United Breweries Limited (UBL) is engaged in the business of manufacture and sale of beer and non-alcoholic beverages.

Q2 FY26 Earnings Results:

-

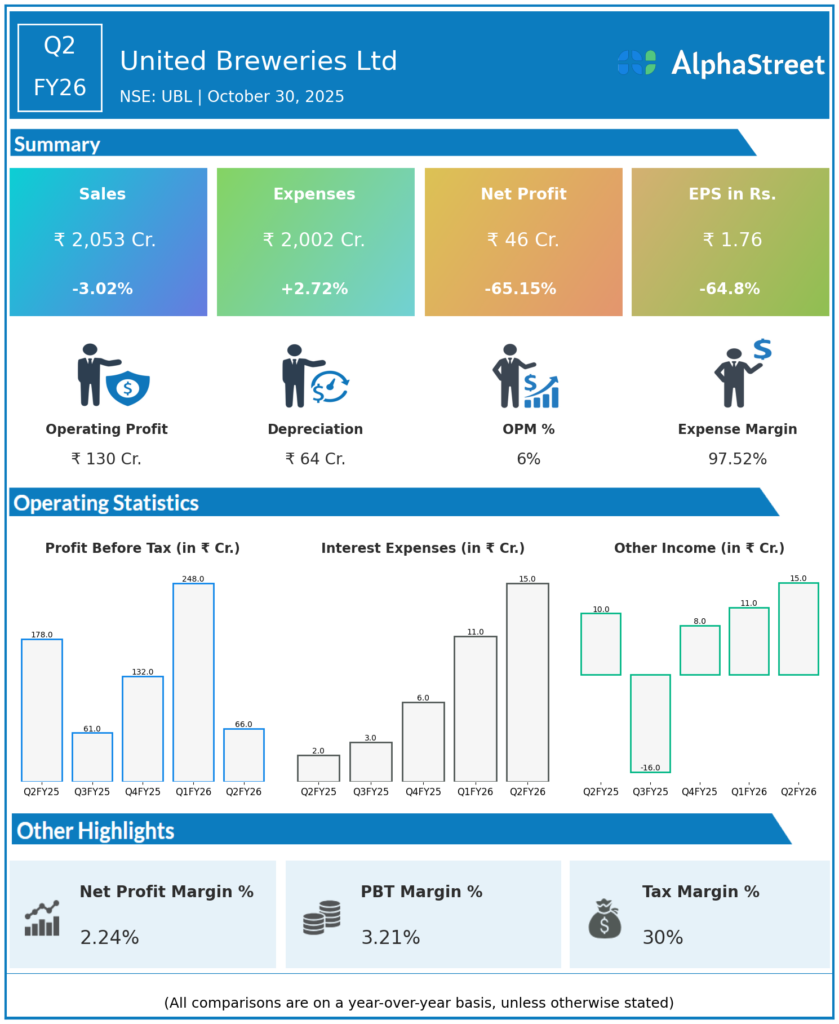

Revenue from Operations: ₹2,052.83 crore, down 3.02% YoY from ₹2,117 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹46.52 crore, down 64.8% YoY from ₹132.17 crore.

-

Profit Before Tax (PBT): ₹65.8 crore, down 63.09% YoY from ₹178.28 crore.

-

EBITDA: ₹130 crore, down 43% YoY from ₹227 crore.

-

EBITDA Margin: 6.3%, down from 10.7% YoY.

-

Total volumes declined 3.4% YoY, affected by stronger-than-usual monsoon and subdued beer market; however, premium segment volume grew 17%.

-

Gross profit rose 5% on a year-to-date basis.

-

EBIT declined 18% due to negative operating leverage and continued brand investments.

-

Market share gains on sell-out basis amid adverse market conditions.

Management Commentary & Strategic Decisions:

-

Management cited strong premium segment growth driven by Kingfisher Ultra, Kingfisher Ultra Max, and Heineken Silver.

-

Overall volume declined due to adverse weather in Rajasthan, Karnataka, Telangana, West Bengal offset partially by growth in Maharashtra, Andhra Pradesh, and Assam.

-

Focus on revenue management and cost initiatives despite short-term margin pressure.

-

Remain optimistic about long-term beer category growth driven by premiumization, disposable income, and favorable demographics.

-

Continued investments planned in brand building and capacity expansions.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹2,862.42 crore, up 15.7% YoY.

-

Profit After Tax (PAT): ₹183.87 crore, up 5.95% YoY.

-

EBITDA: ₹311 crore, up 9% YoY.

-

EBITDA Margin: Approx 10.8%.

-

Strong volume performance and premium segment sales.

-

Profit growth despite a dip in overall revenue due to market dynamics.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.