UPL is principally engaged in the business of agrochemicals, industrial chemicals, chemical intermediates, speciality chemicals and production and sale of field crops and vegetable seeds.

Q2 FY26 Earnings Results

-

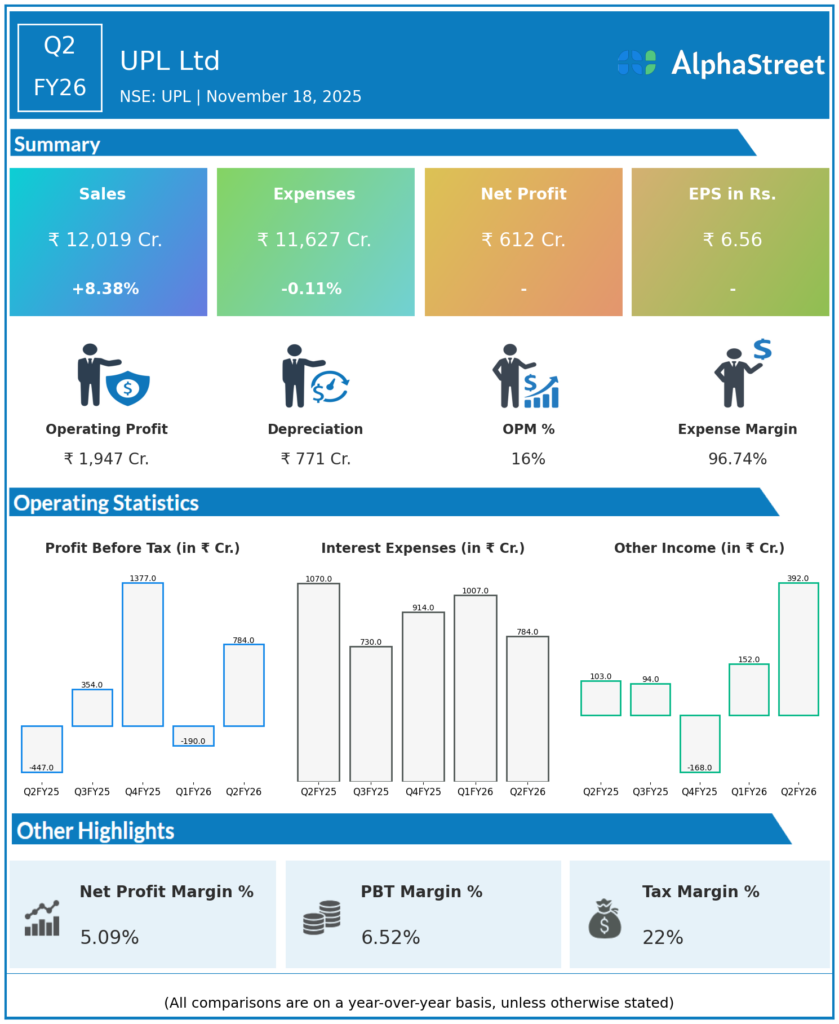

Revenue from Operations: ₹12,019 crore, up 31.1% QoQ from ₹9,359 crore in Q1 FY26, and up 9.5% YoY from ₹11,201 crore in Q2 FY25.

-

EBITDA: ₹2,205 crore, up 40% YoY, with EBITDA margin expanding 410 basis points to 18.3%.

-

Profit Before Tax (PBT): ₹838 crore, a strong turnaround from losses of ₹208 crore in Q1 FY26 and ₹312 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹612 crore, versus losses of ₹176 crore in Q1 FY26 and ₹585 crore in Q2 FY25.

-

Earnings Per Share (EPS): Not directly stated, roughly estimated growth in line with PAT.

-

Net debt reduced by ₹3,729 crore to ₹23,802 crore, reflecting strong cash flow and capital management.

-

Contribution margin surged 21% YoY to ₹5,041 crore with 420 basis points expansion to 41.9%.

-

Strong performance across platforms including UPL SAS and Advanta; UPL Corp faced challenges in Latin America.

-

Management upgraded FY26 EBITDA growth guidance to 12-16% and maintained revenue guidance of 4-8%.

-

Improved operational efficiency, financial discipline, and strategic capital management highlighted by management as key drivers for turnaround and growth.

Management Commentary & Strategic Decisions

-

Jai Shroff, Chairman & Group CEO, emphasized strong first half with sustainable growth driven by market diversification, innovation, and manufacturing integration.

-

Bikash Prasad, CFO, highlighted operational excellence, financial discipline, debt reduction, and improved gearing as foundations for long-term value creation.

-

The company’s post-harvest business DECCO was integrated with Advanta to create synergies.

-

Ratings outlook upgrade from ‘negative’ to ‘stable’ by S&P, Fitch, and Moody’s underscores financial resilience.

-

Continued focus on capex for innovation, cost efficiencies, and portfolio expansion to support future growth.

-

Strategic initiatives include rights issue capital infusion and active evaluation of strategic fund-raising, restructuring, and liquidity events.

Q1 FY26 Earnings Results

-

Revenue: ₹9,359 crore, up 2% YoY.

-

EBITDA: ₹1,303 crore, up 14% YoY; EBITDA margin of 14.1%.

-

Profit After Tax: Loss of ₹176 crore, improved from ₹384 crore loss in Q1 FY25.

-

Net debt reduced significantly by ₹6,129 crore compared to June 2024.

-

Contribution margin improved by 390 basis points YoY to 43.4%.

-

Continued improvement in working capital and balance sheet strength.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.