Incorporated in 1958, Uno Minda Ltd is a manufacturer and supplier of Automotive Solutions and systems to Original Equipment Manufacturers. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Summary

-

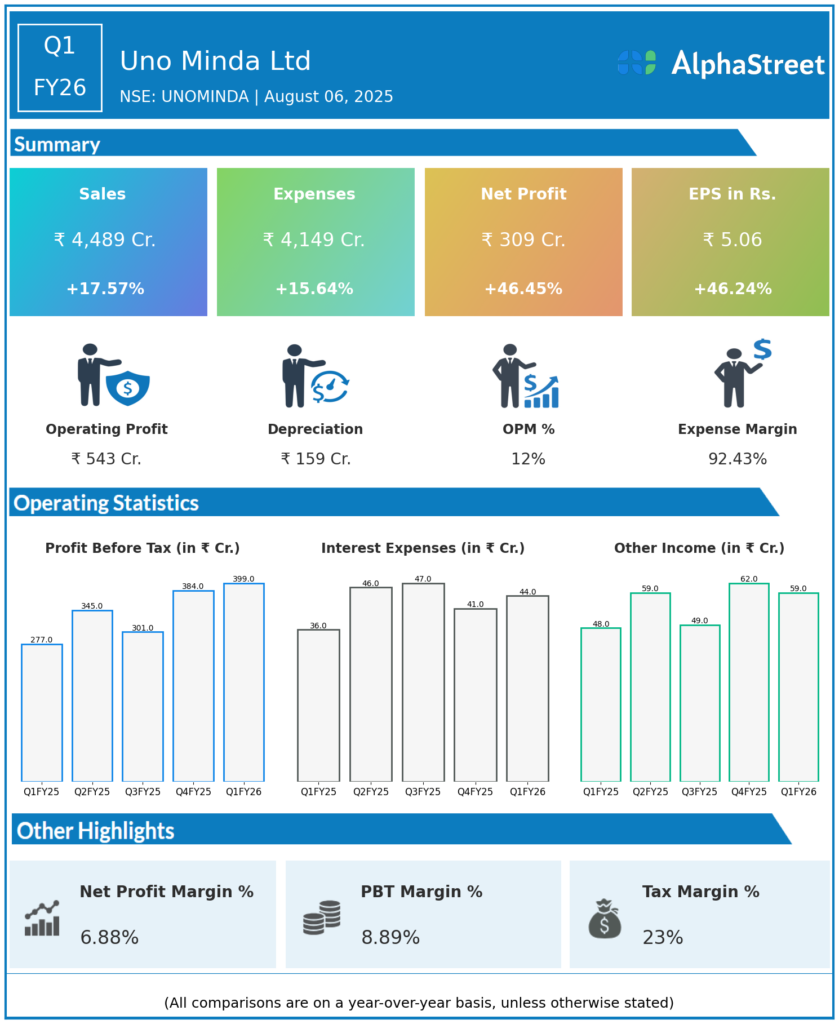

Consolidated Revenue from Operations: ₹4,489 crore, up 18% year-over-year (YoY) from ₹3,818 crore in Q1 FY25. The revenue includes incentive income of about ₹69 crore.

-

Net Profit (PAT): ₹309 crore, a rise of over 46% YoY from ₹198 crore last year.

-

EBITDA: ₹543 crore, up 33% YoY from ₹408 crore in Q1 FY25.

-

EBITDA Margin: Improved by 142 basis points to 12.1% YoY. Normalized EBITDA was ₹474 crore with stable margins of 10.7%.

-

Normalized Net Profit: ₹239 crore, up 21% YoY.

-

EPS (Diluted): ₹5.06, up 46% from ₹3.45 in Q1 FY25.

Key Management Commentary & Strategic Highlights

-

Managing Director Ravi Mehra highlighted the transformation in the automotive industry driven by electrification, digitalization, safety, and premiumization. Uno Minda has positioned itself as a key enabler of next-generation mobility solutions.

-

Management stressed strong execution and growing relevance of innovation-led portfolio across emerging technologies.

-

The company continues to invest in future-ready capacities, strategic partnerships, and R&D in India and overseas to deepen technology leadership.

-

CFO Sunil Bohra noted robust top-line and bottom-line performance across product segments, margin stability, and disciplined capital allocation.

-

Strategic focus areas include emerging automotive technologies such as EV components, advanced driver-assistance systems (ADAS), sensors, and advanced electronics.

-

Emphasis on acceleration of localization efforts to create long-term value for stakeholders.

Q4 FY25 Earnings Summary

- Uno Minda Ltd reported Revenues for Q4FY25 of ₹4,528 Crores up from ₹3,794 Crore year on year, a rise of 19.34%.

- Total Expenses for Q4FY25 of ₹4,002 Crores up from ₹3,320 Crores year on year, a rise of 20.54%.

- Consolidated Net Profit of ₹289 Crores down 4.3% from ₹302 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹4.64, down 7.38% from ₹5.01 in the same quarter of the previous year.

To view the company’s previous earnings, click here