Incorporated in 1971, Unitech Ltd is in the business of Real Estate, Power Transmission and Hospitality.

Q2 FY26 Earnings Results

-

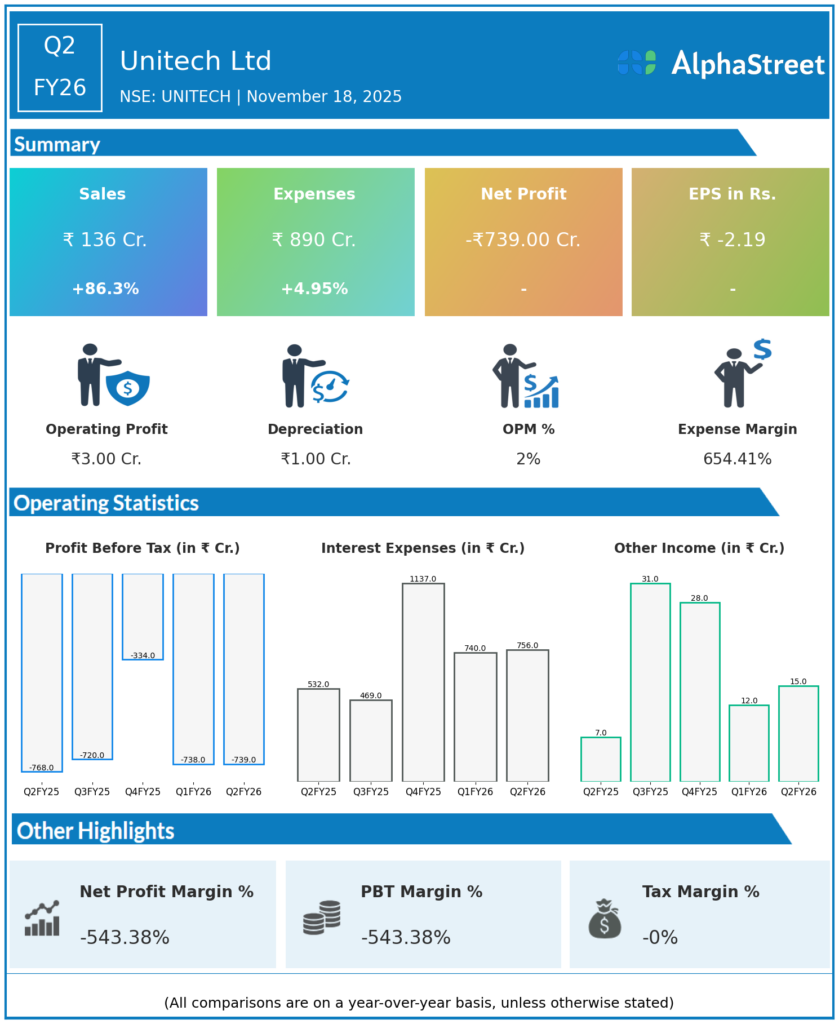

Total Revenue: ₹136 crore, up significantly from ₹79.94 crore in Q2 FY25.

-

Net Loss: ₹738.72 crore, reducing slightly from ₹766.76 crore in Q2 FY25 but indicating continuing deep losses.

-

Earnings Per Share (EPS): Negative ₹1.52.

-

Operating Profit: Approximately ₹75 crore (down from previous quarters).

-

Auditor’s Disclaimer: The auditors issued a disclaimer of conclusion citing insufficient evidence for asset valuations, pending reconciliations, and impairment assessments.

-

Outstanding loans and liabilities remain high at over ₹10,530 crore in loans and ₹529 crore in unpaid public deposits.

-

The company operates under government-appointed management with Supreme Court involvement in resolution proceedings.

-

Management continues to seek concessions from the Supreme Court, explore project completion options, and negotiate settlements with creditors.

-

Cash flow stress and project delays, especially in Delhi-NCR region, persist.

Management Commentary & Strategic Decisions

-

Management acknowledges significant legacy challenges impacting operations and financials.

-

Focus on resolving outstanding legal and financial issues through dialogue with courts and financial institutions.

-

Emphasis on raising finance, improving cash flows, and completing ongoing projects to stabilize operations.

-

Supreme Court’s final decision on the Resolution Framework is critical for future direction.

-

Efforts underway to explore One Time Settlement and other restructuring options.

Q1 FY26 Earnings Results

-

Total Revenue: Approximately ₹100 crore (quarterly figures indicate increasing but limited revenue).

-

Net Loss: Around ₹591.77 crore, showing some improvement from previous quarters but still significant.

-

Sequential loss impact reduced but company remains in deep operational and financial distress.

-

Continued government oversight and management restructuring efforts ongoing.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.