Incorporated in 1958, Uno Minda Ltd is a manufacturer and supplier of Automotive Solutions and systems to Original Equipment Manufacturers.

Q2 FY26 Earnings Results

-

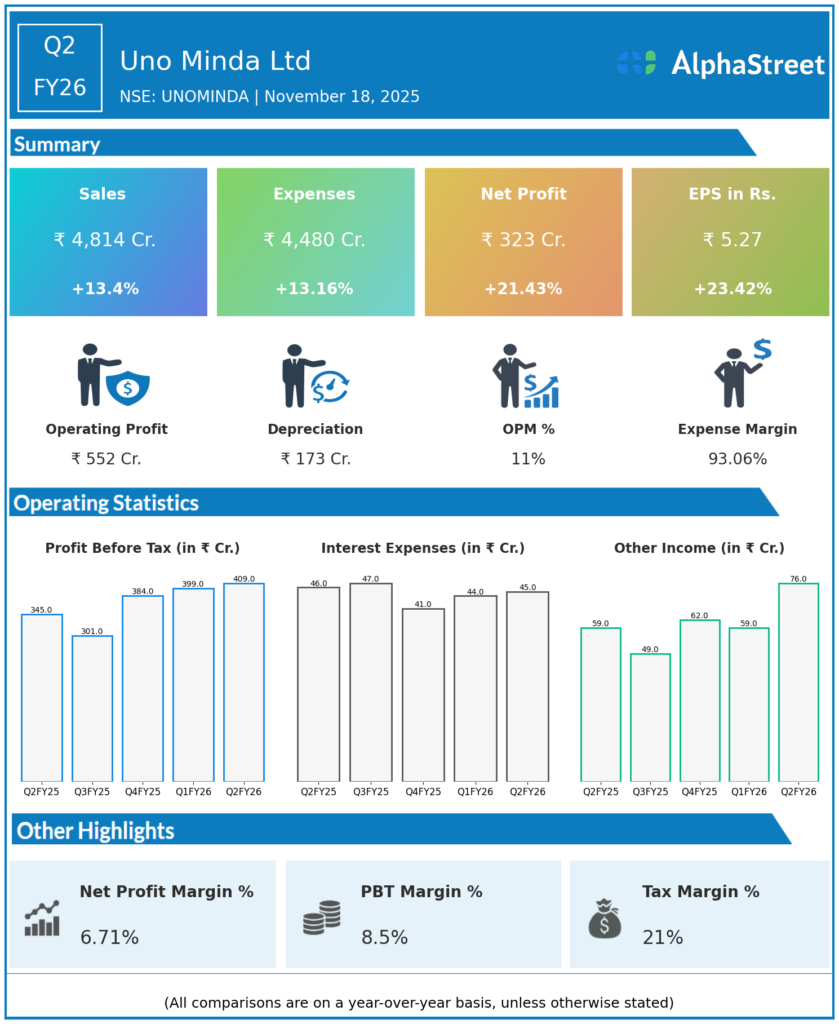

Total Income: ₹4,814 crore, up 7.2% QoQ from ₹4,501.12 crore in Q1 FY26 and up 13.7% YoY from ₹4,246.95 crore in Q2 FY25.

-

Total Expenses: ₹4,481.08 crore, up 8.0% QoQ and 13.2% YoY.

-

Profit Before Tax (PBT): ₹345.88 crore, slightly down 1.7% QoQ but up 16.8% YoY from ₹296.18 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹322.79 crore, up 4.5% QoQ and 21.3% YoY from ₹266.16 crore in Q2 FY25.

-

Earnings Per Share (EPS): ₹5.27, up 4.4% QoQ and 23.7% YoY.

-

Operating profit margin was 11.46%, slightly lower than 12.10% in Q1 FY26 due to higher raw material and employee costs.

-

Interest expense increased marginally to ₹45.39 crore from ₹43.99 crore QoQ.

-

Depreciation expense increased to ₹173.42 crore from ₹159.31 crore QoQ as the company invests in capacity expansion.

-

Effective tax rate declined from 22.57% to 21.13% QoQ, aiding net profit growth.

-

Net profit margin stood at 6.71%, slightly lower than 6.88% in Q1 FY26 but higher than 6.27% in Q2 FY25.

Management Commentary & Strategic Decisions

-

Strong revenue growth driven by increased volume across key products such as switches, horns, lighting systems, and security solutions.

-

The company reported highest-ever quarterly revenue demonstrating market share gains and successful new product launches.

-

Margin pressures from elevated raw material costs (aluminum, copper) and higher employee expenses impacted operating margin.

-

Management continues to focus on operational efficiencies, working capital optimization, and strategic capital expenditures to expand manufacturing capacity.

-

The outlook remains positive with an emphasis on innovation, expanding product portfolio, and improving profitability.

-

Capital efficiency reflected in ROE of 16.34% and ROCE of 15.75% supports long-term growth prospects.

Q1 FY26 Earnings Results

-

Total Income: ₹4,501.12 crore, up 9.56% YoY from previous periods.

-

Profit After Tax (PAT): ₹309.03 crore.

-

Operating margin of 12.10%, showing strength in cost management despite inflationary headwinds.

-

Sequential revenue growth of 7.24% reflects resilience during monsoon season, typically a muted demand period.

-

Continued investments in manufacturing and product development.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.