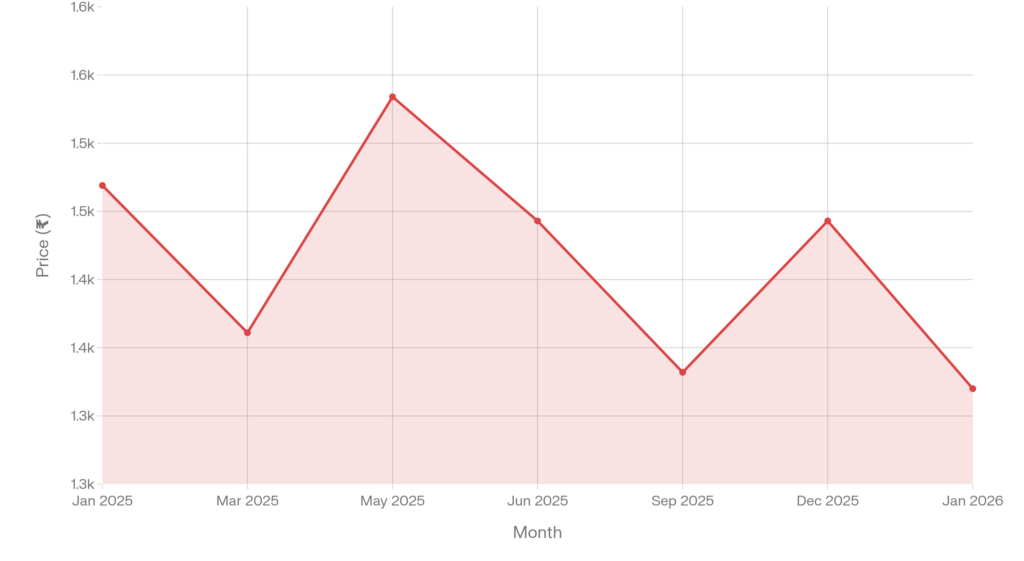

United Spirits Limited (UNITDSPR, NSE/BSE), India’s largest spirits company and a Diageo subsidiary, stock closed at ₹1,320.70 on the day, declining 6.26% over the preceding month.

Latest Quarterly Results

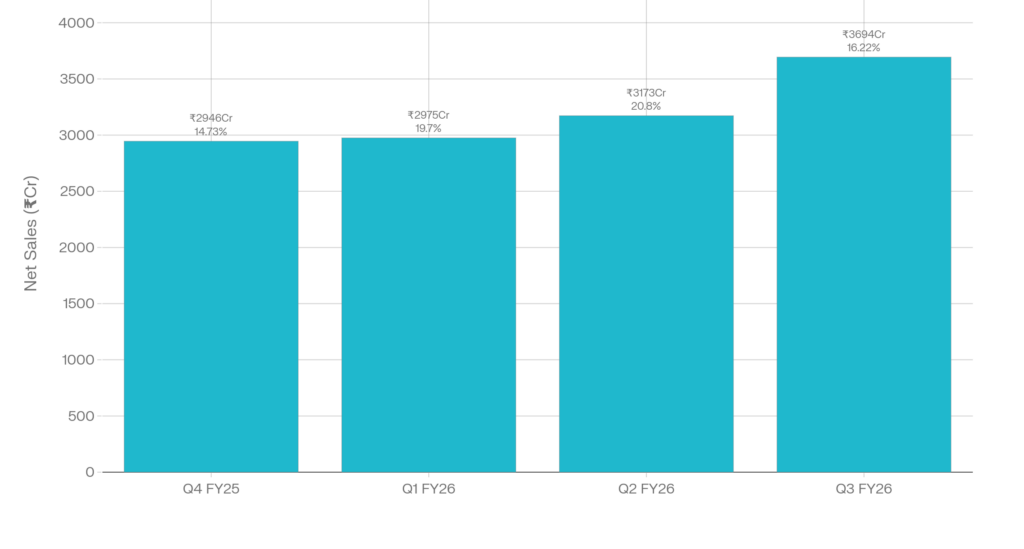

United Spirits delivered record quarterly revenue of ₹3,694 crore on a net sales value basis (excluding excise duty), representing the highest topline in recent quarters and reflecting strong festive season demand. Earnings before interest, tax, depreciation, and amortization (EBITDA) reached ₹618 crore, marginally below street expectations of ₹640 crore, while EBITDA margin contracted 35 basis points year-on-year to 16.8%.

The prestige and above segment, which encompasses premium and luxury brands, drove growth with net sales increasing 8.2%, while the popular segment declined 4.6% – a reflection of the company’s strategic shift toward higher-margin portfolio mix. On a consolidated basis, net profit increased 24.78% to ₹418 crore from ₹335 crore in Q3 FY25.

Full-Year Results Context

For the fiscal year ended March 31, 2025, United Spirits reported standalone revenue from operations of ₹26,780 crore, compared with ₹25,389 crore in FY24, representing 5.48% growth. Profit after tax rose to ₹1,558 crore from ₹1,312 crore in FY24, marking an 18.68% year-on-year increase. Consolidated revenue reached ₹27,276 crore (up 4.84% year-on-year), with consolidated PAT of ₹1,582 crore (up 12.35%). The company’s operating margin expanded from 12.90% in FY21 to 18.60% in FY25, demonstrating the effectiveness of premiumization strategy and cost discipline.

Operating Performance Trend

Operating Performance Trend: Net Sales Growth and Margin Compression

Stock Price Trend

Stock Price Trend: 12-Month Performance (January 2025 – January 2026)

Business & Operations Update

United Spirits’ premiumization strategy continues to show structural strength despite near-term profitability headwinds. The prestige and above segment now represents approximately 88.5% of net sales in FY25 and continues to outpace broader spirits market growth. The company navigated policy-related challenges in Maharashtra – a key market – as well as lapping a one-time retail pipeline fill effect in Andhra Pradesh in the prior-year comparative.

M&A And Strategic Moves

United Spirits maintains its position as a wholly-owned operating subsidiary of Diageo plc, with Diageo holding 56.67% of equity as of December 2025. No material acquisition or divestiture activity was announced during the quarter. The company’s strategic priorities remain centered on portfolio premiumization, innovation in ready-to-drink (RTD) categories, and geographic expansion in underserved tier-3 cities.

Equity Analyst Commentary

Analysts noted the divergence between strong topline growth and margin compression, with consensus highlighting the quarter’s 458 basis point sequential operating margin decline from Q2 FY26 (20.80%) to Q3 FY26 (16.22%) as a structural concern rather than seasonal noise. The sharp margin contraction, despite the highest quarterly sales on record, reflects elevated advertising and promotional expenditure alongside potential input cost pressures and adverse product mix dynamics.

Guidance & Outlook

Management has not issued explicit guidance for full-year FY26 performance. The nine-month FY26 performance shows revenue growth of 3.52% year-to-date to ₹20,943 crore with net profit up 13.74% to ₹1,259 crores, indicating moderation compared to Q3’s 11.83% profit growth.

Performance Summary

Net profit growth of 11.83% and record quarterly revenue demonstrate pricing power and market share gains, predominantly within the higher-margin prestige segment. The 6.26% one-month stock decline reflects investor concern over the 458 basis point sequential margin contraction.