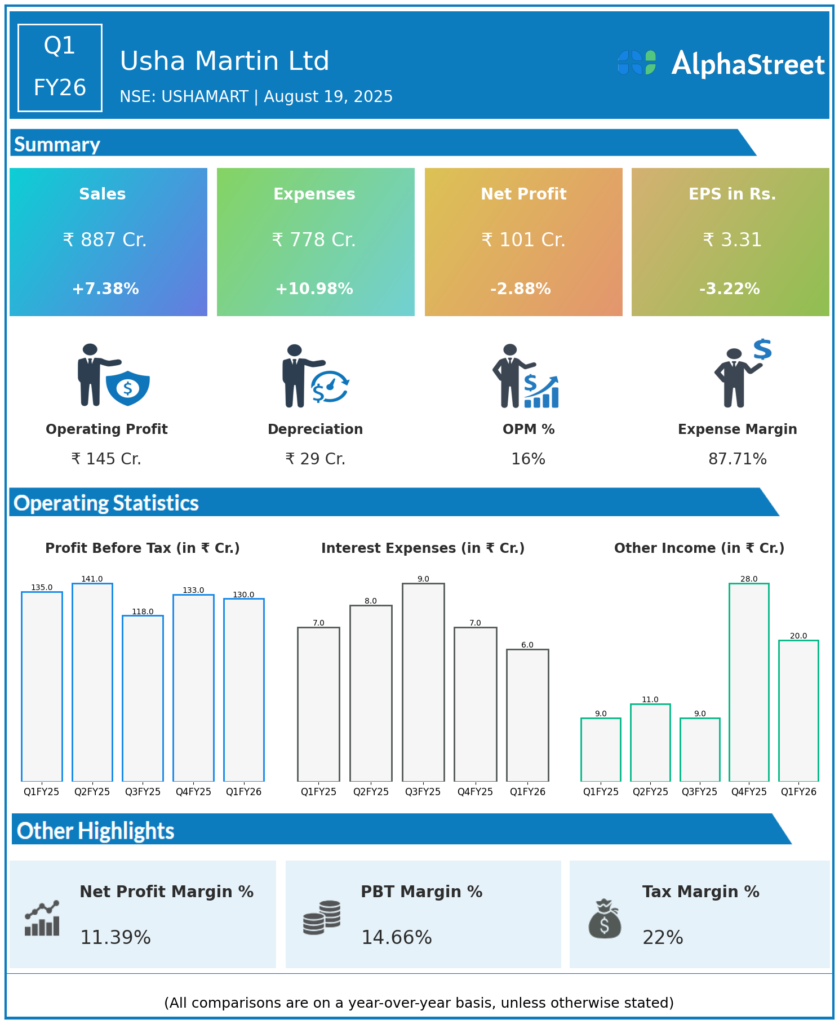

Revenue: ₹887 crore, up 7.3% year-over-year (YoY) from ₹826.4 crore and down 1% quarter-on-quarter (QoQ).

-

EBITDA: ₹160.1 crore, flat YoY; Operating EBITDA Margin: 16.3% (down from 18.6% YoY), reflects higher operational costs but stable overall profitability.

-

Profit After Tax (PAT): ₹100.8 crore, down 2.8% YoY but up sequentially from Q4 FY25.

-

EPS: ₹3.31 (down from ₹3.42 YoY).

-

Total Expenses: ₹777.5 crore, up 11% YoY and 10% QoQ.

-

PAT Margin: 11% (vs 13% Q1 FY25).

-

Volume Growth: Overall volumes up 10.4% YoY, led by wires and wire rope segments.

-

The balance sheet is now net debt free at the consolidated level.

-

Net working capital discipline improved, with working capital days at 196 (down from 209 in Sep 2024).

Management Commentary & Strategic Highlights

-

Q1 saw robust volume growth despite margin compression amid market price pressures and increased costs.

-

Value-added product contribution and disciplined operational controls helped support profitability.

-

“One Usha Martin” initiative significantly improved working capital management.

-

Management remains focused on expansion and operational efficiency to mitigate margin pressures.

Q4 FY25 Earnings Results

-

Revenue: ₹896.1 crore, up by 8 percent on the YoY basis.

-

PAT: ₹101 crore, depicting a decline of 5 percent during the same quarter last year

-

Sequential revenue and profits growth flat as compared to Q1 FY26.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.