Diageo India incorporated in India as United Spirits Ltd.(USL) is the country’s leading beverage alcohol company and a subsidiary of global leader Diageo PLC. The company manufactures, sells, and distributes a wide portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan.

Q3 FY26 Earnings Results

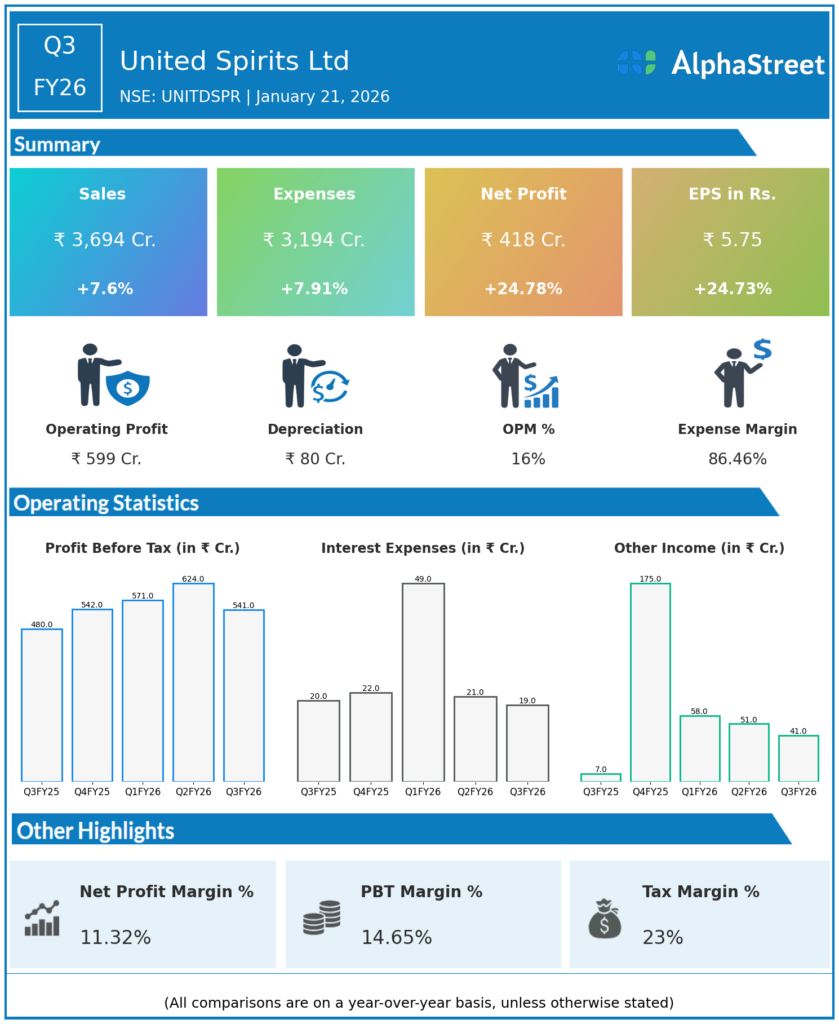

- Revenue from Operations (ex net excise duty): ₹3,683 crore, up 7.3% YoY from ₹3,432 crore in Q3 FY25; up 10.3% QoQ from ₹3,340 crore in Q2 FY26.

- Net Sales Value (NSV): ₹3,694 crore, up 7.6% YoY and 16.4% QoQ, highest quarterly net sales in company history.

- EBITDA: ₹618 crore, up 5.1% YoY from ₹588 crore; EBITDA margin 16.8%, down 35 bps YoY from 17.1%.

- Profit Before Tax (PBT): ₹654 crore, up 5.3% YoY from ₹621 crore.

- Profit After Tax (PAT): ₹529 crore, up 11.8% YoY from ₹473 crore.

- Prestige & Above (P&A) segment: NSV growth of 8.2% YoY, continuing to drive mix improvement.

- Dividend: Interim dividend of ₹6 per share declared (record date Jan 27, 2026).

Management Commentary & Strategic Decisions – Q3 FY26

- CEO Praveen Someshwar highlighted strong festive season execution with highest quarterly NSV ever, driven by premium portfolio growth (P&A +8.2% NSV), successful Andhra Pradesh re‑entry, and resilient standalone performance despite Maharashtra policy headwinds.

- Margin softening (EBITDA margin down 35 bps YoY) was attributed to elevated advertising and promotional spends (14% of net sales) to support brand investments and premiumisation.

- Strategic priorities:

- Continued premiumisation and brand building, with increased A&P spend behind key trademarks to drive faster growth in higher‑end portfolio.

- Leveraging the Royal Challengers Bengaluru (RCB) sports segment synergies and Andhra Pradesh market re‑entry for topline acceleration.

- Optimising productivity initiatives and gross margin flow‑through to support sustainable profitability amid policy volatility.

Q2 FY26 Earnings Results

- Revenue from Operations (ex net excise duty): ₹3,173 crore, up 11.6% YoY from ₹2,843 crore in Q2 FY25; down 5.3% QoQ from ₹3,350 crore in Q1 FY26.

- Net Sales Value (NSV): ₹3,173 crore, up 11.6% YoY.

- EBITDA: ₹660 crore, up 31.5% YoY from ₹502 crore; EBITDA margin 20.8%, up 440 bps YoY from 16.4%.

- Profit After Tax (PAT): ₹464 crore, up 36.1% YoY from ₹341 crore; down ~13.9% QoQ.

- PAT margin: 14.9%, up 400 bps YoY.

- Total sales volume: 16.6 million cases, up from 15.4 million cases in Q2 FY25.

- H1 FY26: NSV ₹6,194 crore, up 10.5% YoY; EBITDA ₹1,304 crore, up 7.3% YoY.

Management Commentary & Strategic Directions – Q2 FY26

- CEO Praveen Someshwar noted strong H1 performance with double‑digit topline and EBITDA growth, driven by standalone business strength and favourable comparisons despite Maharashtra policy changes.

- Gross margin expansion of 219 bps to 46.9% was supported by premium mix, productivity initiatives, and price increases from prior year.

- Strategic focus:

- Driving premium and prestige portfolio growth through targeted brand investments and market activation.

- Navigating policy headwinds (Maharashtra) while capitalising on Andhra Pradesh re‑entry and RCB sports synergies.

- Optimising costs and supply chain to sustain margin gains amid festive/wedding season demand.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.