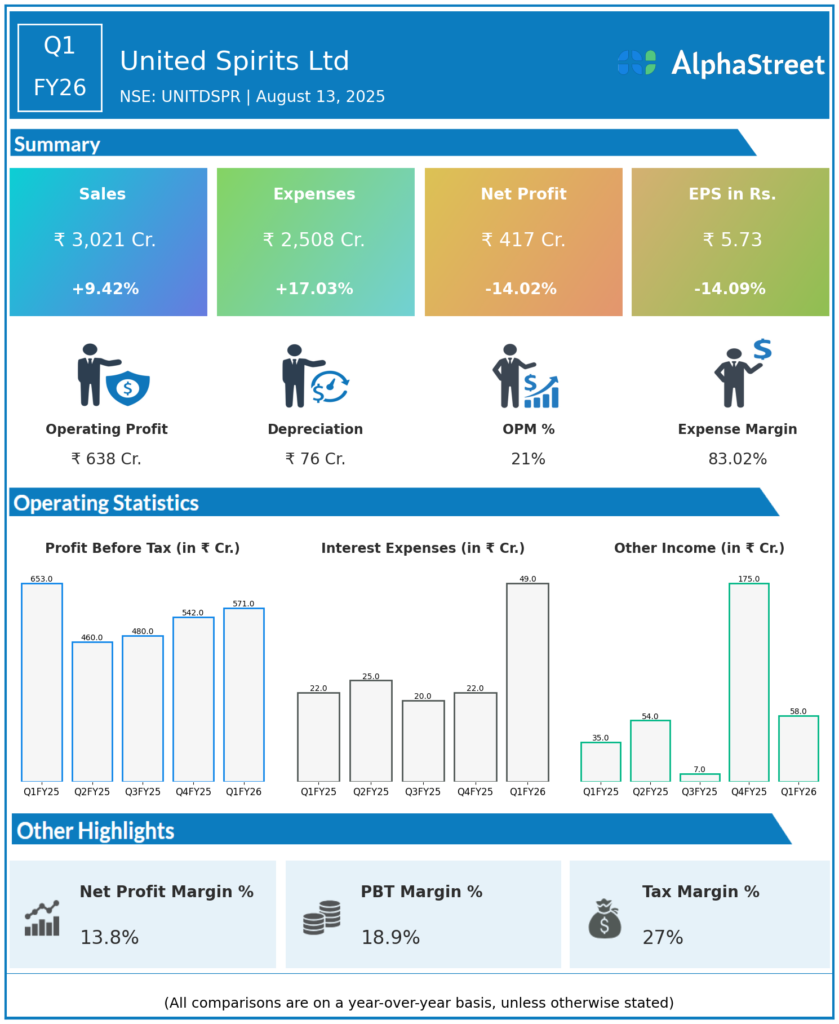

Diageo India incorporated in India as United Spirits Ltd.(USL) is the country’s leading beverage alcohol company and a subsidiary of global leader Diageo PLC. The company manufactures, sells, and distributes a wide portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹3,021 crore, a steep rise of 9.4% YoY (marginal increase from ₹2,761 crore in Q1 FY25).

-

Net Profit (PAT): ₹417 crore, down 14% year-over-year (YoY) from ₹485 crore.

-

Profit Before Tax: ₹571 crore, down from ₹653 crore YoY, reflecting some margin pressure.

-

Expense Management: Excise duty and material costs remained significant; controlled advertising and employee costs helped maintain profitability.

-

Segment Performance: Standalone P&A (premium & above) segment grew around 9%, popular segment up 13.6%.

-

Stock Movement: Shares traded around ₹1,306 on NSE with a slight positive intra-day change.

Management Commentary & Strategic Highlights

-

Despite a challenging demand environment, the company maintained growth momentum driven by strong brand performance, especially in premium and popular segments.

-

Reopening of operations in Andhra Pradesh after a five-year hiatus contributed positively.

-

Management continues to emphasize margin management and cost discipline amid rising input costs.

-

Focus on active portfolio and channel management to sustain growth.

-

The company is navigating muted demand conditions but aims to build on resilient growth and expand market presence.

Q4 FY25 Earnings Results

- United Spirits Ltd reported Revenues for Q4FY25 of ₹3,031.00 Crores up from ₹2,783.00 Crore year on year, a rise of 8.91%.

- Total Expenses for Q4FY25 of ₹2,664.00 Crores up from ₹2,551.00 Crores year on year, a rise of 4.43%.

- Consolidated Net Profit of ₹421.00 Crores up 74.69% from ₹241.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹5.79, up 74.92% from ₹3.31 in the same quarter of the previous year.

-

The quarter witnessed steady operational performance before seasonal variations reflected in Q1.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.