United Breweries Limited (UBL) is engaged in the business of manufacture and sale of beer and non-alcoholic beverages. Presenting below are its Q1 FY26 earnings.

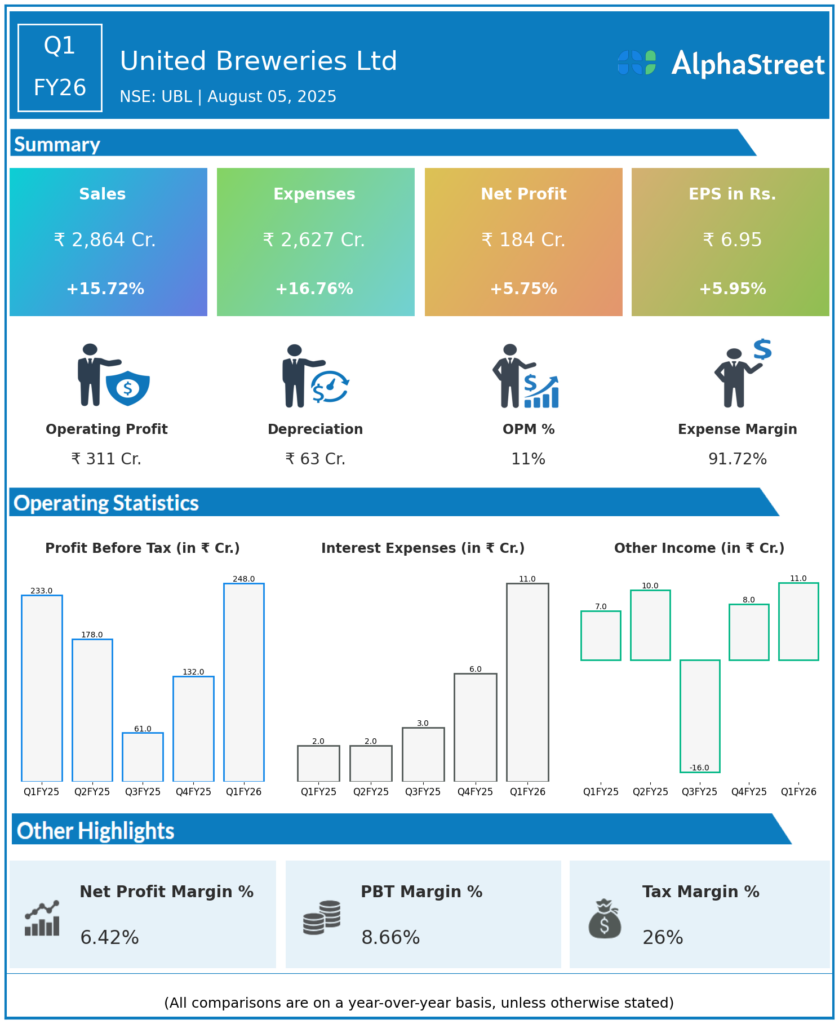

Q1 FY26 Earnings Summary

-

Revenue from Operations: ₹2,864 crore, up 15.7% year-over-year (YoY) from ₹2,473 crore in Q1 FY25.

-

Net Profit (PAT): ₹184 crore, up about 6% YoY from ₹173.3 crore.

-

EBITDA: ₹311 crore, up 9% YoY (Q1 FY25: ₹284.7 crore).

-

EBITDA Margin: 10.8%, compared to 11.5% YoY.

-

Gross Margin: 42.5%, down 50bps YoY, reflecting cost pressures.

-

Sales Volume: Expanded 11% YoY; premium portfolio volume grew 46%, led by Kingfisher Ultra, Amstel Grande, and Heineken Silver.

-

Earnings Per Share (EPS): ₹6.95, up from ₹6.56 in Q1 FY25.

-

Capital Expenditure: ₹136 crore, mainly into commercial and supply chain projects, up ₹89 crore YoY.

-

Strategic Moves: Closed Mangalore facility, expanded Mysore brewery to consolidate Karnataka operations and optimize supply chain.

Key Management Commentary & Strategic Highlights

-

Management expressed confidence in continued growth, highlighting premiumization, volume gains, and market share increases as key strengths.

-

CEO Vivek Gupta emphasized robust category momentum, with premium beers now 10% of sales (and growing over 30%), supporting improved margins and market leadership.

-

The strong response to new launches like Amstel Grande and further expansion in high-growth states was noted.

-

There is a continued focus on revenue management, cost initiatives, and brand building, aiming to support margin accretion and future profitability.

-

The outlook remains optimistic, driven by rising consumer incomes, favorable demographics, and strategic investments to expand premium offerings and capacity.

Q4 FY25 Earnings Summary

-

Revenue from Operations: ₹2,323 crore, up 8.9% YoY.

-

Net Profit (PAT): ₹98 crore, up 20% YoY.

-

EBITDA: ₹186.3 crore, margin at 8% (vs 6.7% in Q4 FY24).

-

Volume Growth: 5% YoY (premium segment up 24%).

-

Gross Margin: 42.1%, +37bps YoY.

-

Capex: ₹254 crore focused on supply chain and future expansion.

-

Dividend: Board recommended a final dividend of ₹10/share for FY25, up from ₹7.5 last year.

-

Other Notes: Q4 challenged by duty increases and supply suspension in Telangana, but premiumization and margin expansion continue.

To view the company’s previous earnings, click here