Diageo India incorporated in India as United Spirits Ltd.(USL) is the country’s leading beverage alcohol company and a subsidiary of global leader Diageo PLC. The company manufactures, sells, and distributes a wide portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan.

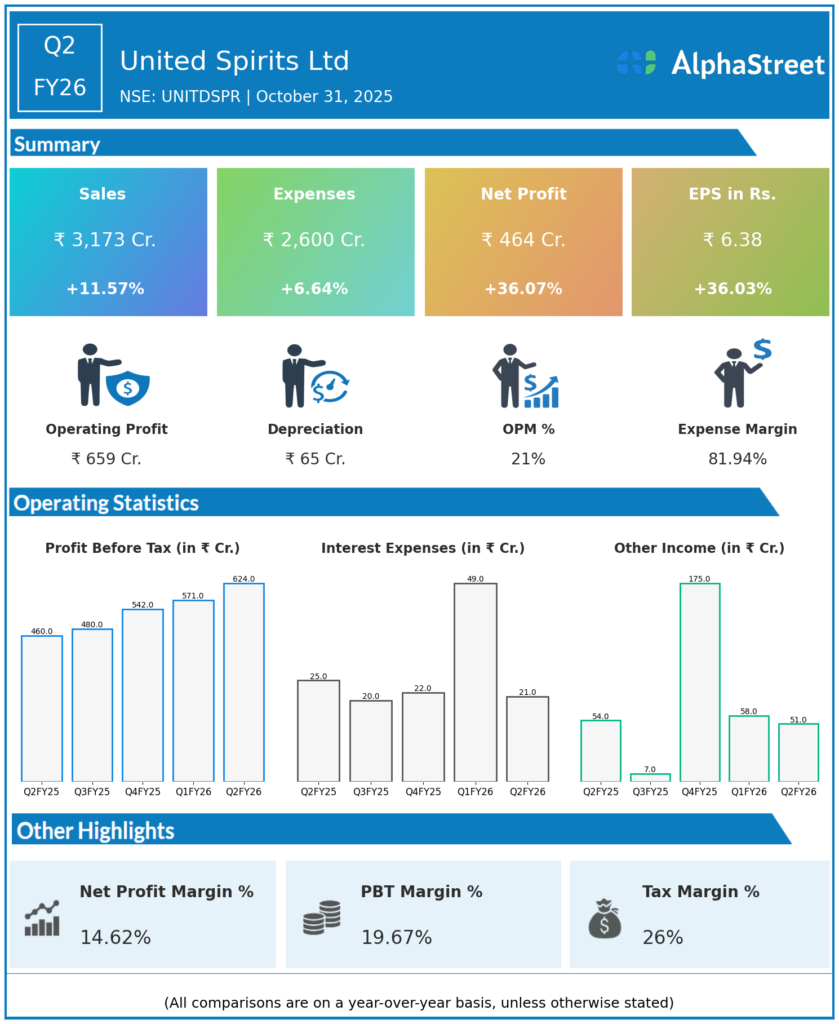

Q2 FY26 Earnings Results:

-

Revenue from Operations: ₹3,173 crore, up 12% YoY, down 5.3% QoQ.

-

Profit After Tax (PAT): ₹464 crore, up 36% YoY, down 13.9% QoQ.

-

Operating Profit ex-other income: ₹850.73 crore; operating margin 23.93%.

-

Other income: ₹50.16 crore, down 41.5% QoQ.

-

Employee costs: ₹470.72 crore; Depreciation: ₹99.95 crore.

-

H1 FY26 net sales: ₹7,307.54 crore, up 10.2% YoY.

-

H1 FY26 consolidated net profit: ₹1,251.64 crore, up 13.3% YoY.

-

EPS (Q2 FY26): ₹5.76 (post 1:1 bonus shares).

Management Commentary & Strategic Insights:

-

Strong double-digit underlying volume growth and sequential margin improvement.

-

Confidence in demand recovery supported by favorable monsoon, GST 2.0 rollout, and strong construction sector.

-

Cautious outlook on external risks like geopolitical tensions and global tariff uncertainties.

-

Focus on profitable, volume-led growth via brand building, supply chain enhancement, and talent acquisition.

Q1 FY26 Earnings Results:

-

Revenue: ₹3,753.10 crore, up 10.5% YoY.

-

PAT: ₹672.41 crore, up 18.7% YoY.

-

EBITDA: ₹941 crore, up 16% YoY; EBITDA margin improved to 25%.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.