“We scaled our business, reached the INR 5,000 Cr AUM milestone, and met our FY23 off book AUM guidance a quarter ahead of schedule thanks to our unwavering focus on our core competencies, extensive use of data analytics in decision-making, and widespread acceptance in the banking and MSME industries. Our Q3’23 results, with the highest ever disbursement and improved profitability, demonstrate our unwavering commitment to growth. We continue to make progress towards the company’s core profitability on a QoQ basis.”

– Mr Shachindra Nath, Managing Director, Concall- Q3FY22

Stock Data:

| Ticker | UGROCAP |

| Exchange | BSE and NSE |

| Industry | Finance |

Price Performance:

| Last 5 days | -2.07% |

| YTD | 14% |

| Last 1 year | 0.73% |

Company Description:

The current era of the company was started in 2018, when ex-religare CEO Shachindra Nath raised USD 142 mn from PE firms and acquired a listed shell NBFC called Chokhani Securities (had no operations). The company was rebranded as Ugro Capital and decided to focus on SME/MSME lending. Ugro Capital believes that lending to SME/MSME is a highly specialized segment. To do this, they have worked with CRISIL to shortlist 8 key sectors: Healthcare, Education, Chemicals, Food Processing / FMCG, Hospitality, Electrical Equipment and Components, Auto Components, Light Engineering. (Note each of these sectors contain multiple sub-sectors/allied sectors) and they have developed a special underwriting and distribution model for each of these sectors

The PE investors of the company are : NewQuest Capital, ADV Partners, Samena Capital, PAG. From the family office side the investors are Himasingka Group, Jaspal Bindra, Famy Care, SAR group. Other public market investors are Indgrowth Capital, PNB Metlife, Chhattisgarh Investments.

Product Portfolio:

Ugro Capital helps in the supply chain financing, unsecured business loans, machinery loans, business loans secured by property, new age products, and micro enterprises loans.

Focus Sectors:

Focus Sectors comprise Healthcare, Education, Chemicals, Food Processing/FMCG, Hospitality, Electrical Equipment & Components, Auto Components, Light Engineering and Micro Enterprises.

Technology Modules:

Ugro capital works on 4 technology modules, which are described below –

- GRO Plus: This is designed for branch-led disbursement which has fully integrated every element of underwriting digitally. It allows for GRO Partners (DSA network) to obtain in-principle approval within 60 minutes.

- GRO Chain: It is an end-to-end platform for supply chain financing that will cater to ecosystem anchors, vendor borrowers and dealer/distributor borrowers.

- GRO Xstream: It is a FinTech platform designed to facilitate a wide range of transaction types between onboarded BFSIs, including co-lending, onward lending, direct assignments, portfolio buyout and securitization.

- GRO Direct: It is a platform built to allow non-intermediated loan applications from eligible SMEs.

Distribution Network & Partnerships:

As of April 2023, the company’s network comprises 23 prime branches, 75 micro branches, 1,000+ GRO partners, 75+ anchors, 40+ OEMS, and 25+ FinTech partners.

What differentiates the company?

- Its tech focused approach makes the company totally different from its peers. Ugro Capital is building a 100% digital underwriting technology for SME lending – (As per company 28% higher approval rates compared to traditional lending – for similar risks). The underwriting technology is unique for each of these sectors.

- The loan products too are very specialized to each of the above sectors. The turn-around time for disbursal is 4-5 days compared to a traditional lender (25-45 days)

- While most Fintech are moving via pure-digital method, the company is following an OMNI channel method – Direct via its own branches, via supply-chain/ecosystem partners (B2B2B/B2B2C) , Digital, Co-lending.

- The company follows the approach of cash flow based lending while most NBFCs follow the method of Traditional Lending.

- Company has built a plug & play platform for lending (Where banks, NBFCs and other Fintechs can partner). It already has a co-origination lending model in place with ICICI, SBI & BOB.

