Unichem Laboratories Ltd is involved in pharmaceuticals in Generics, APIs and Contract Manufacturing (CMO) areas. The company operates 3 formulation facilities at Goa, Baddi, and Ghaziabad, and 3 API facilities at Roha, Pithampur, and Kolhapur. The company has initiated backward integration and upscaling for 6-8 major captive APIs. At the Pithampur API site, it has commenced phase 1 of the capital project to build a volume block of 240 KL, with 3 clean rooms resulting in a capacity addition for 5 captive APIs to produce 600-700 MT API per annum. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

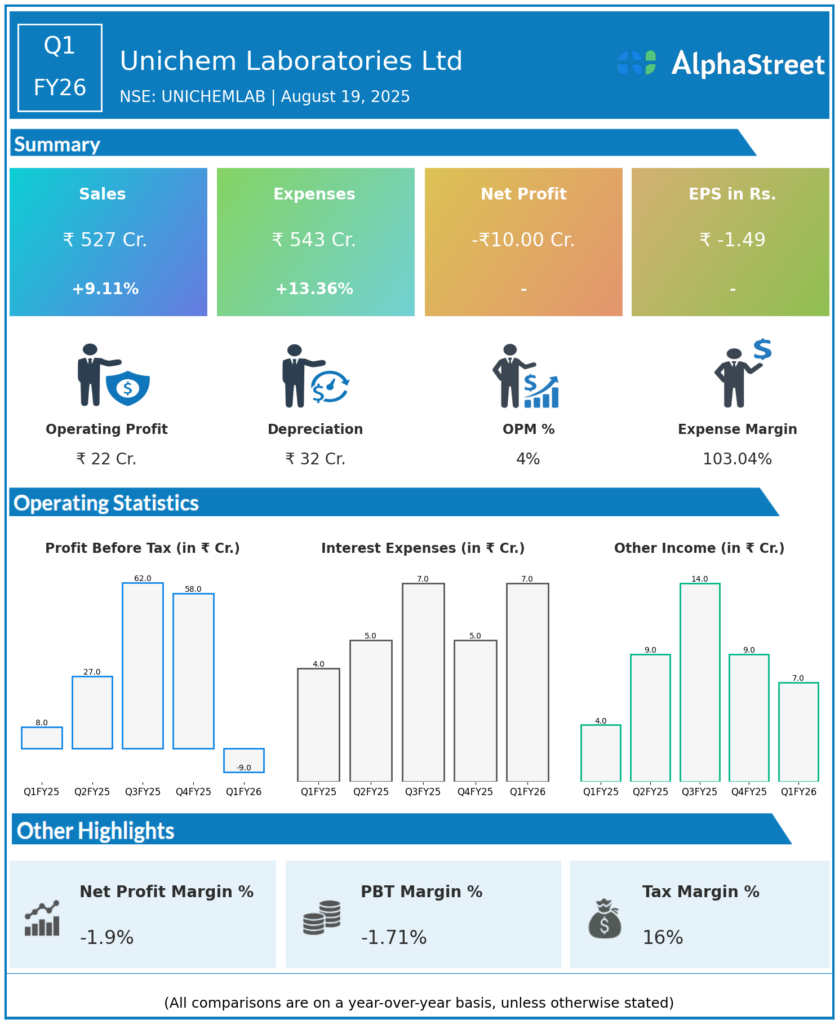

Total Income: ₹527 crore, up 9.1% year-over-year (YoY) and down 10.2% quarter-on-quarter (QoQ).

-

Total Expenses: ₹543 crore, up 13.3% YoY and less than 1% QoQ.

-

Profit Before Tax (PBT): Loss of ₹9.02 crore, improved significantly from a loss of ₹125.87 crore in the previous quarter but declined against a profit of ₹15 crore last year.

-

Profit After Tax (PAT): Loss of ₹10.47 crore, after a profit of ₹53 crore in Q4 FY25 but below the profit of ₹2 crore in Q1 FY25.

-

Earnings Per Share (EPS): Negative ₹1.49 compared to positive ₹7.52 a year ago.

-

The increase in expenses outpaced revenue growth, leading to the loss in Q1 FY26.

- The company has cash and cash equivalents of ₹118 crores.

-

The company continues to face headwinds in profitability but has seen significant QoQ improvement in losses.

Management Commentary

-

The company is focused on stabilizing operations and controlling costs amid market challenges.

-

Despite the loss, the quarter showed quarter-on-quarter improvement signaling recovery.

-

Emphasis on portfolio optimization and operational efficiency to return to profitability.

Q4 FY25 Earnings Results

-

Total Income: ₹587 crore, up 36 percent on the YoY basis.

-

Profit After Tax (PAT): Profit of ₹53 crore after bearing a loss of -₹129 crore during the same quarter, last year.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.