Financials:

What we like:

- Strong set of Fundamentals:

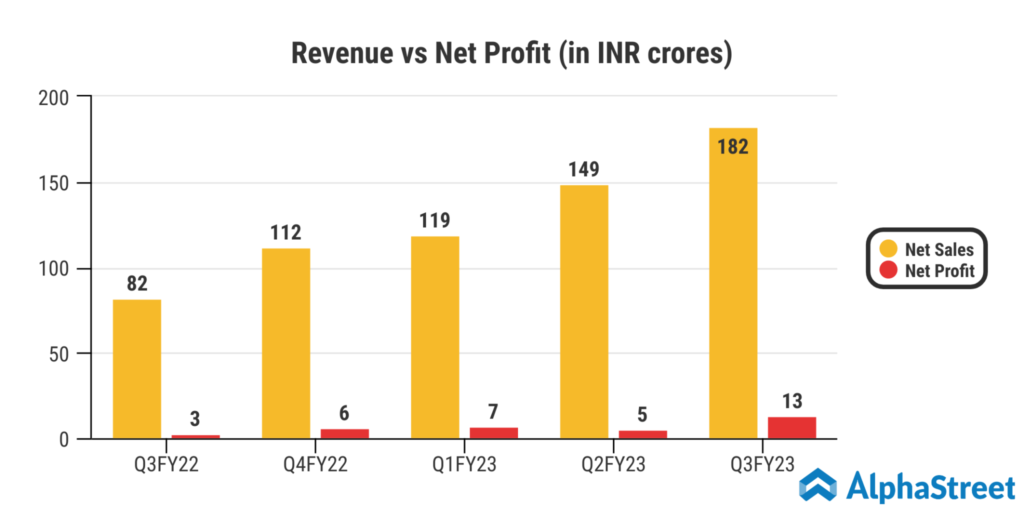

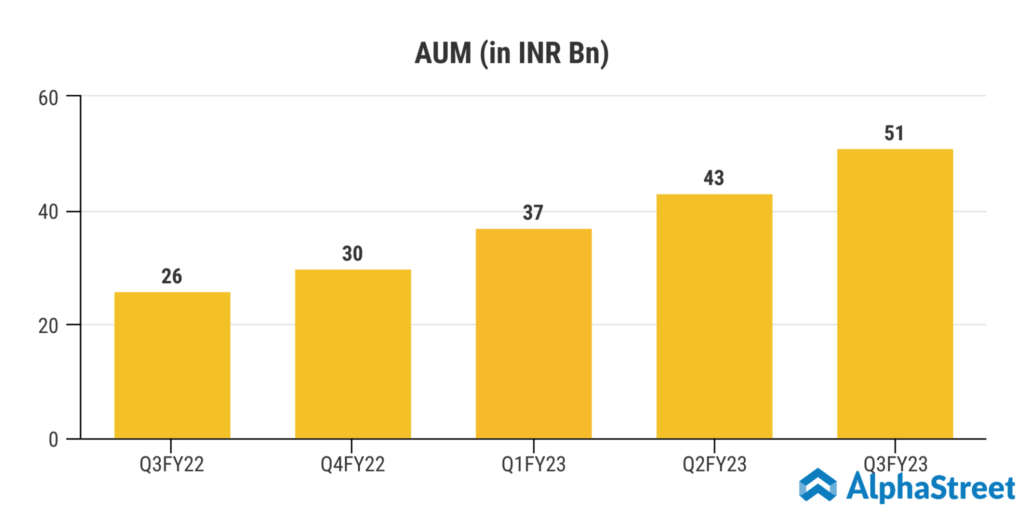

In Q3 FY23, the Company’s major KPIs, including AUM growth, profitability, asset quality, and branch growth, showed significant improvement. AUM grew to 51 Bn achieving a QoQ growth of ~16% and a YoY growth of ~97%. Off-book AUM reached 35% of Total AUM increasing from 29% in Q2 FY23. PBT saw a sharp rise of 27% QoQ and 338% YoY (from Rs. 176 Mn to 222 Mn QoQ and Rs. ~51Mn to ~222 Mn YoY). PAT reached Rs. ~131Mn, representing a growth of 287% YoY and 149% QoQ. Additionally, on a YoY basis, Prime and Micro branches grew from 14 and 68 to 23 and 75 respectively with a number of customers rising to 38,000 from 32,000 on a QoQ basis.

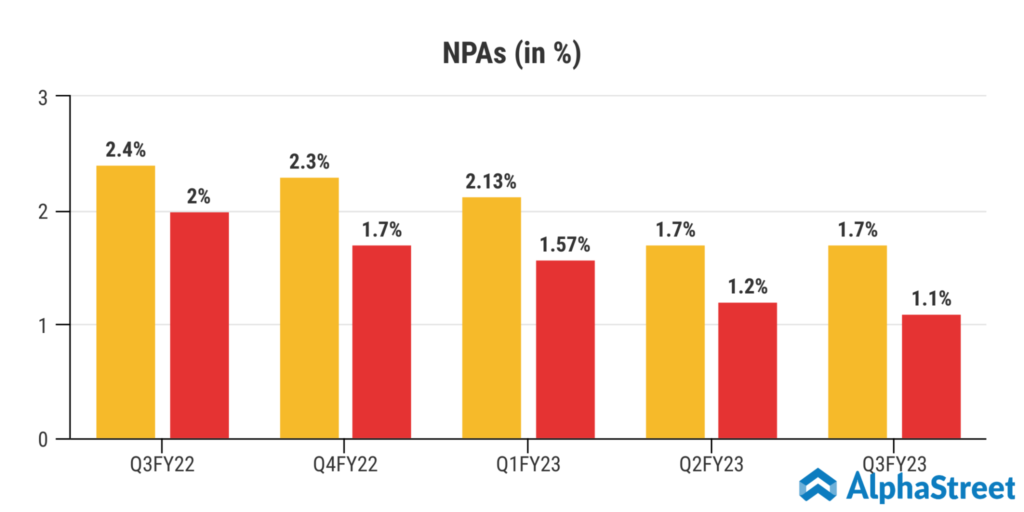

- Stellar Portfolio Performance:

In Q3 FY23, collection efficiencies averaged at 94% (excluding overdue); and GNPA/NNPA stood at 1.7%/1.1% as opposed to 2.4%/2% in Q3FY22. Furthermore, the company demonstrated strong performance in terms of product mix, regional distribution, and sector exposure, with an increase in all types of loans both in absolute terms and in terms of ROI. The ROE/ROA in Q3FY23 were 5.5%/1.4% respectively as opposed to 2.2%/0.6% in Q2 (post adjustment for DTA). The cost of borrowing (debt-equity ratio being 2.98x) has also stayed constant at ~10.5% since Q1 FY23 whereas the portfolio yield has increased from 16.7% in Q1 FY23 to 17.4% in Q3 FY23.

- Huge Industry Opportunity:

The MSME sector presents a vast opportunity for growth due to the current under-penetration of credit, caused by hindrances such as the lack of data, robust technology to analyse and predict heterogeneous borrower behavior, high turnaround time, and the difficulties in assessing the ability and intent to repay based on irregular cash flows and/or a lack of collateral. However, these challenges can now be overcome through the advanced data analytics-driven assessment and underwriting capabilities of Ugro Capital.

Factors to consider:

- MSME / SME sectors are highly impacted by covid. This is the key segment of the company. The company had a bounce rate of 20% in unsecured and 15% in secured.

- The company can fail in its ability to successfully develop the technology and scale accordingly. It could also fail in the ability to meet the guidance provided by them

- Founder stake is low at 2.88%. This is primarily because the founder is a first generation technocrat and has raised high amount of money (USD 142 mn) in the first round

- Competition from existing traditional banks who will look to enter this segment for a larger play is too high in NBFC space.

Industry Analysis and Conclusion:

Lending to MSMEs is well supported by various measures taken to formalize the sector. One can observe more GST compliance with the GST collection amount increasing by 26.9% in FY22. Digital payments are a large part of the Indian banking system, digital transactions grew close to 90%, from 232,000 to 430,000 over FY19 to FY21, primarily led by UPI. The value of digital payments in India is expected to touch $1 trillion by FY26, as compared to $300 billion in FY21. As per the economic survey of FY22 over 66 lakh MSMEs registered on Udyam portal and 95% of those were micro enterprises.

Regulatory policies and creation of a public digital infrastructure are two key pillars of increasing formalization of the MSME sector in India. The Government of India and the RBI have undertaken several reforms (UDYAM registration, GST, e-invoicing, GeM) and floated several schemes (ECLGS, PMMY, CGTMSE) to increase formalisation and also improve the health of the MSMEs. Similarly, a digital stack is being developed for MSMEs which consists of three layers − Udyog Aadhaar Memorandum (UAM), Account Aggregator (AA) and Open Credit Enablement Network (OCEN). Once the STACK reaches a scale in terms of adoption, it will become easier for the lenders to lend to MSME. Sourcing cost is expected to reduce and turnaround time for loans sanction is expected to improve.

The above factors have paved way for operationalizing new age business models to bridge the wide MSME credit gap of India as pandemic has put Data analytics and Technology at the forefront of any BFSI business with Banks and financial institutions realizing the importance of anticipating customer needs and expectations.